-

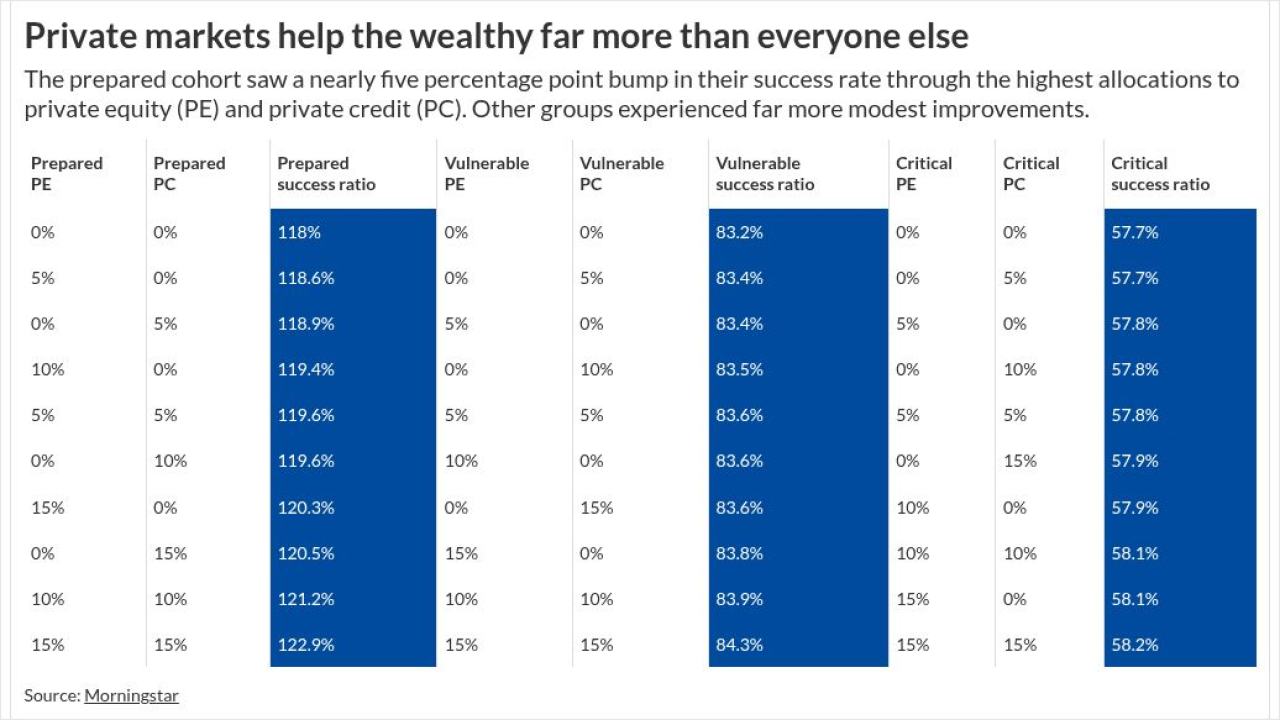

Private allocations can give retirees on a glide path a modest lift in returns, new Morningstar research shows — though the impact isn't uniform across savers.

