The Justice Department is scrutinizing Charles Schwab’s proposed acquisition of TD Ameritrade for antitrust issues, asking

Now in the

“They made it very clear they want to talk specifically about the TD Ameritrade-Charles Schwab deal,” Jason Wenk, CEO of

While the agency's review is not an indication that the companies will face a legal challenge, it underlines the deal's complexity, size and ramifications for advisors, competitors and investors. Should the Justice Department’s antitrust division determine the deal would harm competition or consumers, then it may seek concessions or block it entirely.

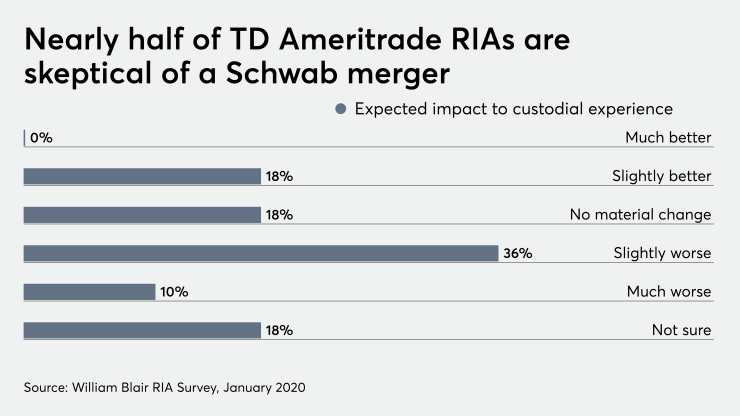

“It’s not the retail side that is feeling the most anti-competitive effects of the merger. It’s the RIA side,” says Timothy LaComb, an antitrust attorney at law firm MoginRubin.

Two custodians and one advisor told Financial Planning they have been contacted by the Justice Department with regard to the Schwab-TD Ameritrade deal. One custodian and the advisor asked not to be identified. The advisor, whose RIA custodies assets with TD Ameritrade, says they talked to attorneys and economists with the agency for about an hour.

“They wanted to know what a broker does, what a broker-dealer does, what an RIA does, what an IAR does, and how a custodian fits in to that,” the advisor says. “They asked some pretty good questions.” Justice Department representatives also asked questions about moving client assets to Raymond James, Wells Fargo, E-Trade and Fidelity, the advisor says.

Those types of questions, experts say, are not unusual for the department. The agency typically seeks documents, emails, testimony and more from the merging companies. It can look back years and subpoena information if needed.

Schwab and TD Ameritrade say they are cooperating fully and expect the deal to close in the second half of 2020, according to a recent SEC filing.

Both companies and the Justice Department declined requests for comment.

As part of a review, the agency may interview competitors and customers to get a sense of how they perceive and operate in the marketplace. “The conclusions of well-informed and sophisticated customers,” can play a key role in the department’s investigation,

In the case of Schwab and TD Ameritrade, that may well mean RIAs.

Retail investors have myriad options for investing, from banks to robo advisors to discount brokers to full service broker-dealers and more. RIAs may have somewhat more limited options.

“If four giant players dominate the market, and Nos. 1 and 3 merge, then that might be a problem [from an antitrust perspective],” says Alex Harman, competition policy advocate at Public Citizen.

Adding complexity is that not all custodians are created equal. Some are self-clearing; others aren’t. Some provide a lot of in-house tech solutions, while others rely on open platforms featuring third-party vendors. Some prefer only working with large RIAs, while a few have no asset minimum.

The scale of different custodians varies widely.

Other custodians are considerably smaller. Shareholders Service Group caters to about 1,600 firms. Pershing has around 750. RBC and Raymond James have approximately 100 and 200 fee-only RIAs, respectively, using their custodial services. And E-Trade Financial,

Are these true competitors to Schwab and TD? Is there a high barrier to entry for new firms joining the RIA custodial market? And how might third-party vendors, such as tech firms, be affected? Will they lose access to RIAs? Those are the kinds of questions the Justice Department will want to answer as part of its review, experts say.

“This is really the first time the DOJ is examining our industry,” Tom Nally, head of TD Ameritrade’s custodial division,

“There definitely will be people who don’t win in this,” says Altruist founder Jason Wenk.

Should the Justice Department find that the deal — or aspects of it — violate antitrust law, then the agency could either seek to block it in the courts or squeeze concessions from Schwab and TD, such as promises not to raise prices for a period of time or divestiture of certain business units.

The federal government reached such an accomodation with Sprint and T-Mobile over their proposed merger — only for state attorneys general to file a lawsuit against

Last year, the Justice Department and Federal Trade Commission concluded 26 significant U.S. merger investigations and filed seven complaints seeking to block mergers, according to Dechert,

Charles Schwab CEO Walt Bettinger expressed confidence that his firm’s deal would pass the Justice Department’s review.

“[The DOJ is] very bright, very thoughtful and careful in considering to ensure that they fulfill those duties from a consumer standpoint. But we feel very confident that the combination creates that true ideal model with no trade-offs,” Bettinger said during a February conference call with shareholders.

Among the benefits Schwab expects from the deal: potential cost savings of $1.8 billion to $2 billion; an opportunity for Schwab clients to leverage TD’s trading capabilities; and the chance to offer Schwab’s investment products to an expanded client base, according to a company presentation.

Custodial competitors say they aren’t sweating the proposed mega-acquisition. Competitors such as Fidelity and Shareholder Services Group say they are seeing an

“I have zero fear of it,” Wenk of Altruist says. “I don’t think it’s a bad thing. To me, it’s fairly inconsequential.”

Wenk says he is surprised that the deal has drawn the attention of the Justice Department.

While the barrier to entry in the custodial marketplace might be high, custodians don’t have to self-clear to compete, and “it’s lower than a bunch of other industries,” Wenk says, pointing to medicine and biotechnology.

Public Citizen’s Harman cautions that it may be premature to draw conclusions about where the department’s investigation is headed. Just one possible upshot, of many: “If the DOJ is asking for a second review, then they have questions about potential harm to the market,” Harman says.

With additional reporting by Andrew Welsch.