Small-cap funds have paid off for clients over the last year despite the high price tags that often come with these investments.

With $51.7 billion in combined assets under management, funds that led the pack with at least $500 million in AUM posted an average one-year return of 15.43%, according to Morningstar Direct data. For comparison, that is more than 13 percentage points higher than the Dow’s 2.13% return over the same period. Part of the reason for their superior performance has been the Fed’s pause on raising interest rates, explains Greg McBride, senior financial analyst at Bankrate.

“Smaller companies tend to borrow via loans and be more impacted by rising interest rates than larger companies that can tap the bond market and lock in funding costs for a longer period of time,” McBride says. “Higher rates can act as a headwind to the growth rate of smaller companies, but if the Fed is sidelined for a while, that removes one obstacle to maintaining the pace of growth.”

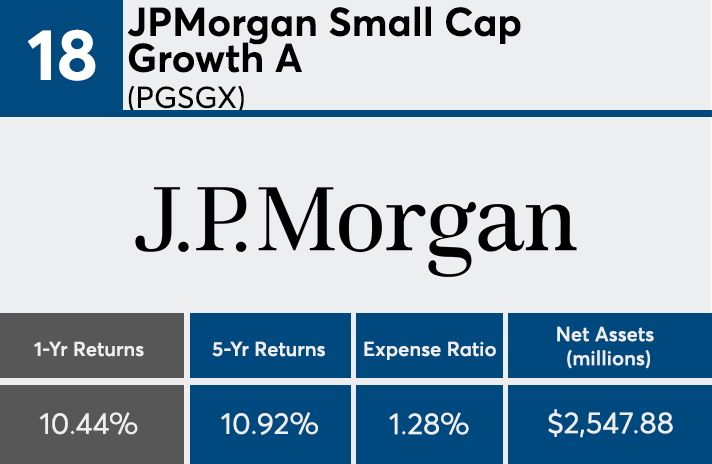

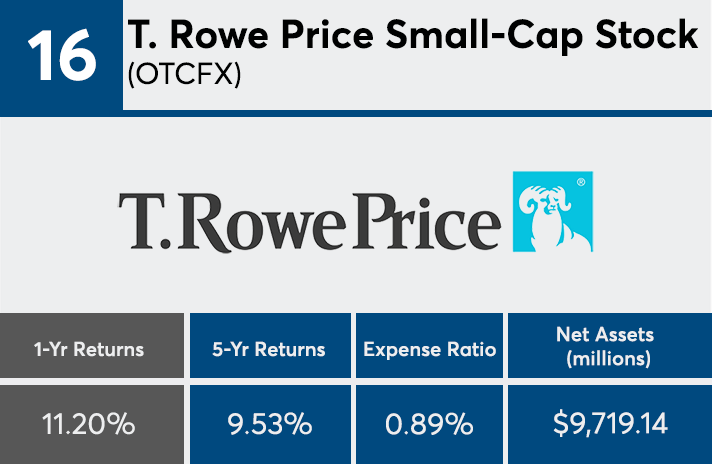

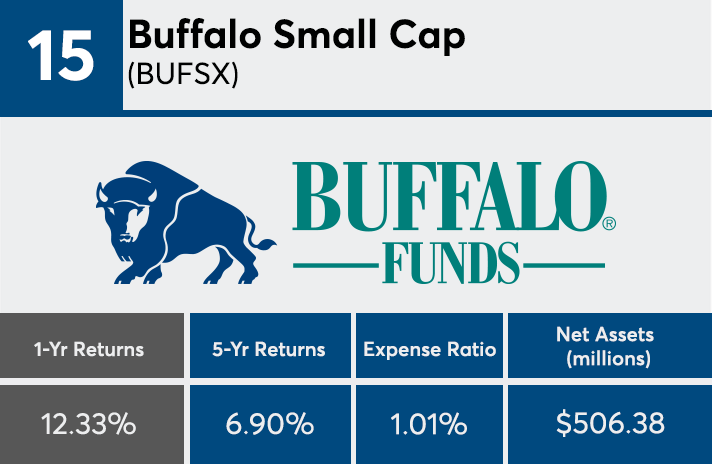

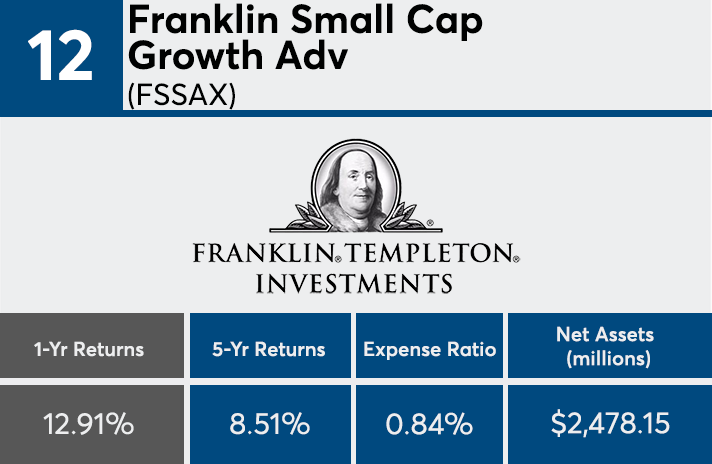

A similar analysis of the industry’s 20 largest small-cap funds show significantly lower returns despite their more attractive fees. With an average expense ratio of 0.43%, these products eked out an average one-year return of 3.96%, according to Morningstar data. Although the