Earnings

Earnings

-

While the bank’s second-quarter earnings disappointed, wealth management services, driven by Merrill Lynch, were a bright spot.

July 15 -

Higher equity values and client activity pushed up the major custodian’s revenue in the second quarter, despite significant headwinds.

July 15 -

Yet there is concern the Delta variant of the coronavirus may spread and spear policy actions that could slow economic growth.

July 15 -

The megabank announced second-quarter revenue of $4.1B for the Asset and Wealth Management unit, with net income of $1.2B.

July 14 -

Its parent seeks to support more holistic planning by combining it with two other subsidiaries.

June 18 -

The firm grew its total assets under administration by 30% year-over-year, reaching $530 billion.

May 27 -

While several analysts are bullish, not all are convinced of the Canadian asset manager’s newfound strategy.

May 21 -

During first quarter earnings last month, the bank said that it would take a $300 million restructuring charge related to the cuts in the second quarter.

May 19 -

After its industry-leading headcount dipped slightly during the temporary ban, the wealth manager plans to offer more resources for incoming recruits.

May 10 -

The RIA completed seven transactions in the first quarter, along with starting a new international venture in partnership with the billionaire Hinduja family.

May 10 -

The tax-focused wealth manager’s parent disclosed lower first-quarter earnings after an eventful period marked by a proxy fight and a reported acquisition offer.

May 7 -

As its advisor headcounts in the W-2 channel have stagnated, Raymond James Advisor Select added a major former UBS quartet.

May 6 -

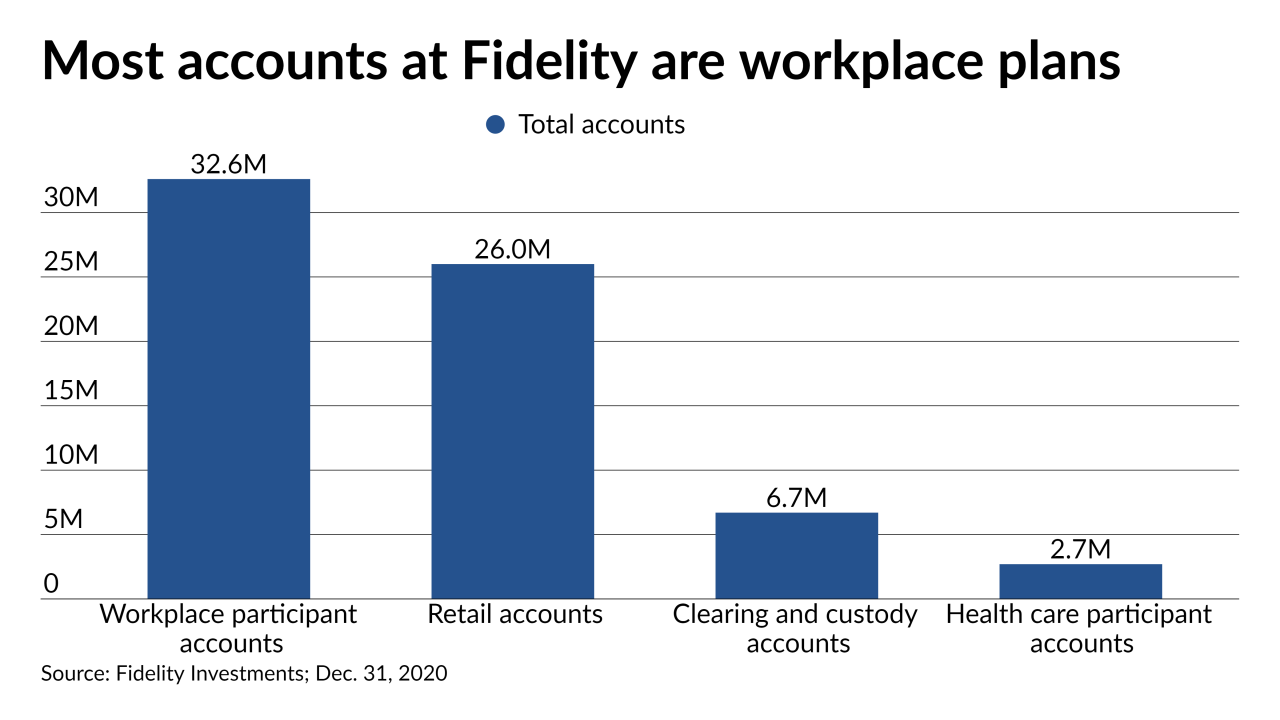

The company has benefited from a market surge, new investors and an uptick in broker breakaways.

