Earnings

Earnings

-

The last time the pool was smaller was in 2012, when it decided to cut large parts of the investment bank and was fined for trying to rig global interest rates.

March 10 -

The nation's largest IBD vows to take a “proactive approach” to the fiduciary rule.

February 9 -

CEO Jim Cracchiolo said the firm's efforts won't go to waste should the rule be overturned.

February 2 -

Ronald Kruszewski says a shift in the size of transition packages, made in response to the fiduciary rule, "benefits us competitively."

January 31 -

The wirehouse also reported record revenue of over $2 billion for the recent quarter.

January 27 -

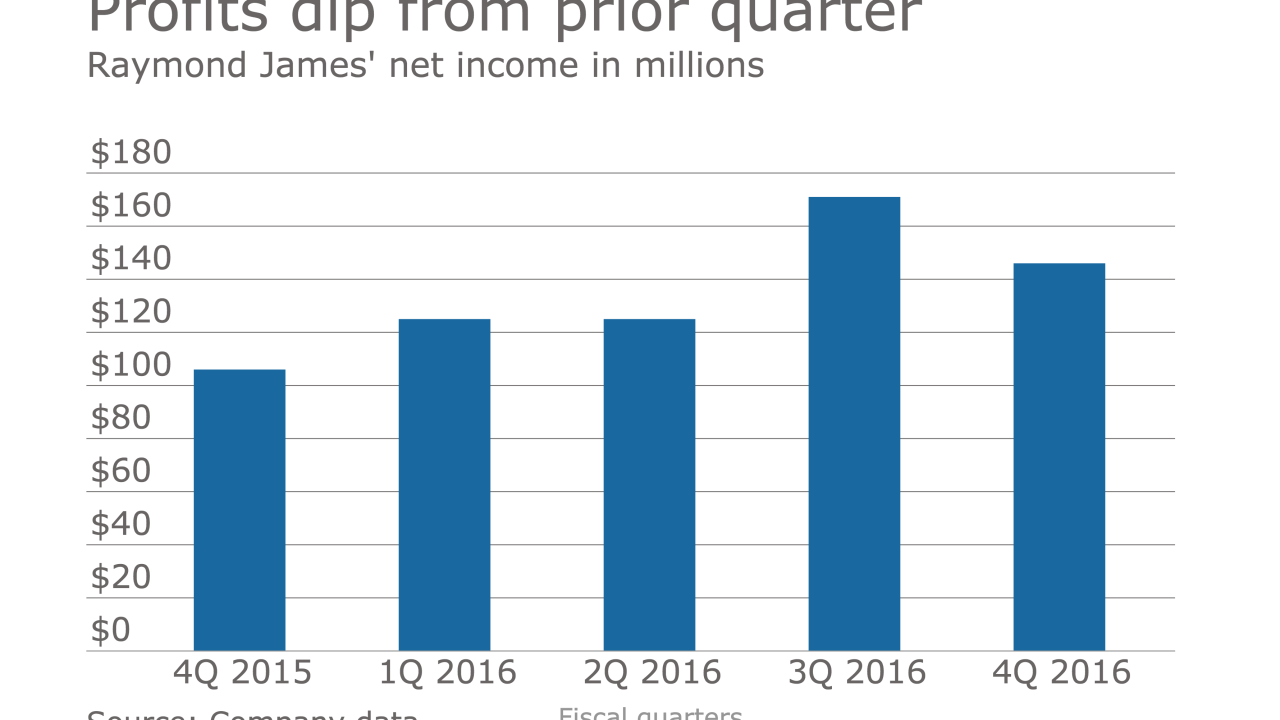

The firm is preparing for the fiduciary rule and contesting a lawsuit alleging that Raymond James allowed a $350 million fraud to be perpetuated.

January 26 -

Revenue in 2016 from the retail brokerage business slipped 6% to $281 million from $300 million in 2015.

January 20 -

While fourth-quarter revenue from brokerage services posted a sharp 20% over-over-year decline, the overall wealth management business still managed to come out ahead.

January 20 -

Fourth-quarter revenue jumped 19% year-over-year, while profits soared 57%.

January 18 -

James Gorman laid out plans for the wealth management unit, which turned in record earnings for the fourth quarter.

January 17 -

The advisory business ended the year on a strong note, boosted by growth in net interest income, which rose 14% year-over-year.

January 13 -

The business, which includes Merrill Lynch, said profits were up 1.8% year-over-year, but down 9% from the previous quarter.

January 13 -

CEO Ron Kruszewski says market conditions and the fiduciary rule are dampening growth at the firm and throughout the industry.

November 3 -

Amid reports of a possible sale, assets rise and expenses fall.

November 3 -

CEO Sergio Ermotti pledged that cost-cutting efforts are to continue.

October 28 -

Client assets for the firm's advisory business hit a record high.

October 25 -

"Optimizing choice for our clients … is critical to how we operate as a firm," CEO James Gorman said during an earnings call where the wirehouse reported net revenue was a record $3.9 billion last quarter.

October 19 -

Headcount rises for the 11th consecutive quarter for the wirehouse, which is prepping for the Department of Labor's fiduciary rule.

October 17 -

J.P. Morgan Chase, Citigroup, First Republic and Bank of America were among the institutions questioned on the issue of incentive compensation.

October 17 -

Net income for the wealth management unit rose to $677 million from $606 million for the year-ago period.

October 14