UBS’s two biggest legal cases in years are entering the final stretch in a test of Chief Executive Officer Sergio Ermotti’s strategy of taking on French and U.S. authorities.

The Swiss bank was hit with a long-expected U.S. fraud lawsuit that accused it of fueling the 2008 financial crisis by deceiving investors who bought billions of dollars of risky mortgage-backed securities. In France, the state and prosecutors are seeking as much as 5.3 billion euros ($6 billion) in fines and damages over allegations it helped clients hide money from authorities. That would be easily the largest criminal penalty ever levied in the nation.

UBS’s hard bargaining has resulted in both cases going to court, often a last resort for banks, with the worst-case scenario being huge fines and lengthy legal battles. The cases are among a series of such obstacles UBS has faced since the start of the financial crisis, including a $1.5 billion fine in 2012 for rigging the Libor benchmark.

"The French are demanding a lot — probably ten times more than what I estimate UBS has provisioned,” Daniel Regli, an analyst at MainFirst in Zurich, said by phone. “At a maximum, half of that amount would be realistic. The Swiss bank "has gone the route of fighting cases, most have come to agreements with authorities. Time will tell if this more aggressive approach works out."

It’s an approach that worked for Barclays. It fought back against the Justice Department in a similar case two years ago, when negotiations broke down over the size of the penalty involved. Federal prosecutors in Brooklyn filed a civil complaint against the bank, but settled the case earlier this year for $2 billion, less than half what U.S. authorities had originally demanded.

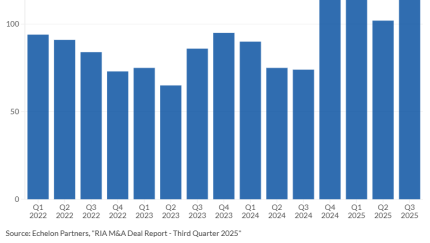

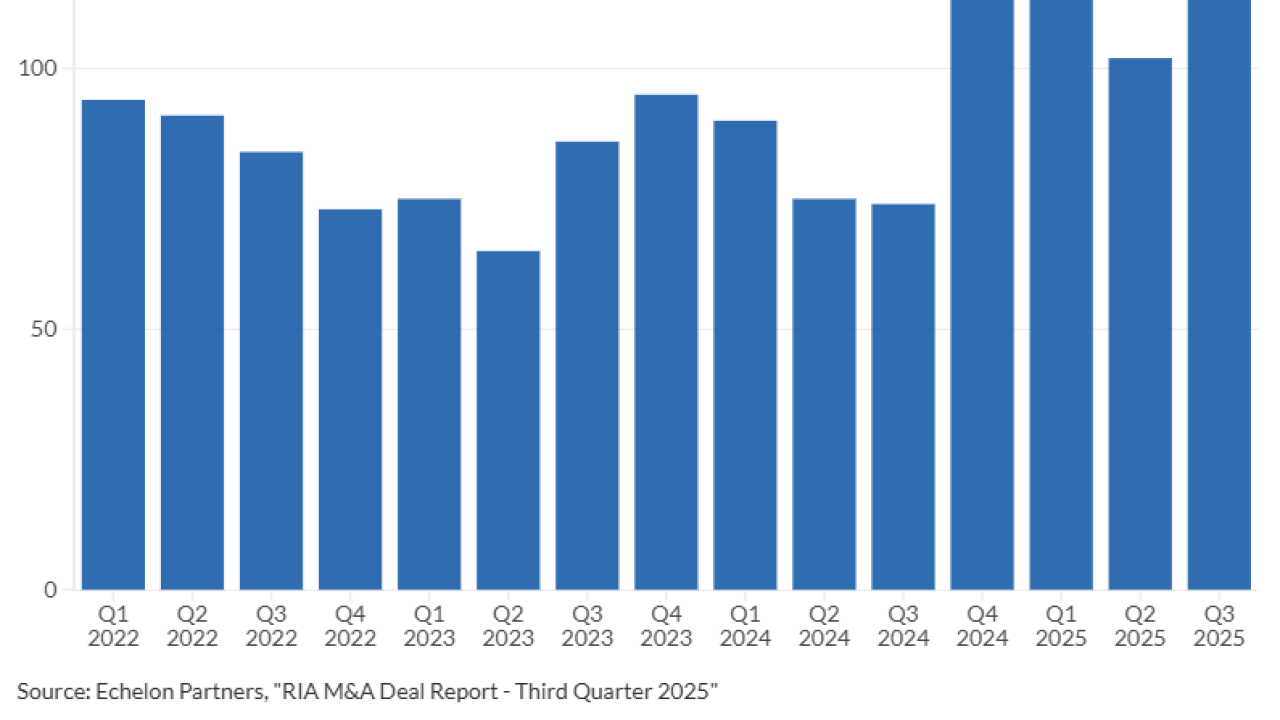

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

Also, Raymond James lands a $420M father-son team from Edward Jones, Cetera recruits a $350M LPL duo, and Cambridge acquires a $1B AUM dual registrant.

The UBS case in France ended up in court after settlement talks collapsed in March 2017 over how much it should pay. UBS had been pushing to settle the investigation for less than the 300 million euros it paid to resolve a similar case in Germany. That’s also the amount HSBC agreed to settle a similar criminal investigation by the French government last year, the second-biggest corporate charge levied in the nation.

UBS and its units securitized more than $41 billion of mortgage loans in deals that proved to be "catastrophic failures," U.S. Attorney Richard Donoghue in Brooklyn, New York, said in a statement. The U.S. case comes two years after Deutsche Bank and Credit Suisse agreed to pay a combined $12.5 billion over allegations by the Justice Department that they peddled toxic mortgage debt.

Prosecutors in France asked the court to impose a record fine of 3.7 billion euros that would be commensurate with UBS’s size, the nature of the crime and the damage to society. The French state, which is a plaintiff in the Paris trial, is seeking 1.6 billion euros from the bank in addition to any court-imposed penalties. A ruling is expected in several weeks, possibly early next year.

“The underlying facts are of an exceptional breadth and a systematic nature,” Prosecutor Serge Roques said Thursday during his closing arguments at the month-old trial. UBS called the prosecution’s fine calculation “irrational” and said the trial was ordered by lead French investigators on the basis of “erroneous conclusions.”

Before the court case started, UBS had to post 1.1 billion euros in bail. The bank has denied all the allegations.

The Swiss bank might pay around 565 million Swiss francs in the French case, Thomas Hallett, an analyst at Keefe Bruyette and Woods, said in a note to clients. He bases his estimate on the assumption that half of the approximately 10 billion euro assets in the investigation are "suspect". And precedents including HSBC’s tax evasion agreement with France and tax agreements by Switzerland’s biggest banks with the U.S.