Commonwealth Financial Network may have discovered a new way to use the challenges facing the independent broker-dealer space to its advantage.

The company’s partners launched a company called Advisor360 to offer

The offering is something of an outlier in the industry as IBDs often keep their proprietary tools a closely-held secret because rising

But there’s an advantage to opening the doors to digital partnerships, says Darren Tedesco, Commonwealth’s managing principal for innovation and strategy.

“I’ve now got the ability to really accelerate all of the things we envision doing, with some added resources from licensing our technology,” Tedesco says, adding that the offering will enhance tech “for Commonwealth advisors, MassMutual advisors and, obviously, the rest of the industry is my hope.”

MassMutual’s MML Investors Services and Commonwealth also made a good match because both use Fidelity’s National Financial Services as a custodian and operate from headquarters in Massachusetts, Tedesco says.

-

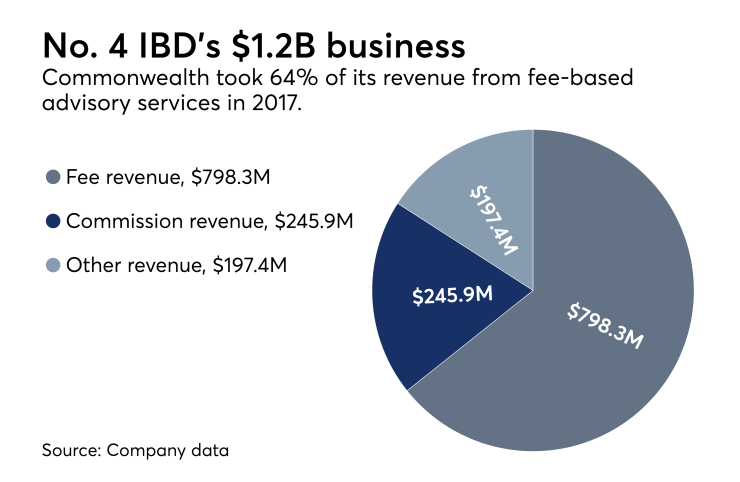

The five new advisors kicked off recruiting in 2019 for the No. 4 IBD after it set a record in the previous year.

January 16 -

“I don’t want to call a helpline, I want a partnership,” the advisor says of her move to the firm, which expects to hit record gross recruited production.

December 21 -

Executives say valuing friendliness alongside other factors is helping to drive a record $66 million in incoming production this year.

November 28

J.D. Power’s annual survey reveals the importance of leadership and culture, along with differences among male and female representatives.

He estimates that implementation could take as long as 12 to 18 months, though MassMutual spokesman Michael McNamara notes that it won’t require any repapering or client authorizations. The deal will give MassMutual advisors “a powerful new tool” rather than replace any tech, McNamara says.

Advisor360 “will dramatically accelerate MassMutual’s ability to deliver a fully digital, end-to-end, unified experience for our advisors and their clients, holistically across planning, protection and wealth management,” he said in an email statement. “It will also improve ease of doing business and enable our advisors to do what they do best: Service their existing clients and grow their practices.”

The firms did not disclose any financial terms of the deal, though Tedesco did say that MassMutual’s payment is based on the number of users.

MassMutual’s advisor force has nearly doubled from 4,800 over the past decade, the firm says. The acquisition of MetLife's Premier Client Group pushed the firm’s IBD into the No. 5 spot from No. 15 on Financial Planning’s latest annual

The new offering could provide an influx of capital for Commonwealth’s technology while boosting its profits and paving the way for other collaboration, according to Sheryl Rowling, a CPA planner from San Diego-based Rowling & Associates who developed tax rebalancing software she later sold to Morningstar.

“It is kind of unusual to see competing organizations that are so close in size coming to an agreement to share a resource,” she says. “For competitors in the insurance space, having an entire group that is equipped with advanced technology to be able to offer more of a comprehensive approach to their clients — that's going to give them an edge over their insurance competitors.”

Rowling and Jen Goldman, whose consulting firm helps RIAs with technology, operations, marketing and other services, cite consolidation as a major factor. The difference between a private, independent firm like Commonwealth and a captive insurance BD poses difficulties, though, Goldman says.

“You're introducing a software that kind of suggests you should be running your business differently. What makes it a challenge is also a positive,” Goldman says. “The purpose for MassMutual to do this is that they do want that mind shift to happen.”

Advisor360 has opened its own office near Commonwealth’s headquarters outside Boston, with about 250 employees. The firm may add another 100 more over the next 18 months, according to Tedesco. Advisor360 must be separate from Commonwealth, due to regulations about one broker-dealer seeing another’s data.

The offering consists of three “core tools” for operations and practice management, advisor portals and client-facing software, according to a company brochure. It includes trading, reporting, analytics, customer relationship management, planning, document handling, messaging and other capabilities.

Advisor360 already handles data from all custodians, though it’s starting with a “tight integration” under Fidelity’s NFS, Tedesco says. He aims to reach agreements with Pershing, Charles Schwab and TD Ameritrade, to make the new platform fully multi-custodial for all its tools in the future.

Commonwealth had been considering a tech offering for roughly four years, after successful returns on surveys of advisors and tech firms, according to Tedesco. Advisors gave the firm a score of 955 out of 1,000 on

Two years ago, the company began discussing the idea with tech vendors and private equity firms, who advised Commonwealth that it needed a standalone firm for the platform, Tedesco says. He and other partners fully backed the startup, but they’ll consider PE firms and other sources of capital, he says.

In the Feb. 13

“We had been trying to build the best technology platform for decades, so this hasn't been an overnight process,” Tedesco says. “It turned out to be a pretty good match — kind of made in heaven — to start us off.”