-

Now, armed with data from the rule’s rollout in Europe, asset managers in the U.S. have a better sense of each analysts’ worth — fairly or not.

December 19 -

Direct lenders, including hedge funds and buyout firms, are prepared to spend billions to lure borrowers away from the $1.2 trillion leveraged loan market.

December 18 -

So much faith has been put on the partial trade deal with China that stocks have nearly recovered since President Trump’s first round of tariffs on imports.

December 17 -

Funds that track custom-built indexes often seek exposure to securities based on factors like ESG and strategies that would typically be actively managed.

December 16 -

As asset managers create younger wholesaling teams, they're also adapting models that leverage digitally savvy hybrid roles.

December 12Synthesis Technology -

The fund will track an index that divides the industry into five categories: pharmaceuticals, testing and analytics, cultivators, hemp and ancillary business.

December 11 -

The $1.8 billion deal is expected to close in mid-2020.

December 10 -

Jeff Smith's dismissal was first announced in a memo by CEO Larry Fink and President Rob Kapito, who only said the executive had violated corporate policy.

December 10 -

"It's going to become increasingly more important for financial professionals to understand the potential benefits of sustainable investing," an exec says.

December 10 -

“It’s going to become increasingly more important for financial professionals to understand the potential benefits of sustainable investing,” an executive says.

December 6 -

Like other bank-owned asset managers, the division is under pressure from new regulations such as MIFID II and a protracted shift toward passive investing.

December 6 -

To stand out from the crowd, some issuers have embraced thematic strategies focused on niche investments that could become the next boom industry.

December 3 -

The current impact of fund rebalancing on front-month VIX futures is about 20% of daily volume on the index’s contracts.

December 2 -

Rather than disclosing their portfolios every day like conventional ETFs, the nontransparent products will reveal their holdings at least once a quarter.

November 15 -

Equity funds tracking the sector are the second-most popular asset class after U.S. government bonds this year, BNP Paribas says.

November 14 -

Financed by their personal savings, the team behind the machine-learning fund have harnessed their engineering acumen to invest in developed markets.

November 13 -

Major repairs are needed to ensure Social Security’s long-term stability, according to an expert.

November 12 -

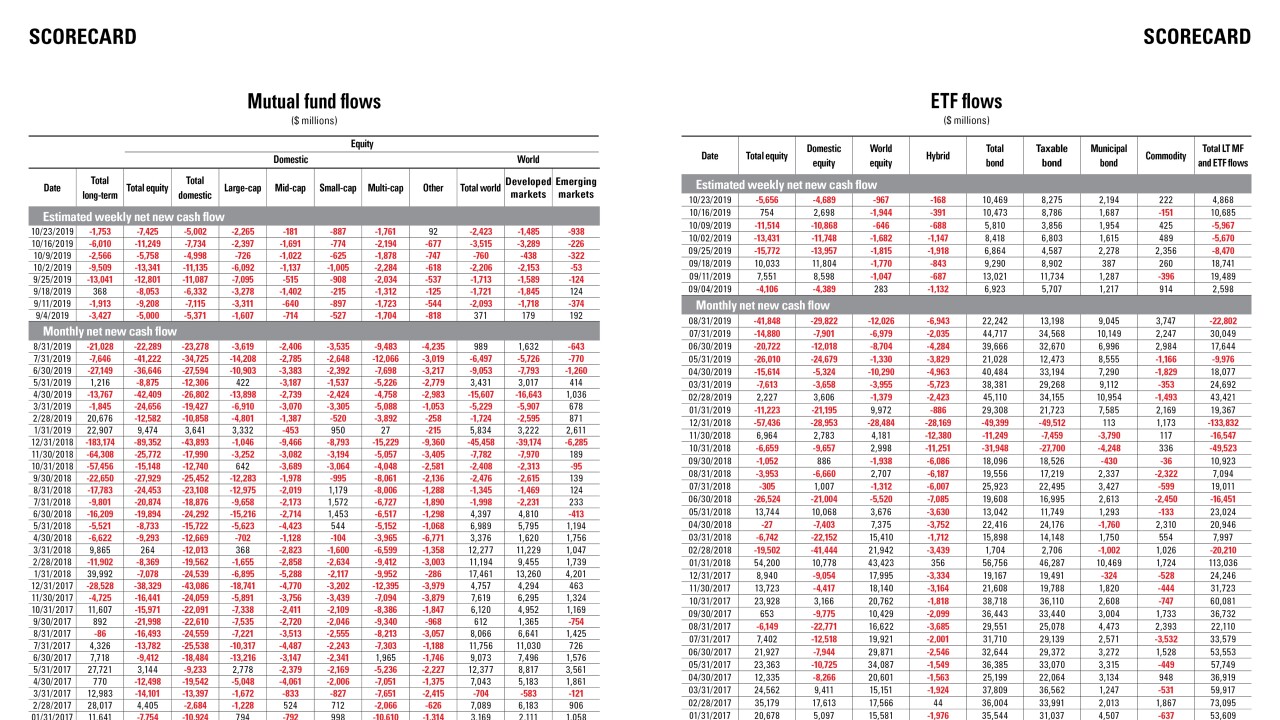

Data reported by the Investment Company Institute.

November 7 -

The SEC's recently passed ETF modernization rule is just one regulatory change industry leaders expect will impact asset management in the years ahead.

November 7 -

The changes follow the firm’s recent move to cut some client fees on separately managed accounts.

November 5