-

Unions aren't just good for workers. In some ways, they make ideal clients for financial advisors.

May 9 -

America's youngest investors are far more confident and proactive about retirement planning than previous generations. What's their secret?

April 27 -

Auto-enrollment is helping Gen Z Americans save much more actively than the 20-somethings of yesteryear.

April 23 -

The regulator's latest staff bulletin also calls on planners at hybrid firms to always be clear about if they're wearing their broker or advisor hat.

April 21 -

Researchers find that performance expectations are highest among people who invest in environmental, social and governance causes for moral reasons.

April 14 -

Americans pay billions of dollars in taxes each year when draining their retirement plans as they change jobs. The "leakage" doesn't bode well for long-term savings, data shows.

April 11 -

Even though there's not a way to predict who might face the next wave of layoffs, advisors can help clients prepare their finances.

April 10 -

More than 41% of U.S. workers drain their retirement savings when they quit or get fired, according to a new study. Why?

April 6 -

He spoke at Future Proof after the firm unveiled its collaboration with Dynasty Financial Partners and a funding rounds that raised $80 million.

March 28 -

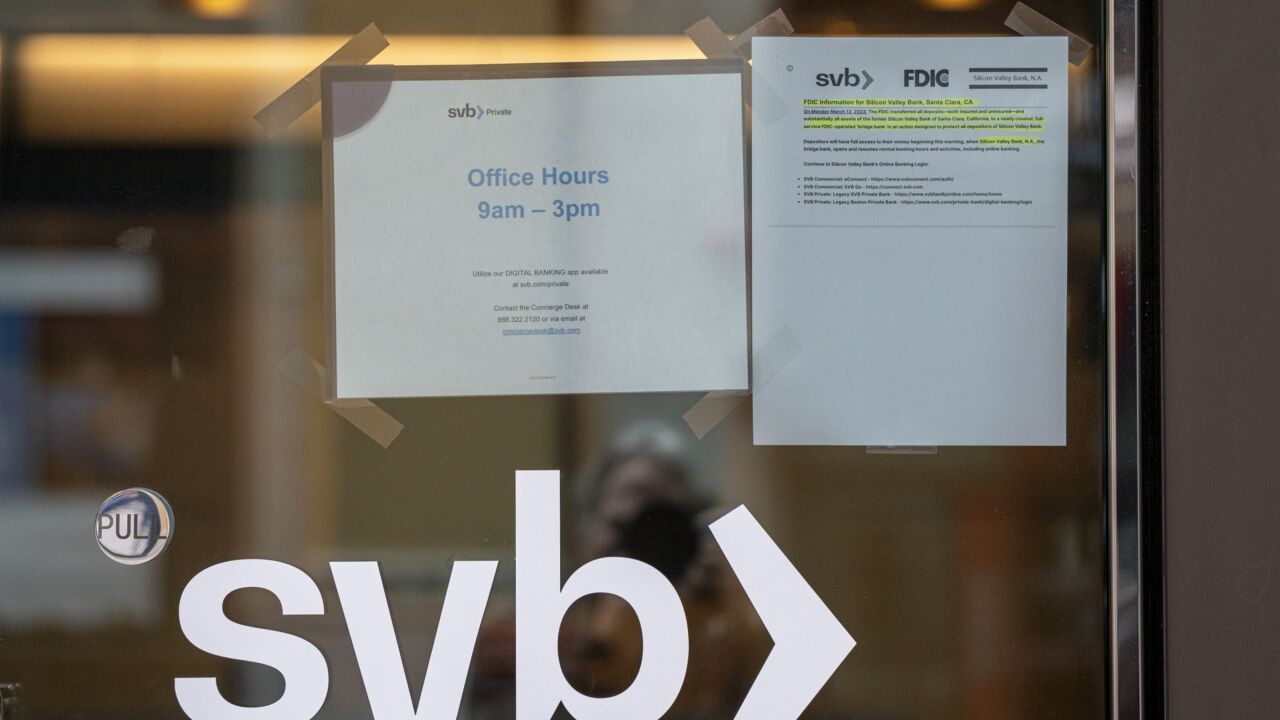

Financial advisors are flooded with questions from panicked clients. Here's a field guide to answers.

March 21 -

After three banks collapsed, a New York teacher wonders if the wreckage could reach her nest egg. Should she be worried?

March 16 -

New provisions increase the ways workers can contribute toward their futures and employers can invest in their workforce's financial wellness.

March 16 ADP Retirement Services

ADP Retirement Services -

The 4% rule isn't the only option. Plus, one counterintuitive idea says retirees can live larger this year.

March 14 -

A new study by FINRA and NORC offered encouraging signs that people who put money into stocks and bonds for the first time in 2020 are in it for the long run.

March 8 -

Contributions to 401(k)s and IRAs now can reduce your 2022 taxes soon due this filing season. Here's what advisors, many of whom can themselves benefit, need to know.

March 7 -

New data from Fidelity Investment shows disparate reductions in account balances for IRAs and employer-sponsored retirement plans last year.

February 26 -

A video producer in New York has a new job and a new retirement plan. Can, and should, he consolidate his savings?

February 23 -

Lawyers and compliance experts say advisors and brokers should still put clients' interests first when considering taking money out of a 401(k).

February 17 -

Women enroll in their workplace retirement plans more than men, and typically contribute more of their income. Why are they still falling behind?

February 15 -

A proposed amendment to the Investment Advisers Act would require planners to vet third-party custodians before entrusting them with clients' cryptocurrency, real estate or other alternative investments.

February 15