-

Citing mounting investor losses from unpaid arbitration awards, investor advocates see a role for Congress to force FINRA's hand.

March 7 -

Form U4s and U5s don’t always match up, but it’s still the advisor’s responsibility to be proactive, writes compliance expert Alan J. Foxman.

March 6 -

The Senator wants to know what the SEC is doing to prevent harassment at banks.

March 5 -

The rep borrowed $528,000 from a SunTrust client without the bank’s prior written approval, FINRA alleged.

March 1 -

The advisor lured the client into investing $100,000 in what he claimed was a private placement bond but instead deposited the money into his personal bank account, say federal prosecutors.

February 27 -

The advisor fleeced the duo of nearly $1 million by misappropriating their stock holdings and initiating unauthorized wire transfers from their bank account, prosecutors allege.

February 26 -

The scrutiny puts a spotlight on a small corner of the $3.4 trillion ETF industry.

February 23 -

The 84-year-old client wanted to preserve her wealth, but says her advisor made "unsuitable" asset allocations.

February 21 -

New FINRA rules will help the wealth management industry do its part to identify and prevent elder abuse.

February 21

-

The advisor persuaded the customer to liquidate his IRA and invest the money in a risky and costly options trading strategy the advisor managed, FINRA alleged.

February 20 -

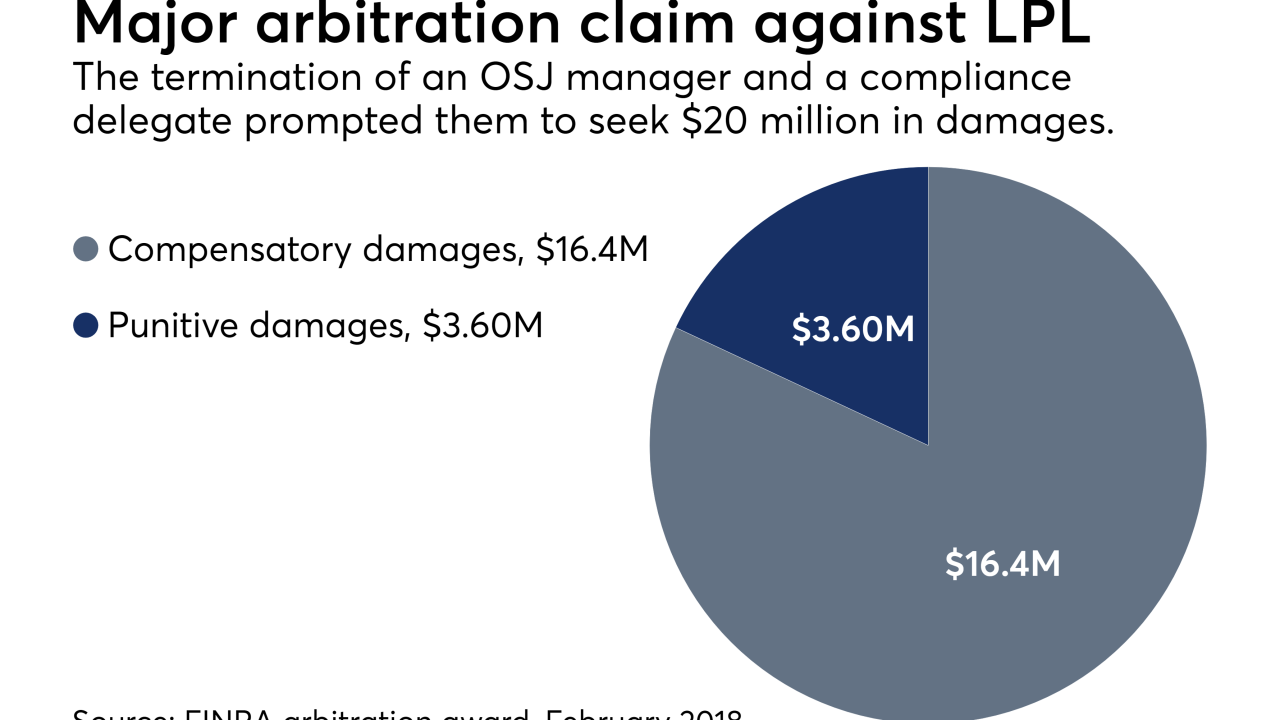

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20 -

A recent scam involved a fake signature from FINRA CEO Robert Cook.

February 16 -

Thomas Buck spent 33 years with Merrill Lynch before he was fired in 2015.

February 14 -

The firm invested the widow's money in oil and gas securities, real estate investment trusts and other investments that did not square with her conservative risk profile, her lawyer argued.

February 13 -

Investor advocates laud regulator's newest steps to address the longstanding problem.

February 9 -

The regulator proposed rule changes that will make it considerably more difficult for advisors to erase customer complaints from their disciplinary records.

February 8 -

The regulator found the firm was deficient on capital requirements and, on 84 occasions, did not accurately calculate its customer reserve requirements.

February 5 -

The stolen funds allegedly went to pay for college expenses and credit card bills, according to federal prosecutors.

January 31 -

The stolen funds went to pay for his daughter’s college expenses and to reimburse other clients, according to federal prosecutors.

January 31 -

The two declined to cooperate with investigations into allegations that they engaged in undisclosed outside business ventures.

January 30