-

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

3h ago -

RBC Wealth Management-U.S. sees a 12% surge in assets under administration — thanks largely to skyrocketing market gains.

February 26 -

New research shows visuals and gamified tools can dramatically boost client understanding and engagement around complex retirement rules.

February 24 -

With AI concerns crimping wealth management firms' stock values, an analysis by Fitch Ratings reveals the companies' underlying dynamics after a strong 2025.

February 24 -

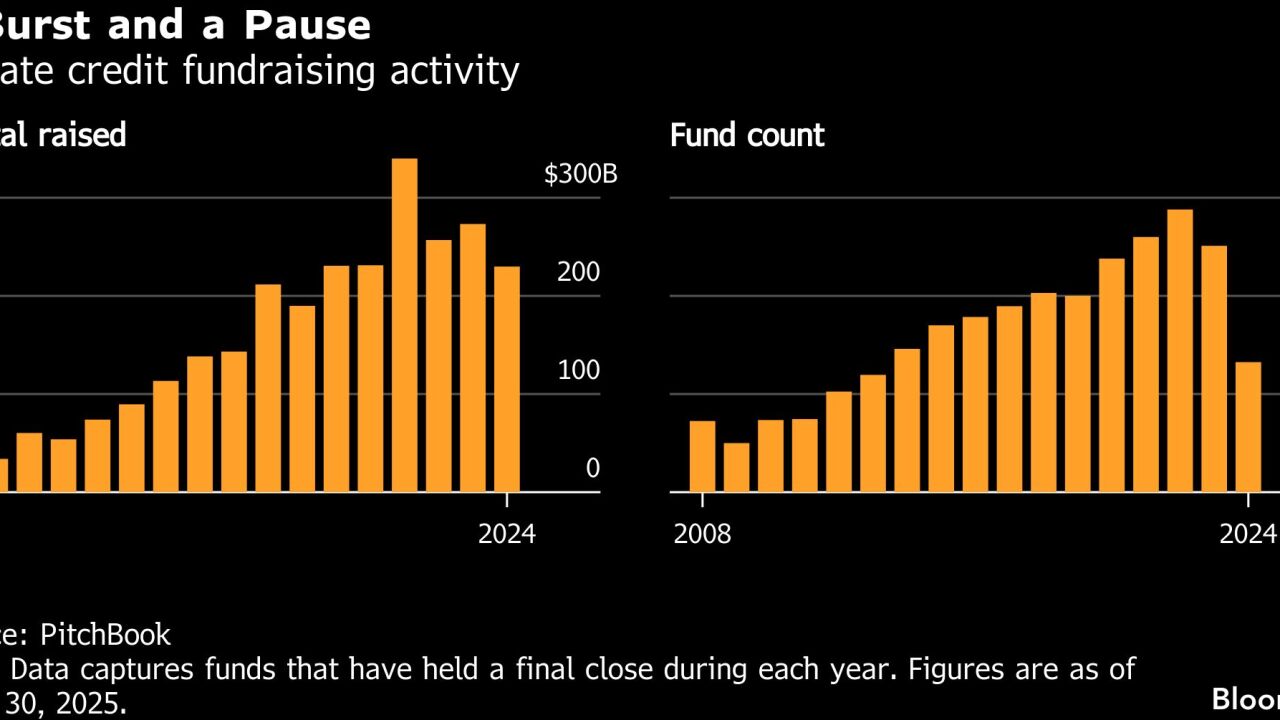

Blue Owl's decision to halt withdrawals from one of its private credit funds raises further questions about the already obscure world of private credit.

February 23 -

The platforms, where bets are placed on everything from U.K. soccer teams to the price of bitcoin, are getting traction from investors and attention from regulators.

February 23 -

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

February 19 -

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 12 -

The tech can be smart and speedy, but also tone deaf when it comes to picking up the nuance of client conversations.

February 11 Raise Your EI

Raise Your EI -

Wealthy parents fear their kids will squander their inheritances. Financial planner Mary Clements Evans solved for that while cementing her firm's future.

February 10 -

Virtually every major firm on Wall Street has joined the push into private markets, with many trying to get in early on the biggest "next big thing" to hit financial services since the exchange-traded fund.

February 6 -

Private equity-backed M&A activity has steadily risen. Owners may do great in a sale, but what about advisors lower in the organization?

February 5 -

UBS Americas reported $14 billion in net new asset outflows in Q4, marking its worst period since the firm announced major compensation changes in November 2024.

February 4 -

Internal succession planning is messier but aligns with a true fiduciary firm's core values, argues Neela Hummel of Abacus Wealth.

February 3 Abacus Wealth Partners

Abacus Wealth Partners -

CEO Rich Steinmeier looks past advisors defections to tout progress toward its goal of retaining 90% of the assets Commonwealth Financial Network had at its purchase last year.

January 30 -

Ahead of the expected closing of Fifth Third Bank's deal to acquire Comerica Bank, Ameriprise CEO Jim Cracchiolo provided few new details.

January 29 -

CEO Paul Shoukry took a swipe at big private equity-backed acquirers, saying in an earnings call that most advisors want to be at firms "where they're not going to have to have another disruption in three to five years."

January 29 -

Red flags may abound, but so do arguments for an extended equities streak. Keeping clients on an even keel is crucial.

January 29 Wealth Teams Alliance

Wealth Teams Alliance -

Stifel CEO Ron Kruszewski said a surge in advisor recruiting and record wealth management results could lead the firm to invest even more in hiring in 2026.

January 28 -

The raise comes following a year when the firm earned $57 billion in net income, approaching a record set in 2024.

January 23