Andrew Welsch is a former managing editor of Financial Planning.

-

The elderly have called with technology issues, needing assistance with poorly understood account statements and to report scams. The calls also have helped the regulator identify mistakes and instances of abuse.

May 24 -

Richard Ketchum adds that the regulator needs to take a closer look at the culture of wealth management companies to see if executives are setting the right tone: "It is essential that a firm's leadership own the policies and procedures."

May 23 -

Three weeks after the broker killed himself, the firm agreed to a confidential settlement with his wife for an undisclosed amount.

May 19 -

In an unusual move, the two veteran advisers left the independent channel to rejoin an employee broker-dealer.

May 19 -

The regulator says the firm had "widespread failures" in its anti-money laundering programs for both its employee and independent channels.

May 18 -

While large brokerage firms pilot digital advice platforms, D.A. Davidson is holding back to see what works and doesn’t, says a top executive.

May 18 -

The new recruits are industry veterans who oversaw more than $330 million in client assets.

May 17 -

He will join a team of ex-Merrill advisers that will oversee more than $370 million in client assets at Snowden.

May 16 -

The firm is not launching a standalone robo service, but says new technology will empower its roughly 7,100 advisers to better meet client needs.

May 16 -

The independent firm affiliated with Raymond James recruits a veteran with nearly 40 years of industry experience.

May 16 -

The advisers are also balking at the firm's insistence that former advisers seeking to claim comp go through its dispute resolution process instead of FINRA.

May 12 -

The firm's newest recruits generated $3.5 million in annual revenue.

May 12 -

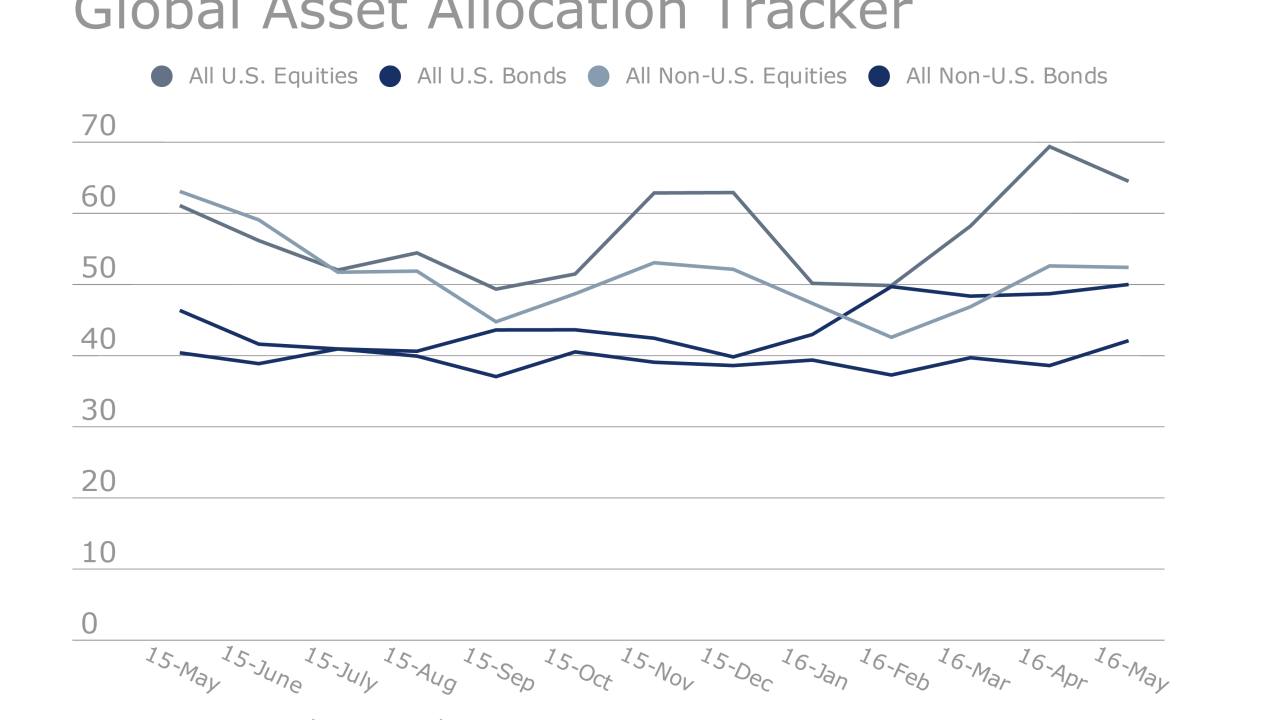

Wealth managers report being divided on whether to allocate more client funds to global or domestic stocks.

May 12 -

The wirehouse terminated the broker two days after losing a $34 million arbitration case brought by the client's widow, who alleged elder abuse and other misconduct.

May 11 -

The acquisition hungry firm added nearly 800 independent and employee advisers over the previous year.

May 9 -

The two veteran wirehouse advisers joined Wells Fargo's independent broker-dealer.

May 6 -

Stung by a 16% year-over-year decline in transaction-based revenue, the wirehouse looks to loans, bank products and a contingent of former Credit Suisse advisers for a bounce back.

May 3 -

Michael Armstrong, who has been serving as Global Head of Wealth Management at Jefferies, will take over as CEO of RBC's wealth management business.

April 29 -

The debate has spread far beyond planners and regulators, suggesting to some that public consciousness, and widespread change, might be on the rise.

April 29 -

Mark Immel had been awarded $450,000 in arbitration but faced further legal battles.

April 27