Ed Slott, a CPA in Rockville Centre, New York, is an IRA distribution expert, professional speaker and author of several books on IRAs. He is also the founder of

-

Advisors can protect clients’ estate planning goals post-Secure Act but the vehicle will have to change.

By Ed SlottFebruary 6 -

The Secure Act was designed to expand retirement savers’ options but it has subsequently all-but-eliminated the stretch IRA for beneficiaries. It's on advisors to make clients aware of the major change.

By Ed SlottJanuary 7 -

If not addressed, the client may see a higher tax bill than was planned. That won't go over well at tax time next year.

By Ed SlottDecember 12 -

Despite recent tax law changes, recharacterizations are still possible and can prove a valuable strategy to correct such missteps.

By Ed SlottNovember 21 -

Buyout amounts are high right now, but there are many other factors to consider when guiding your client to the right choice.

By Ed SlottNovember 8 -

Armed with some specific details, advisors can explain why the seductive option is both too good and too good to be true.

By Ed SlottOctober 11 -

Advisors may need to alert clients as to when these checks will be taxable.

By Ed SlottSeptember 4 -

After a booking error by an advisor, a client barely avoided being taxed on $500,000 and dodged more than $200,000 in taxes and penalties.

By Ed SlottJuly 19 -

A lump-sum distribution for net unrealized appreciation on employer stock can slash a tax bill in half, but there’s plenty of fine print.

By Ed SlottMay 28 -

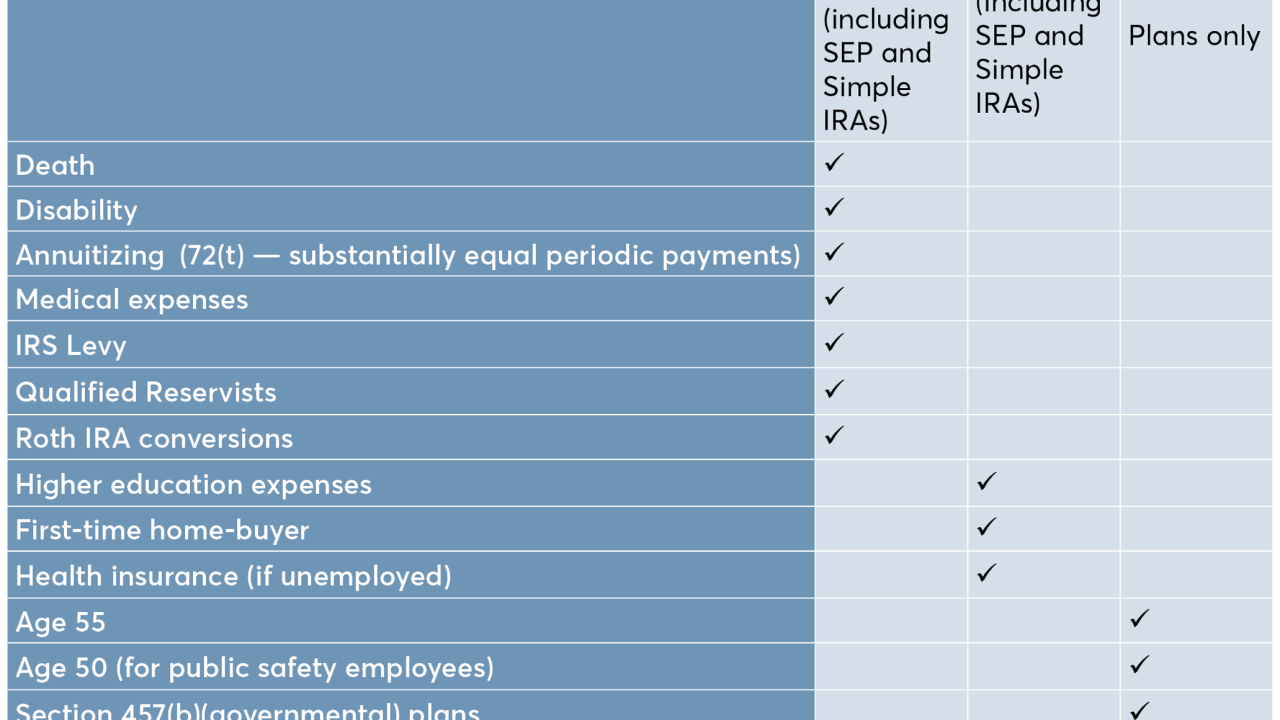

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

By Ed SlottApril 29 -

Errors are regrettably common. They are also easily avoidable.

By Ed SlottApril 1 -

Retirement plans may decline to offer delayed RMDs, plan loans, stretch and hardship distributions and a host of other legally sanctioned tax maneuvers.

By Ed SlottFebruary 19 -

Community property rules, how to divide 401(k)s and the nuances of QRDOs are just some of the specifics advisors should know.

By Ed SlottJanuary 10 -

Financial planners don’t have to be attorneys to help clients avoid high cost oversights

By Ed SlottDecember 24 -

The biggest QCD question is whether it will be effective for a check not cashed by year’s end?

By Ed SlottDecember 18 -

Retirement assets received in a divorce settlement may be available to creditors, a federal court has ruled. The decision may have far-reaching consequences for clients.

By Ed SlottNovember 28 -

Still, time is limited. Tell clients they’d better take advantage of the current exemption before it expires.

By Ed SlottNovember 21 -

How advisors can help clients protect these funds when inherited. If they don't, a few small, early mistakes can cause a client to lose most of the proceeds.

By Ed SlottOctober 24 -

Military families can use one of these provisions to seriously cut their tax burden. Plus, can clients make an IRA contribution on behalf of a deceased person?

By Ed SlottOctober 23 -

Advisors can help by being familiar with tax relief options that might be available to affected clients. Here's what to look for.

By Ed SlottOctober 10