-

Like other bank-owned asset managers, the division is under pressure from new regulations such as MIFID II and a protracted shift toward passive investing.

December 6 -

To stand out from the crowd, some issuers have embraced thematic strategies focused on niche investments that could become the next boom industry.

December 3 -

The current impact of fund rebalancing on front-month VIX futures is about 20% of daily volume on the index’s contracts.

December 2 -

Rather than disclosing their portfolios every day like conventional ETFs, the nontransparent products will reveal their holdings at least once a quarter.

November 15 -

Equity funds tracking the sector are the second-most popular asset class after U.S. government bonds this year, BNP Paribas says.

November 14 -

Financed by their personal savings, the team behind the machine-learning fund have harnessed their engineering acumen to invest in developed markets.

November 13 -

Major repairs are needed to ensure Social Security’s long-term stability, according to an expert.

November 12 -

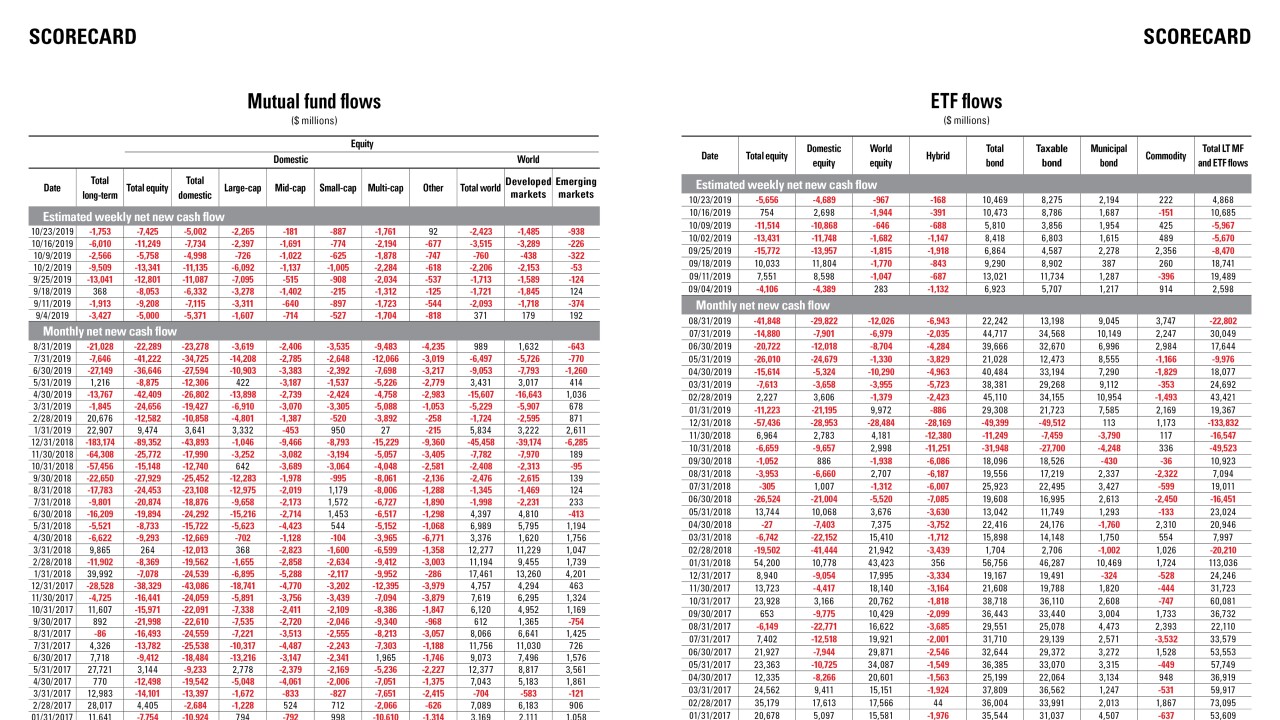

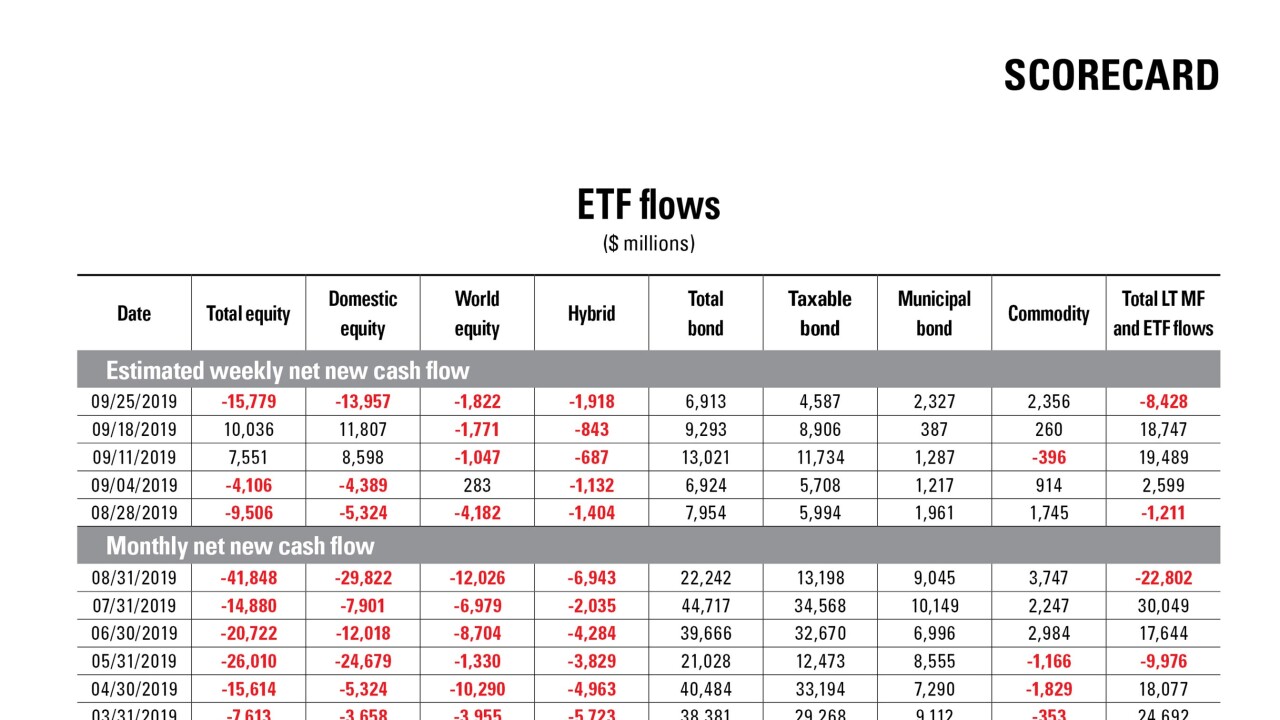

Data reported by the Investment Company Institute.

November 7 -

The SEC's recently passed ETF modernization rule is just one regulatory change industry leaders expect will impact asset management in the years ahead.

November 7 -

The changes follow the firm’s recent move to cut some client fees on separately managed accounts.

November 5 -

As the sector grows to over $30 trillion in Europe, North America, Japan, Australia and New Zealand, one popular approach consists of excluding offenders.

November 5 -

The large number of closures in equities and “other” categories could not be offset by new additions, Index Industry Association research shows.

November 4 -

The SEC’s recently passed ETF modernization rule, which expands choice in the market, “is probably the end of the mutual fund industry.”

November 1 -

It's no exaggeration to say rock-bottom fees are an existential threat to many asset managers. However, technology could still save the day.

November 1 Broadridge

Broadridge -

The move comes amid years of mediocre returns posted by hedge funds, prompting investors to pull money and demand lower fees.

October 30 -

Many lenders have started to scale back as the fund industry copes with reduced demand for research following MiFID II.

October 29 -

The downside for their clients, however, is it may obscure just how much credit risk they’re exposing themselves to.

October 25 -

Seema Hingorani will help oversee relationships with the firm’s largest clients and create a new training program to develop talent.

October 24 -

Data reported by the Investment Company Institute.

October 23 -

More than $1 trillion is invested in bond ETFs, with trading leaping 41% in 2018 from a year earlier, according to research.

October 23