Although active management is not nearly as popular as it once was, its high-fee top-performers have managed to post some flashy returns.

The success rate among stock pickers has continued to sink, with just 36% of active managers outperforming the average passive peer over 12 months through June, according to Morningstar. That’s down from 43% in 2017.

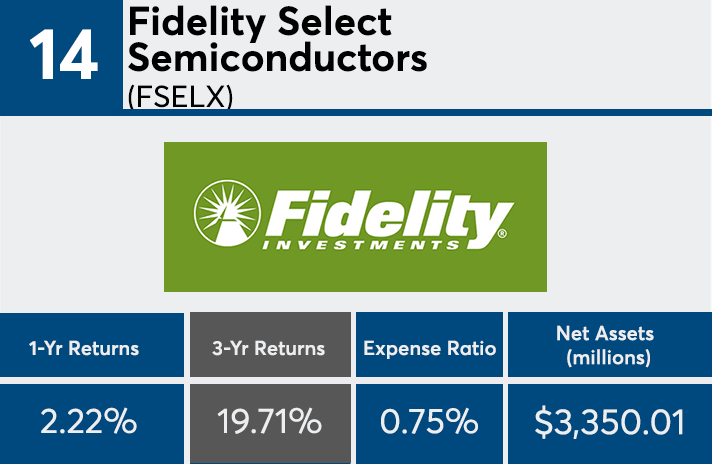

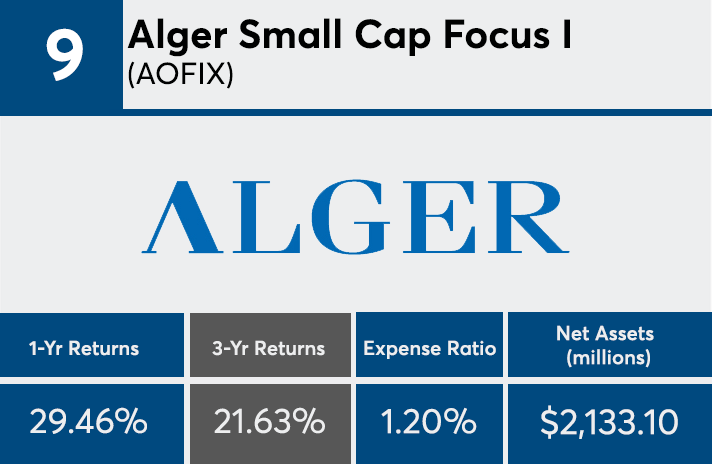

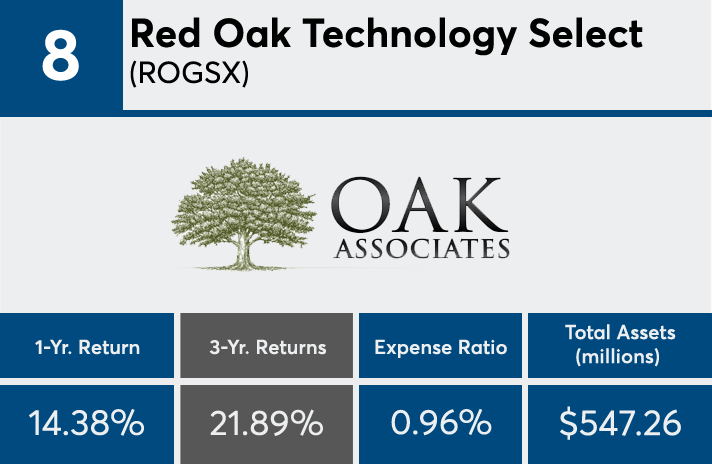

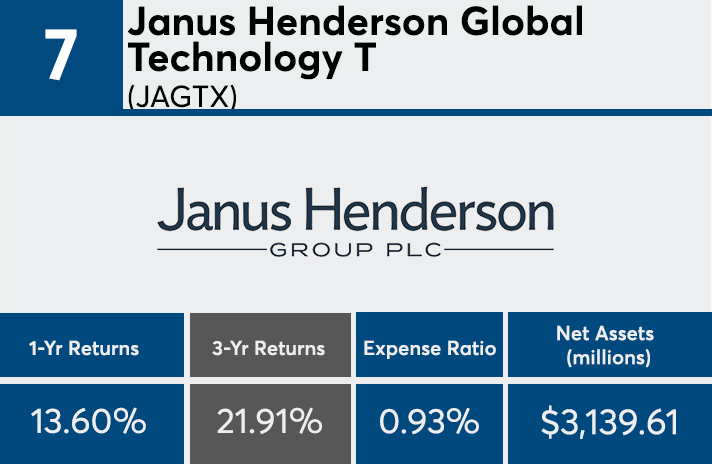

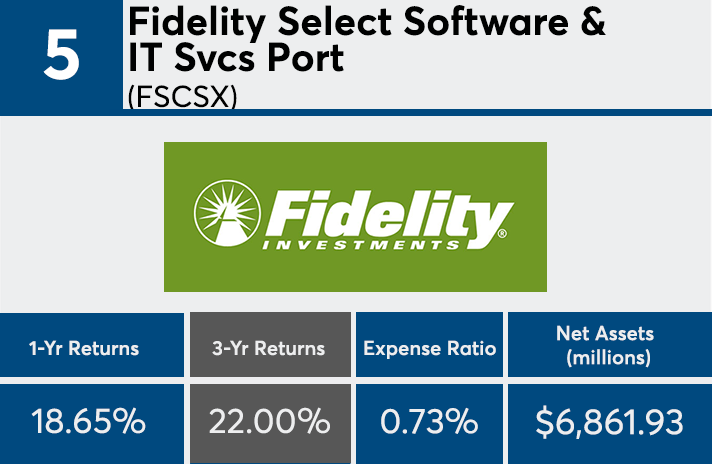

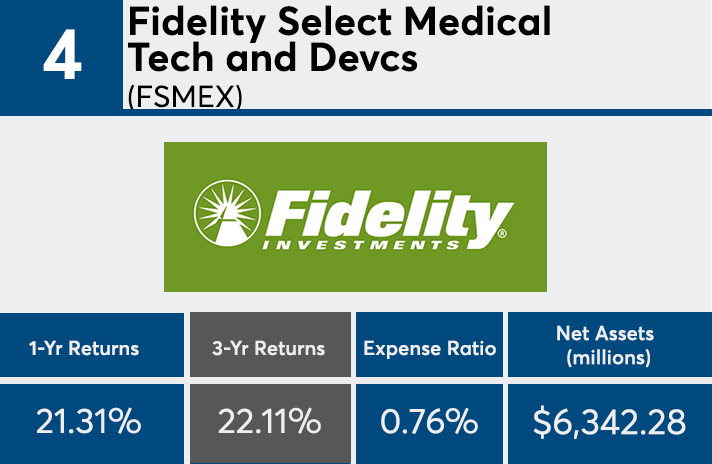

With an average expense ratio of just under 100 basis points, the industry’s top-performing actively managed mutual funds with a minimum AUM of $500 million over the last three years were largely tech sector offerings, data show. These funds posted an average return of 21% over that period, while all but three posted double-digit numbers over the past year. A similar grouping of passive funds had an average return of 13.38%. Factors including low interest rates may have contributed to success, says Greg McBride, chief financial analyst at Bankrate.

“It is no surprise that technology sector funds dominated the list of best-performing funds over the past three years,” McBride says. “But with rising interest rates and slowing profit growth, it will be tough to replicate this performance over the next three years.”

Active value managers had a relatively tough go of things over the past 12 to 18 months. Large-, mid- and small-value categories, when pitted against their passive peers, underperformed by 23, 27 and 27 percentage points, respectively, according to the Morningstar Active/Passive Barometer semiannual report. McBride notes that “the market has rewarded growth over value in the past three years; at some point, though, this will reverse.”

Performance came at a higher cost for active funds. Although the top-performing mutual fund on our list posted an average expense ratio of 0.99%, the average fee among the larger universe of active funds with more than $500 million in AUM (excluding leveraged funds) was slightly less at 0.81%, Morningstar Direct data show. Advisors seeking to justify these fees to clients should stress the commitment of the managers, McBride says.

“Mutual fund managers get up every day knowing they have to earn enough additional return for their investors to offset the higher costs relative to passive investing,” McBride says. “Money will flow to those managers and funds that can most consistently generate returns that justify their fees.”

Scroll through to see all 20 actively managed funds with the highest three-year returns. Leveraged and institutional funds were excluded, as were those with investment minimums above $100,000. We also show one-year returns, assets and expense ratios. All data from Morningstar Direct.