December 2 -

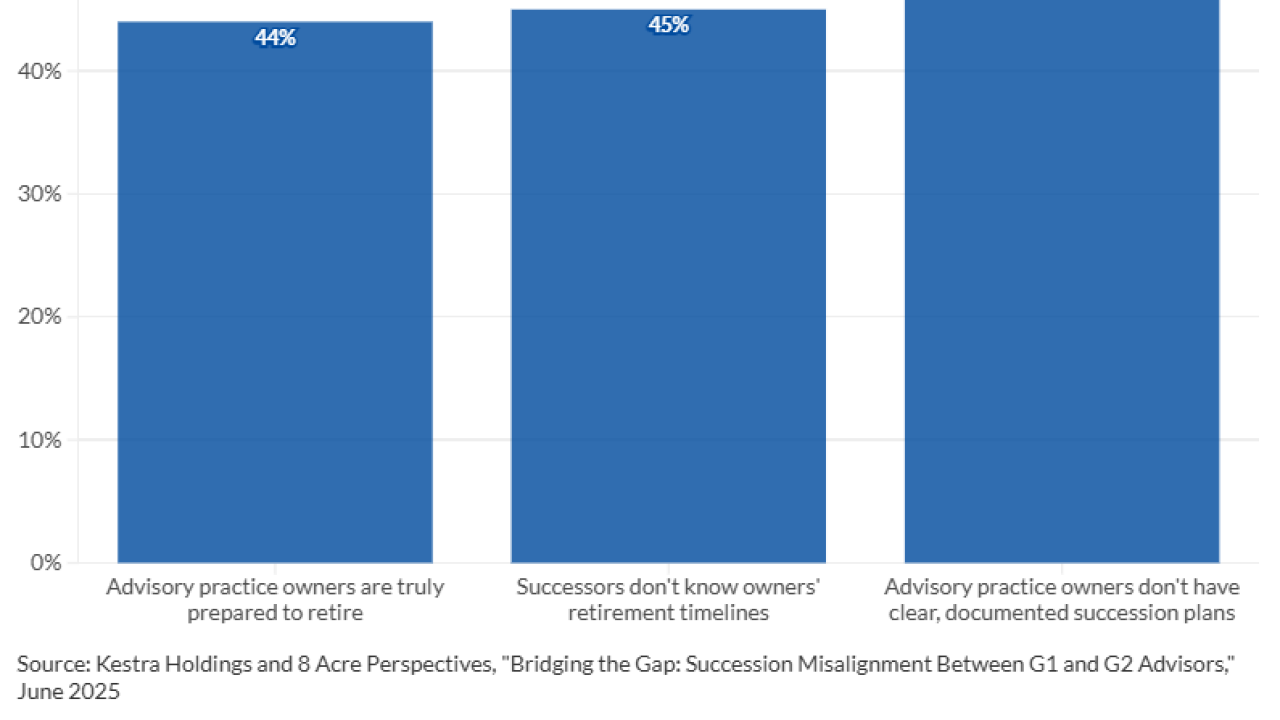

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

December 2 -

Funds that primarily hold select cryptocurrencies, including bitcoin, ether, XRP and solana will be allowed.

December 2 -

Artificial intelligence isn't an algorithmic takeover but an essential wealth management tool.

December 2 Aidentified

Aidentified -

UBS chief data and analytics officer Joe Cordeira says AI won't replace advisors. But it can help them by providing little nudges to do everything from rebalancing a portfolio to wishing a client happy birthday.

December 1 -

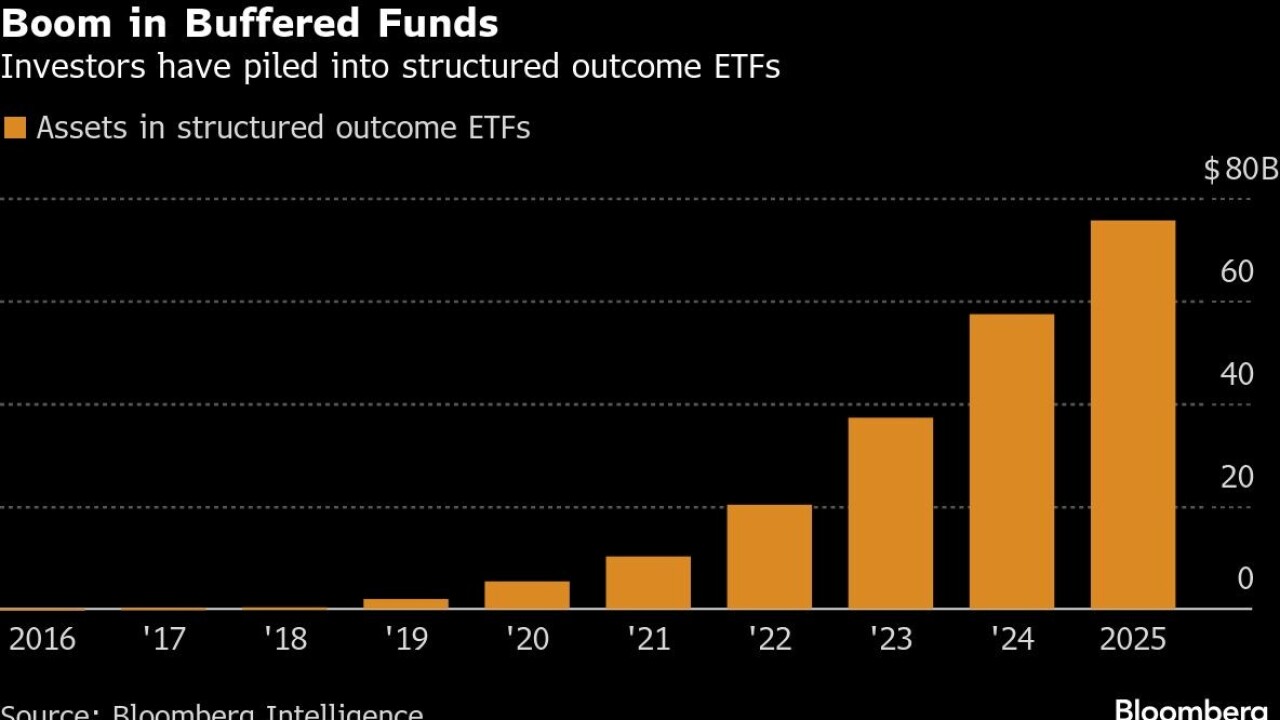

Innovator Capital Management, which Goldman will acquire next year, was a pioneer with ETFs that hedge risk by offsetting investors' exposure to equity losses by also capping their ability to realize gains.

December 1 -

After the newly crypto-friendly Donald Trump won reelection, bitcoin jumped over $100,000. Many advisors and even more clients remain skeptical, though.

December 1 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28 -

Also, Raymond James lands a $420M father-son team from Edward Jones, Cetera recruits a $350M LPL duo, and Cambridge acquires a $1B AUM dual registrant.

November 26 -

Advisors who reframed strategic decisions shifted investor perceptions of identical financial results, research shows; here's what that means for retirement planning.

November 26 Janus Henderson Investors

Janus Henderson Investors