With that in mind, we collected the 20 largest mutual funds and ranked them by five-year annualized returns. Given the bull market in recent years, the returns were understandably strong; averaging 10.7%, slightly outpacing the very long-term annualized gain (since 1928) of 9.65% for the S&P 500, according to data from the NYU Stern School of Business.

All 20 funds were from just three asset managers: Fidelity had two (including the top fund), while Vanguard and American Funds had nine each.

All the funds listed here were in the black for the five-year period, although some just barely. Eight were in single digits, and the bottom two were at less than 2% for the past five years. The average expense ratio was 41 basis points for these funds, with the highest coming mostly from the actively managed products of American Funds, as well as one of Fidelity’s. Vanguard’s expense ratios were mostly on the lower end given its strategy of offering passive products.

Scroll through to see the 20 largest funds and their five-year returns. We also show one-year returns, expense ratios and total assets for each fund. All data from Morningstar Direct.

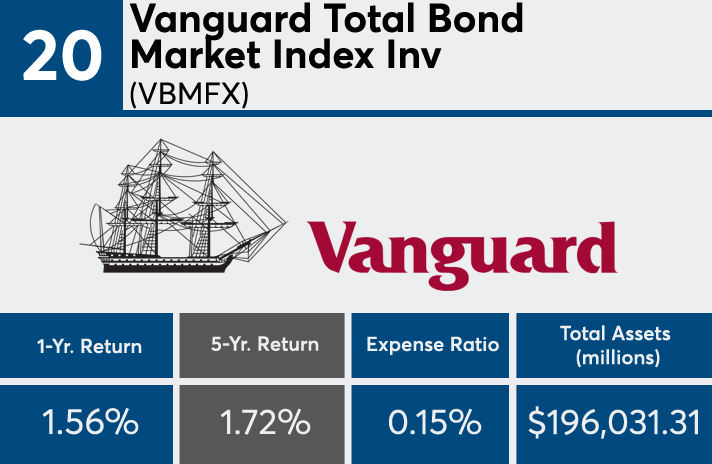

20. Vanguard Total Bond Market Index Inv (VBMFX)

5-Yr. Return: 1.72%

Expense Ratio: 0.15%

Total Assets (millions): $196,031.31

19. Vanguard Total Bond Market II Idx Inv (VTBIX)

5-Yr. Return: 1.76%

Expense Ratio: 0.09%

Total Assets (millions): $154,677.93

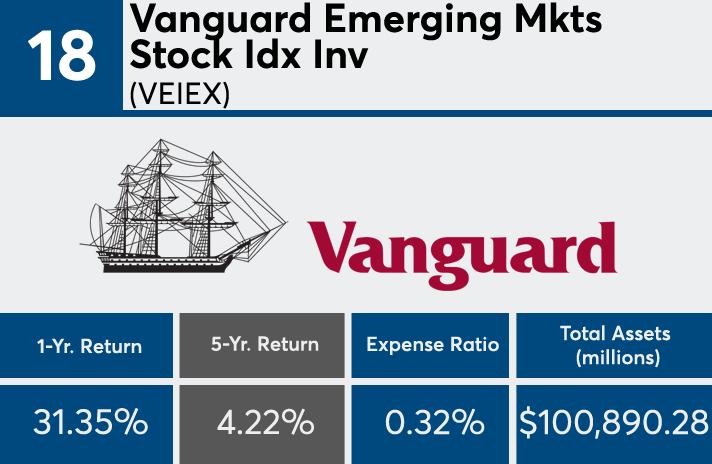

18. Vanguard Emerging Mkts Stock Idx Inv (VEIEX)

5-Yr. Return: 4.22%

Expense Ratio: 0.32%

Total Assets (millions): $100,890.28

17. Vanguard Total Intl Stock Index Inv (VGTSX)

5-Yr. Return: 6.91%

Expense Ratio: 0.18%

Total Assets (millions): $351,499.18

16. American Funds Capital Income Bldr A (CAIBX)

5-Yr. Return: 7.30%

Expense Ratio: 0.59%

Total Assets (millions): $110,440.33

15. Vanguard Developed Markets Index Admiral (VTMGX)

