Almost a year after taking over at UBS' investment bank, co-heads Piero Novelli and Rob Karofsky are working on their first shake-up of the business.

Novelli, who runs deals, is considering a reshuffle of his leadership as he and trading chief Karofsky seek to revamp a division that’s posted volatile results in the past year, according to people familiar with the matter. Their plans could entail hundreds of job cuts, said the people, who asked not to be identified because the deliberations aren’t public.

The discussions are preliminary and a final decision hasn’t been made, the people said. UBS declined to comment.

UBS is seeking to boost collaboration between dealmakers and the wealth management unit, while sharpening a focus on industries most of interest to its richest clients. That approach has already been successful for the Swiss bank this year.

The business of advising clients on deals and stock offerings was a standout in the second quarter, after slumping 48% in the first three months of the year. The rebound was helped by UBS’s role in advising on a string of large deals, including the spinoff of contact lens maker Alcon from Novartis and Amcor’s acquisition of packaging company Bemis.

UBS has also tapped into its network of wealthy clients. The firm helped Asian families secure billions of dollars worth of investments in Manhattan properties with help from the investment bank. The unit is also seeking to do more with private equity firms, pensions and sovereign wealth funds, adding talent from rivals.

Still, the investment bank’s 10% return on equity in the first half of the year was roughly half that of UBS’ other divisions. The unit had 5,333 employees at the end of June.

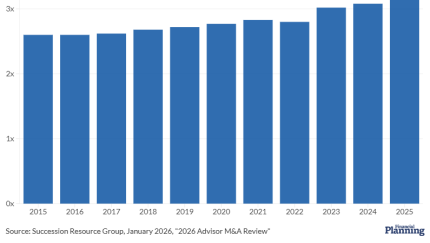

As valuations continue to rise across the industry, more firms are using compensation to invest in their top talent and future growth, Succession Resource Group says.

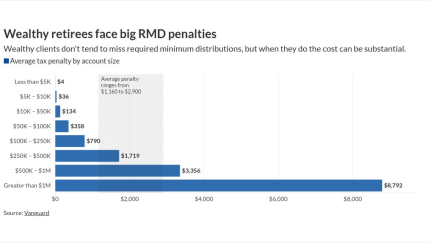

Missed IRA RMDs can cost clients thousands, Vanguard research shows. But financial advisors can help erase tax penalties and avoid future ones with a few key strategies.

Rather than investigate her claims against the head of the firm's wealth unit, the accuser claims that Citi's human resources turned its spotlight on her. Citi denies the claims.

The Swiss bank promoted Novelli and Karofsky last September, splitting the role held by Andrea Orcel, who was set to join Spain’s Banco Santander as CEO only to see his appointment fall through after the Spanish bank decided he was too expensive. The investment bank’s co-head structure mirrors that of the wealth-management business, which is run by former Commerzbank CEO Martin Blessing and Tom Naratil.

Like Orcel and Ermotti, Novelli is a former Merrill Lynch employee. He joined UBS in 2004, overseeing global mergers and acquisitions, and returned in 2013 after a stint at Nomura.

Karofsky has helped expand in equities and prime brokerage at UBS since joining in 2014 and previously worked at AllianceBernstein, Morgan Stanley and Deutsche Bank.

Novelli and Karofsky recently set up a new unit — called Private Capital Markets — to target a greater share of private transactions.