Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

At least three dual practices with nearly $1.5 billion in client assets have left since the No. 1 IBD unveiled the new guidelines.

March 8 -

The No. 9 IBD has emerged as one of the major players in a tough recruiting fight after the massive acquisition.

March 7 -

After acquiring four firms’ assets, the industry giant still faces big challenges ahead.

March 2 -

CEO Bob Oros says the firm is focusing on recruiting more experienced advisors, among other changes at the No. 19 IBD.

March 1 -

Funds managed by Marco “Mick” Hellman sold most of their holdings, while CEO Dan Arnold received options worth $5 million.

February 28 -

The IBD network has retained Goldman Sachs for a structural review that could have major implications.

February 26 -

Sales dropped by 8% last year, but LIMRA finds reason for optimism in 2018.

February 22 -

An advisor who is a former ballplayer set ambitious goals for 2021 with an alternate take on the hybrid strategy.

February 22 -

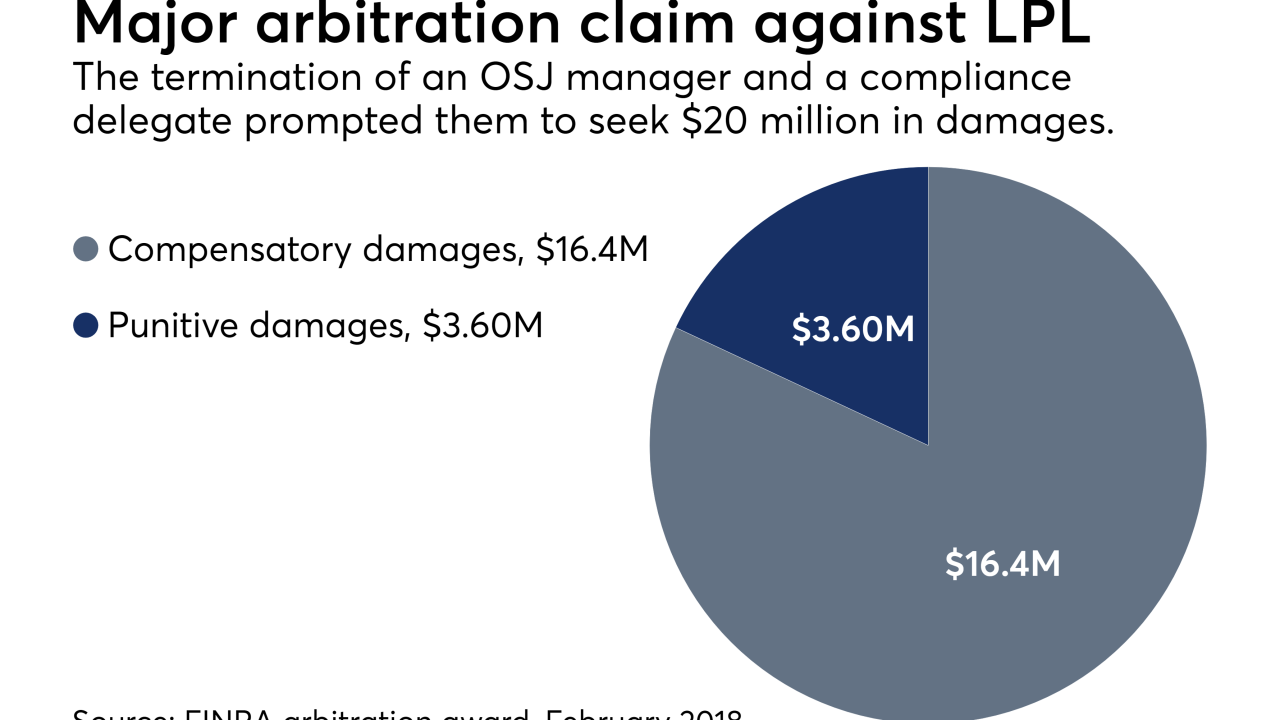

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20 -

The CEO of the firm’s parent says it expects to trim hundreds more advisors from its ranks over coming months.

February 20 -

CEO Josh Pace credits the smaller custodian’s agreement to be sold to E-Trade for the move.

February 16 -

Massachusetts regulators accuse the firm of running afoul of the impartial conduct standard by holding sales contests.

February 15 -

The firm is tapping a pool estimated by LPL to be as large as 1,200 brokers with $35 billion in client assets.

February 14 -

Robert Moore divided the firm's six IBDs into two channels, promoted a new COO and hired from a rival.

February 13 -

Private Advisor Group reported impressive growth even as other practices of its kind have left the No. 1 IBD.

February 12 -

Cetera, Advisor Group and Securities America are unveiling upgrades they hope will help advisors save time while growing their businesses.

February 12 -

As lure, the firm deploys a $52 million technology platform that is the “best that I've seen.”’

By Ann MarshFebruary 8 -

Robert Moore’s view sets him apart from other executives who argue that new talent will replace low producers.

February 7 -

Pole-vaulting advisor Mark Cortazzo’s practice marked at least the second hybrid in three months to leave the firm for Mutual Securities.

February 6 -

Executives from Pershing and Fidelity say smaller firms can find a home in the hybrid space.

February 5