Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

Smaller firms are opting to turn into OSJs in an era of shrinking margins for IBDs and record consolidation in wealth management.

February 26 -

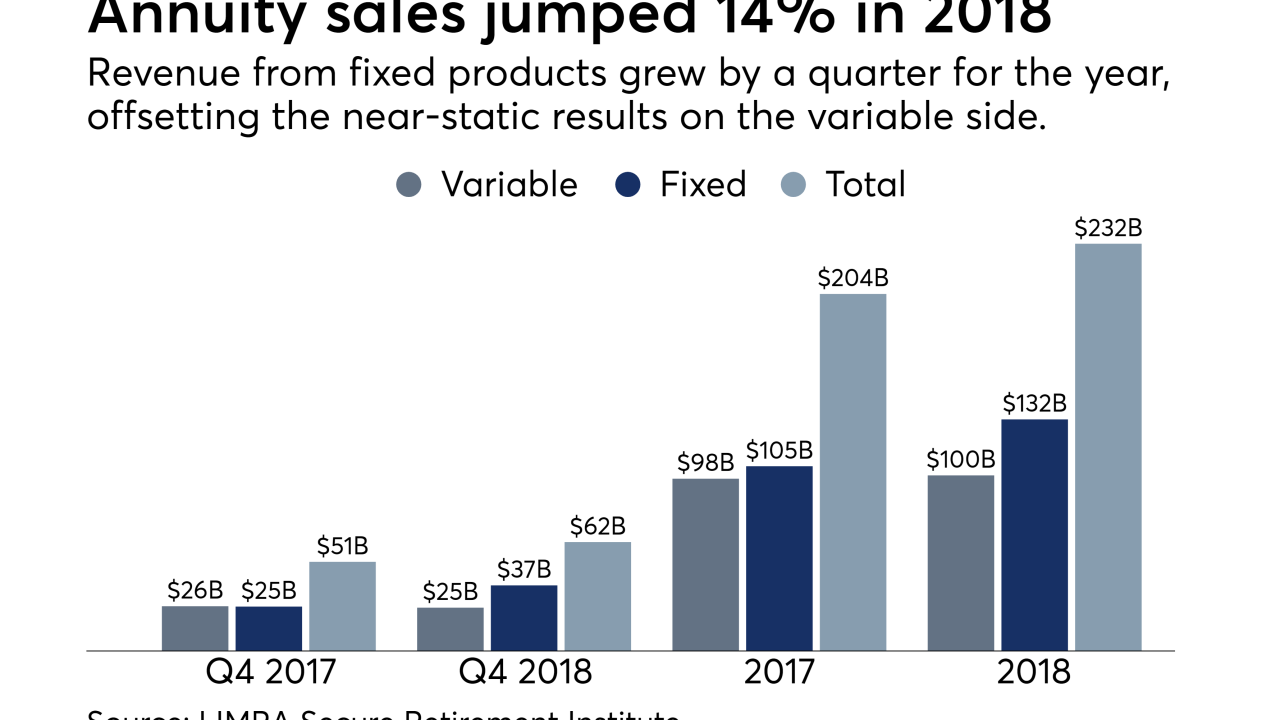

Fixed and variable contracts ended 2018 at nearly reverse levels of revenue from their totals three years earlier.

February 25 -

The private equity giant with a track record of taking firms public would add the IBD to its list of more than 850 investments for $73 billion worldwide.

February 25 -

The No. 1 IBD is pitching advisors on the merits of its offerings — but rivals have also added major teams from its ranks.

February 22 -

The IBD is one of three dozen firms the regulator has accused of failing to provide sales-charge waivers to eligible retirement plans and charities since 2015.

February 21 -

The new standalone firm’s first licensing agreement would bring MassMutual’s 9,000 reps on to the platform developed by the No. 4 IBD.

February 20 -

The CEO said his decision to resign followed a physician’s recommendation in connection with an undisclosed medical problem.

February 19 -

The No. 1 IBD’s efforts display opportunity amid the shortcomings of an industry still lacking measurable data from some of its largest firms.

February 19 -

The tax-focused IBD’s custodial and platform transition is taking longer than the company or its advisors expected.

February 14 -

Clients have received a combined $3.7 million in settlements involving two barred former reps of the IBD set to be acquired by Atria Wealth Solutions.

February 12 -

The No. 1 IBD is reaping the benefits of learning the lesson that it “can never move away from the advisor,” according to its head of business development.

February 11 -

Securities Service Network is pitching advisors on its tax offerings, access to management and parent-firm resources.

February 8 -

Two advisors who joined Alex. Brown after the Deutsche Bank acquisition in 2016 seek to void the FINRA panel's arbitration decision in a court challenge.

February 7 -

The firm cut its headcount by 22% while boosting productivity by 48% in 2018, and it plans to roll out a new desktop platform for its 1,060 representatives.

February 6 -

The past year brought major changes to the IBD network, including the sale of its majority stake and a structural reorganization.

February 5 -

Firms who resist or fail to understand advisors’ needs will lose the game, according to a panel of executives.

February 5 -

Under the deal, private equity-backed Wealth Enhancement Group would make its 10th acquisition in the past five years.

February 1 -

CEO Dan Arnold pledged new tech-enhanced support for advisors as part of a larger cultural transformation.

February 1 -

A new FINRA initiative to root out breaches of supervisory rules on 529 plans provoked criticism from the IBD advocacy group.

January 31 -

In an unusually frank discussion, women executives from five major firms urged the industry to get involved in educating young people about wealth management.

January 30