While the world of wealth management is one of mergers, acquisitions and celebrating growing AUM totals, it is also one that occasionally includes client deception, federal indictments and criminal behavior.

The past 12 months have seen several new allegations brought to light, as well as a number of lingering cases finally reaching resolution after years of moving through the criminal justice system.

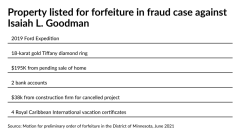

Many involve manipulation of investors in pursuit of a lavish lifestyle. Others involve loss of life or the most vulnerable members of the population becoming victims.

Here are some of the biggest crime and court cases covered by the Financial Planning team in 2021.