5-Yr. Return: 7.79%

Expense Ratio: 0.07%

Total Assets (millions): $113,609.94

14. American Funds Europacific Growth A (AEPGX)

5-Yr. Return: 8.56%

Expense Ratio: 0.85%

Total Assets (millions): $169,283.69

13. American Funds Income Fund of Amer A (AMECX)

5-Yr. Return: 9.12%

Expense Ratio: 0.56%

Total Assets (millions): $112,418.99

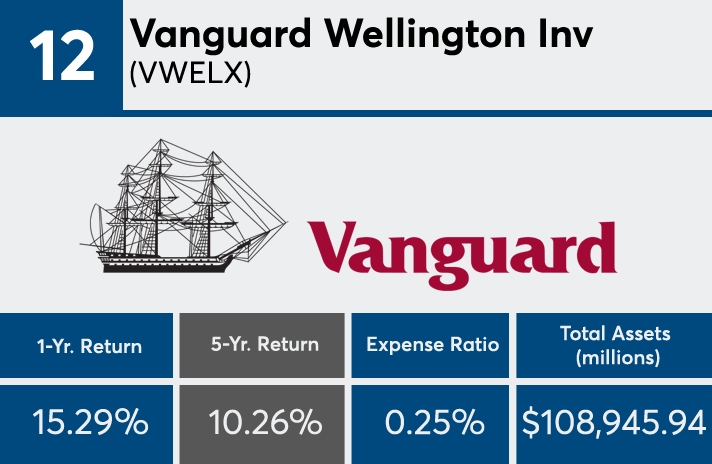

12. Vanguard Wellington Inv (VWELX)

5-Yr. Return:10.26%

Expense Ratio: 0.25%

Total Assets (millions): $108,945.94

11. American Funds American Balanced A (ABALX)

5-Yr. Return: 10.45%

Expense Ratio: 0.60%

Total Assets (millions): $125,074.89

10 American Funds Capital World Gr&Inc A (CWGIX)

5-Yr. Return: 10.80%

Expense Ratio: 0.77%

Total Assets (millions): $102,069.36

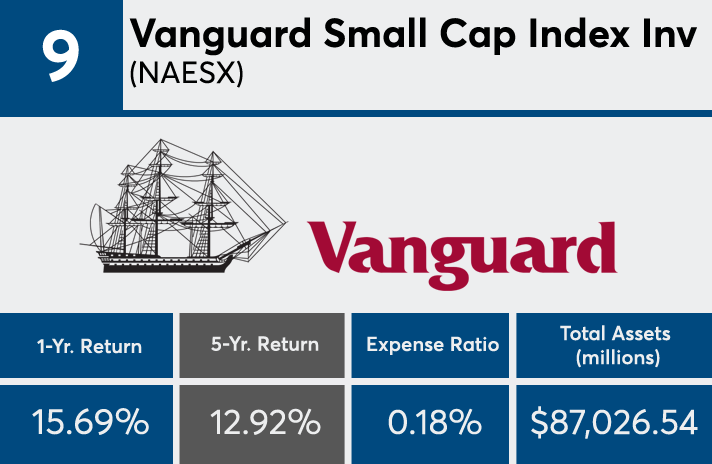

9. Vanguard Small Cap Index Inv (NAESX)

5-Yr. Return: 12.92%

Expense Ratio: 0.18%

Total Assets (millions): $87,026.54

8. American Funds Washington Mutual A (AWSHX)

5-Yr. Return: 14.36%

Expense Ratio: 0.58%

Total Assets (millions): $104,542.01

7. Vanguard Total Stock Mkt Idx Inv (VTSMX)

5-Yr. Return: 14.67%

Expense Ratio: 0.15%

Total Assets (millions): $701,066.48

6. American Funds Invmt Co of Amer A (AIVSX)

5-Yr. Return: 14.71%

Expense Ratio: 0.60%

Total Assets (millions): $94,416.45

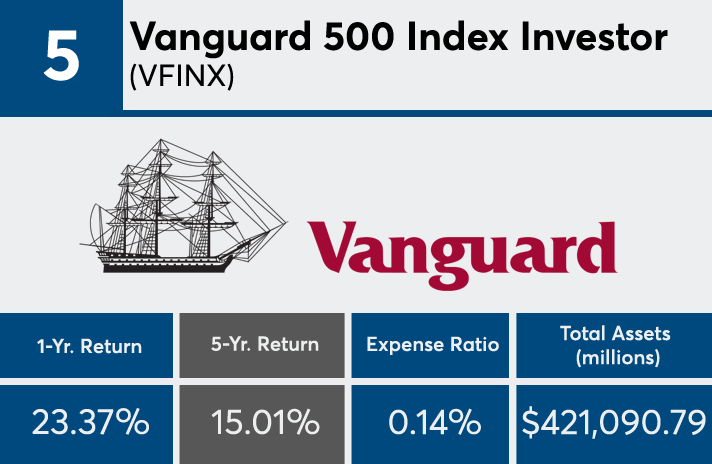

5. Vanguard 500 Index Investor (VFINX)

5-Yr. Return: 15.01%

Expense Ratio: 0.14%

Total Assets (millions): $421,090.79

4. American Funds Fundamental Invs A (ANCFX)

5-Yr. Return: 15.03%

Expense Ratio: 0.62%

Total Assets (millions): $99,689.05

3. Fidelity 500 Index Investor (FUSEX)

5-Yr. Return: 15.07%

Expense Ratio: 0.09%

Total Assets (millions): $149,718.29

2. American Funds Growth Fund of Amer A (AGTHX)

5-Yr. Return: 16.15%

Expense Ratio: 0.64%

Total Assets (millions): $187,138.95

1. Fidelity Contrafund (FCNTX)

5-Yr. Return: 16.85%

Expense Ratio: 0.68%

Total Assets (millions): $133,631.36