-

Both long and short investments focused on volatility were mostly crushed lately.

February 14 -

The recent plunge raised suspicions that quants had caused or exacerbated the sell-off.

February 14 -

Mercer Advisors picks up where it left off last year.

February 13 -

Mark Mobius will step down after more than three decades with the firm.

February 13 -

Thanks to differentiated bets on stocks, equity mutual funds beat benchmarks across the board.

February 13 -

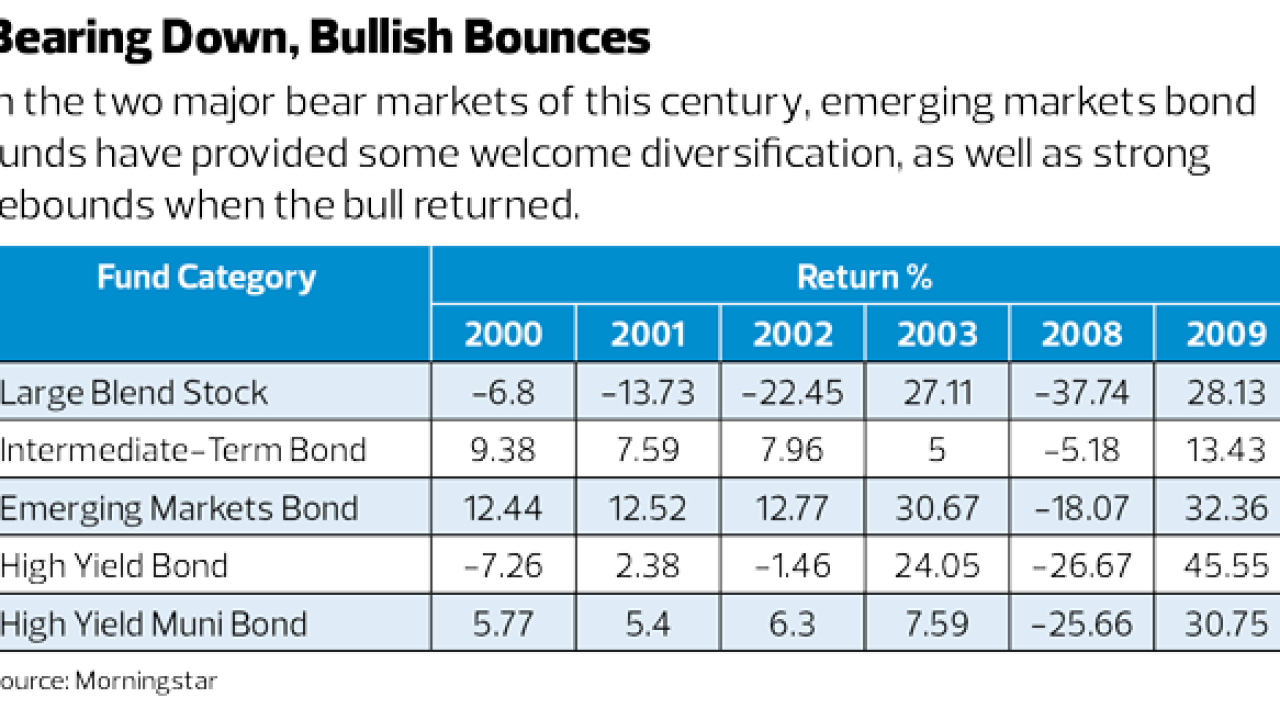

After stellar performance in a hectic decade, advisors home in on these funds.

February 13 -

Data reported by the Investment Company Institute.

February 12 -

The firm says it has moved away from the products after an implosion of a vast array of arcane bets against stock market volatility.

February 12 -

Cloud-based platforms may pose a disruptive threat to asset managers and custodians offering fixed-income products.

February 9 -

Even core investments in developing nations reflect the firm’s conviction that Fed hikes are about to wreak havoc across markets.

February 9 -

The resurgent threat of inflation and higher bond yields helped trigger a burst of volatility.

February 8 -

The proliferation of esoteric funds not easily understood by retail investors has created greater potential for damage.

February 8 -

The top 20 funds are from just three asset managers: Fidelity, Vanguard and American Funds.

February 7 -

The last time the industry’s largest ETF experienced redemptions close to this pace was before the financial crisis.

February 7 -

Technology, materials and consumer shares paced a 1.7% gain in the S&P 500, while DowDuPont and Home Depot led a 567-point surge in the Dow, the biggest in two years.

February 6 -

Credit Suisse said it will liquidate an ETP, effectively wiping out a fund whose market value topped $2 billion just three weeks ago.

February 6 -

The major indexes are now down for the year.

February 5 -

Getting clients to understand how volatility is an essential part of investing isn’t easy, but is even harder when stocks had been in the midst of an uninterrupted bull run.

February 5 Mercer Advisors

Mercer Advisors -

Even if those assets are used to pay for nonmedical expenses, an HSA can still be ahead of a 401(k) plan or an IRA.

February 2 -

It’s the biggest plunge in equities since June 2016.

February 2