Jessica Mathews is an associate editor for Financial Planning. Follow her on Twitter at @jessicakmathews.

-

The custodian’s Liberty platform and “intimate” service are now likely to rest in the hands of a wirehouse.

February 27 -

Schwab’s new executive explains his split with TD Ameritrade and his commitment to his new employer’s 4,500 sub-$100 million advisors.

February 26 -

Fee wars among asset managers are having small, but notable impacts across the industry and prompting renewed focus on core business.

February 25 -

CEO Peter Mallouk wants to create a “reserve” to see the RIA through any economic downturn.

February 12 -

Direct indexing, heightened competition and advisor tech platforms were just some of the critical details executives discussed.

February 7 -

Here’s what these companies are doing to attract and retain employees.

February 7 -

The agency is seeking additional information from the firms as well as competitors and advisors.

February 6 -

Metrics and strategy are key at YCharts. So are mystery-flavored Oreos.

February 4 - RIA Connect is “light-years” ahead of its last iteration and will be available by June, says the custodian.Sponsored by TD Ameritrade National LINC

- Top-of-mind concerns: Industry consolidation, levels of disruption and the fate of Veo One.Sponsored by TD Ameritrade National LINC

-

The firm will move from a bank custodial platform to a brokerage platform in the second quarter — all while getting a radical face lift.

January 30 - TD Ameritrade’s Tom Nally revealed that and other key details as the two firms press ahead with a proposed acquisition.Sponsored by TD Ameritrade National LINC

-

The SEC examined approximately 2,180 RIAs in 2019.

January 16 -

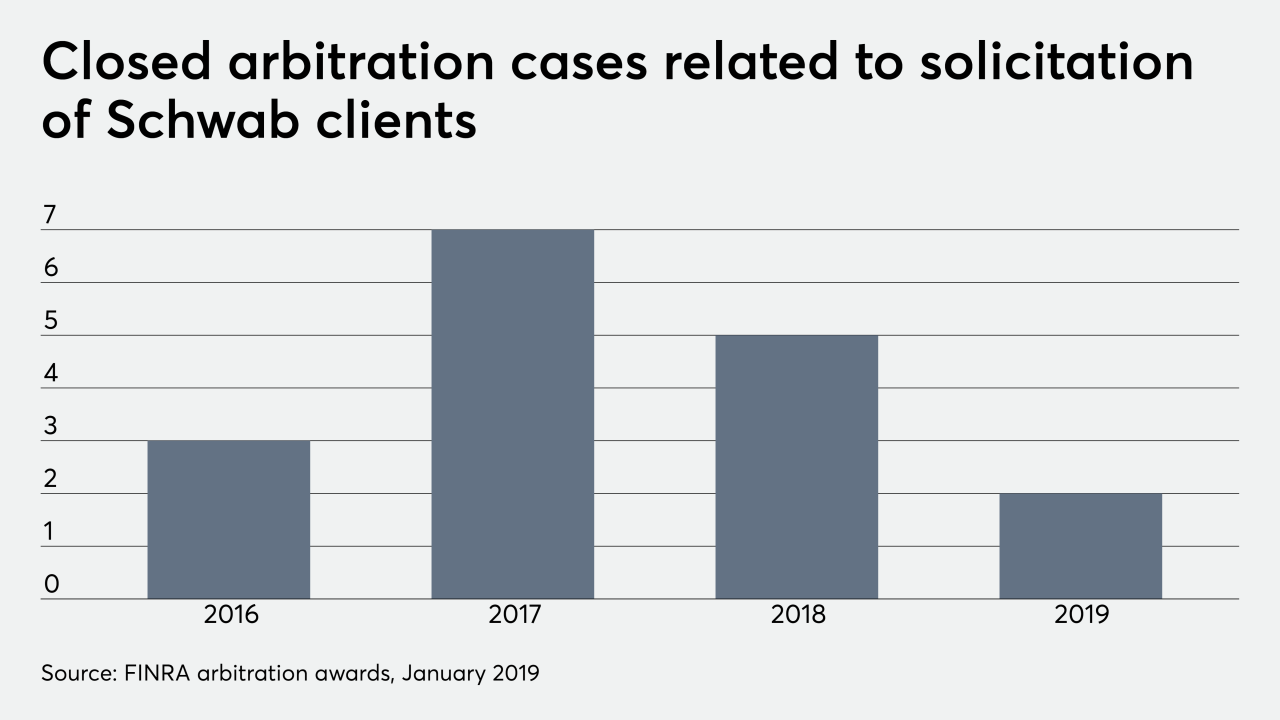

Planners — and RIAs that want to hire them — have faced hurdles tied to client solicitation rules.

January 13 -

BlackCrown tried to call foul on Schwab’s anticipated acquisition, asserting it would become an “unlawful monopoly” and stifle innovation in the custodial marketplace.

January 3 -

With Portfolio Intelligent Income, the discount brokerage is shifting some of its focus toward clients ready to spend their investments.

December 19 -

The commission-free brokerage did not reasonably review “hundreds of thousands of orders each month,” according to the regulator.

December 19 -

Competitors such as Merrill Edge have taken similar measures on commissions.

December 12 -

The wirehouse last made changes to its compensation plan in 2016.

December 10 -

The “vast majority” of retail clients already qualified as of October but certain customers were still paying $2.95 a trade.

December 9