-

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

3h ago -

A new report from Cerulli Associates shows older, affluent investors are far more skeptical of AI use than their younger counterparts. Financial advisors who use AI tools in their practices say transparency is key to setting wary clients at ease.

7h ago -

Keep your general knowledge skills sharp while earning an hour of CE credit toward maintaining industry certification by taking Financial Planning's latest continuing education quiz.

February 27 -

No one is challenging clients as the best source of recommendations for financial advisors. But growth experts say many are missing out on the potential for highly profitable collaborations with outside professionals.

February 26 -

The revamped platform will be available by late summer and feature several upgrades, including a greater ability to be discovered by artificial intelligence search results.

February 25 -

Graduate students at the University of Texas at Austin are using advanced analytics and AI to examine Wealthtender's client reviews — and create a new data metric for the industry.

February 25 -

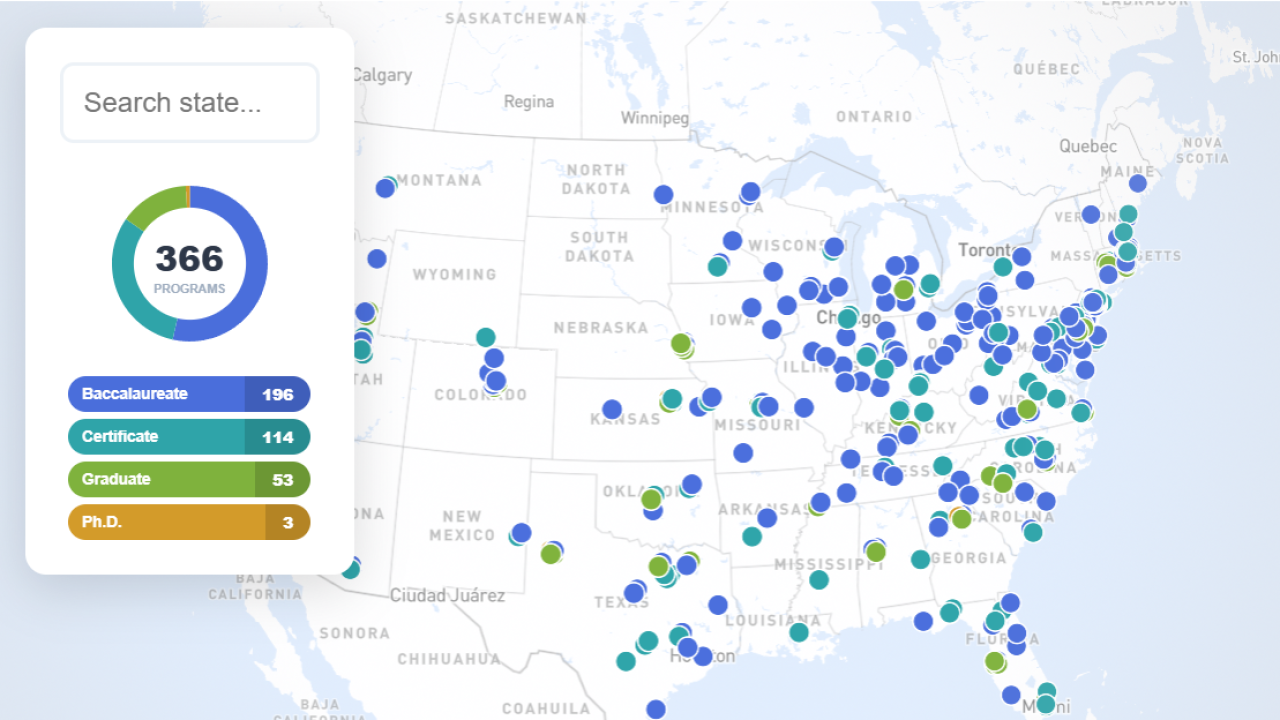

The growth of CFP Board-registered programs, from certificates to doctoral programs, reflects the industry's shift away from commission-based models.

February 25 -

Lisa Golia, now chief operating officer of the firm's U.S. wealth business, will be in charge of hiring, retaining and paying advisors.

February 24 -

New research shows visuals and gamified tools can dramatically boost client understanding and engagement around complex retirement rules.

February 24 -

With AI concerns crimping wealth management firms' stock values, an analysis by Fitch Ratings reveals the companies' underlying dynamics after a strong 2025.

February 24 -

Advisors are only human, and mistakes are bound to happen. But missteps, for all the pain they can cause, can also help an advisor — and their practice — grow stronger.

February 24 -

Paul Reid Galietto's lawyer says he was let go by Credit Suisse in 2021 after the firm tried to unfairly blame him for losses from the collapse of the giant family office Archegos Capital Management.

February 24 -

Showing up for clients is still crucial, but using AI to deliver on financial goals matters more, says Altruist's CEO.

February 24 Altruist

Altruist -

The arrival of Warren-Fantano Wealth Management at Janney will give the regional broker-dealer a new office in Delaware.

February 23 -

Impact investing experts admit that the first year under President Trump has brought changes to the rhetoric around ESG. The realities look far more murky, though.

February 23 -

A pair of putative class-action lawsuits this month accuse Edward Jones of allowing information clients enter online to be harvested for use in targeted marketing campaigns.

February 20 -

The Weikes Slattery Group generated $17 million in annual revenue from locations in New York and California.

February 20 -

Financial advisors have critical roles for modifying financial plans to cover costs and long-term plans when clients find themselves faced with caring for a family member.

February 19 -

Wescott and Moneta Group present helpful examples of paths for financial advisors and other employees that experts say are essential for growth.

February 19 -

From the Bible to best-selling books, the NBA player turned business owner credited his success in part to his voracious reading habit.

February 18