-

Form U4s and U5s don’t always match up, but it’s still the advisor’s responsibility to be proactive, writes compliance expert Alan J. Foxman.

March 6 -

The Senator wants to know what the SEC is doing to prevent harassment at banks.

March 5 -

The rep borrowed $528,000 from a SunTrust client without the bank’s prior written approval, FINRA alleged.

March 1 -

The advisor lured the client into investing $100,000 in what he claimed was a private placement bond but instead deposited the money into his personal bank account, say federal prosecutors.

February 27 -

The advisor fleeced the duo of nearly $1 million by misappropriating their stock holdings and initiating unauthorized wire transfers from their bank account, prosecutors allege.

February 26 -

The scrutiny puts a spotlight on a small corner of the $3.4 trillion ETF industry.

February 23 -

The 84-year-old client wanted to preserve her wealth, but says her advisor made "unsuitable" asset allocations.

February 21 -

New FINRA rules will help the wealth management industry do its part to identify and prevent elder abuse.

February 21

-

The advisor persuaded the customer to liquidate his IRA and invest the money in a risky and costly options trading strategy the advisor managed, FINRA alleged.

February 20 -

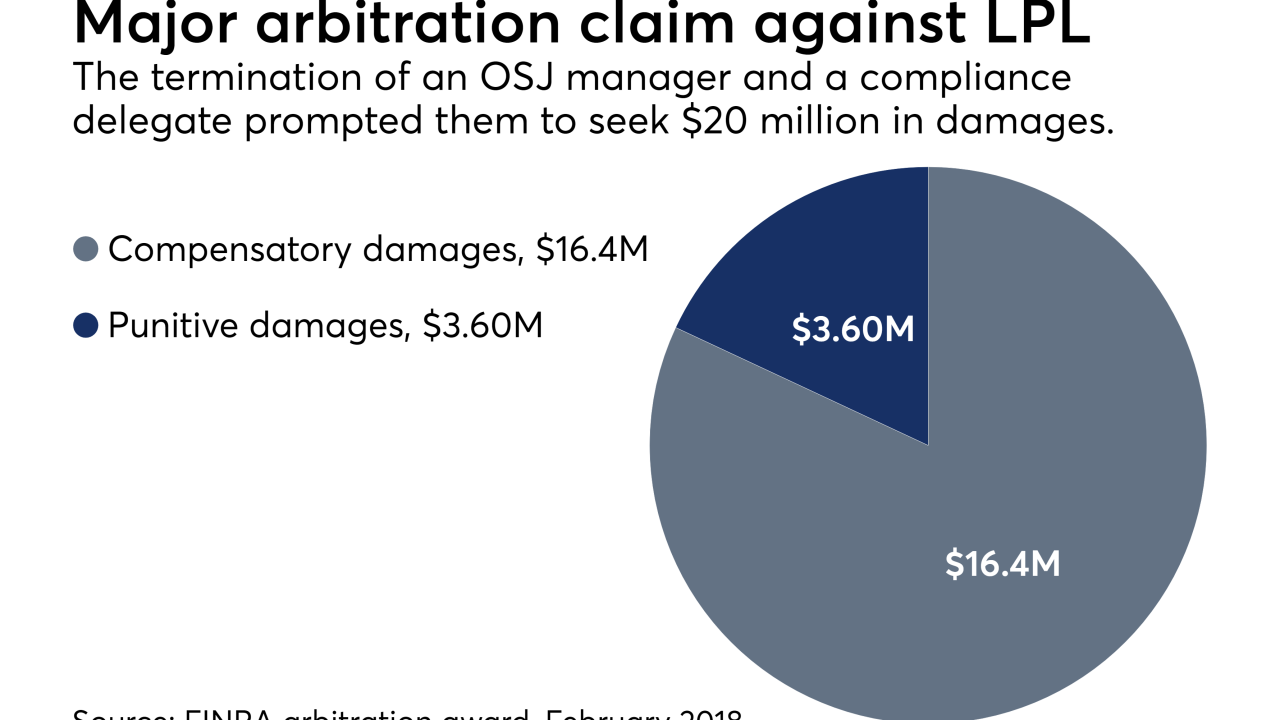

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20