May 5 -

More growth is on the way: the No. 1 IBD has one more massive recruiting move and a $300M acquisition to complete.

April 30 -

The firm slimmed down its headcount slightly, even as it saw an uptick in advisor-related revenues from fees and asset management.

April 29 -

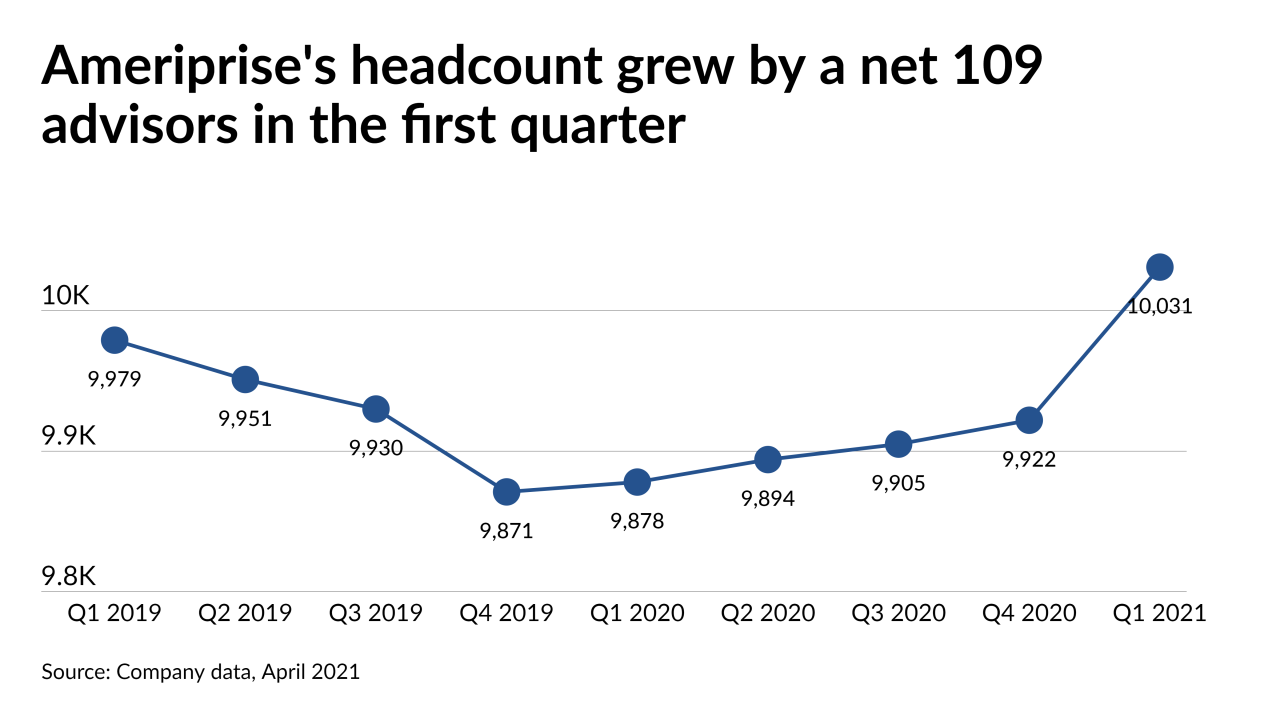

The company upped its recruiting package last year, a change that has been “very well received by prospective advisors,” according to the CEO.

April 29 -

The firm’s recruiting is also gaining steam, despite the ongoing impact to its bottom line from low interest rates.

April 28 -

The Swiss bank added a sprinkle of new US advisors for the first time in years, amid record quarterly profits and plans for global job cuts.

April 27 -

As the firm repelled a rare activist challenge, a potential private equity buyer has approached it, according to a news report.

April 23 -

Despite record growth in wealth management, an otherwise rosy earnings report was marred by $911 million loss related to Archegos Capital.

April 16