best-performers carry expense ratios that seem especially high in today's market — 1.11% — the entire asset class can seem relatively rich for investors who have grown accustomed to expense ratios under 20 basis points.

“Expense ratios are higher on small-cap funds because there is less available research on the companies — meaning investment managers may need to do more of their own due diligence — and because trading costs are higher in smaller, less liquid companies,” McBride says. “Investors should make sure they’re getting what they pay for with active management, and if not, go with an index fund.”

Across the larger fund universe, investors paid an average of 0.52% for fund investing in 2017, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs. That was 8% less than they paid in 2016.

For advisors with clients questioning these higher fees, McBride says it’s important to be clear about how their portfolios are constructed and their overarching, long-term goals.

“Investing in small-cap companies helps further diversify your holdings and boost overall return," he says. “While smaller companies — and the mutual funds/ETFs that invest in them — tend to be more volatile, there is the prospect for higher returns over time as smaller companies tend to grow faster and are less affected by developments overseas or currency fluctuations.”

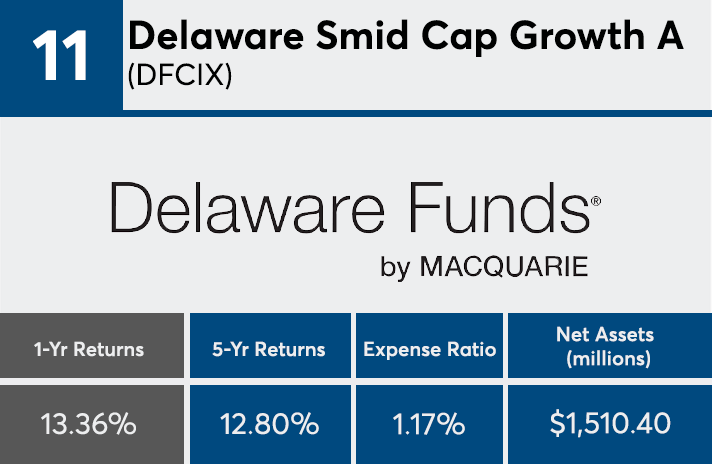

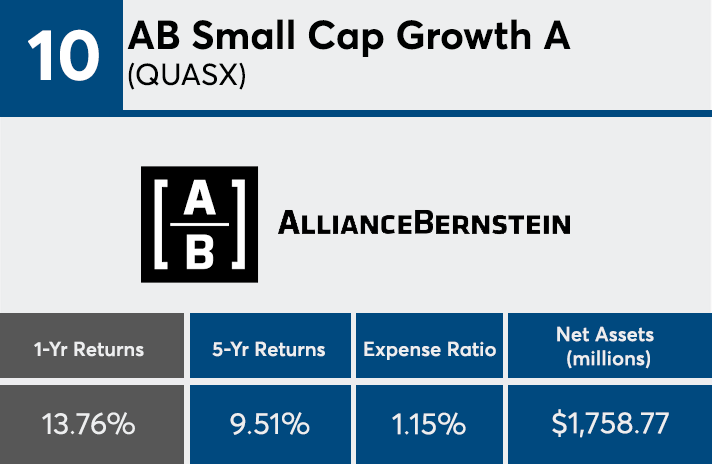

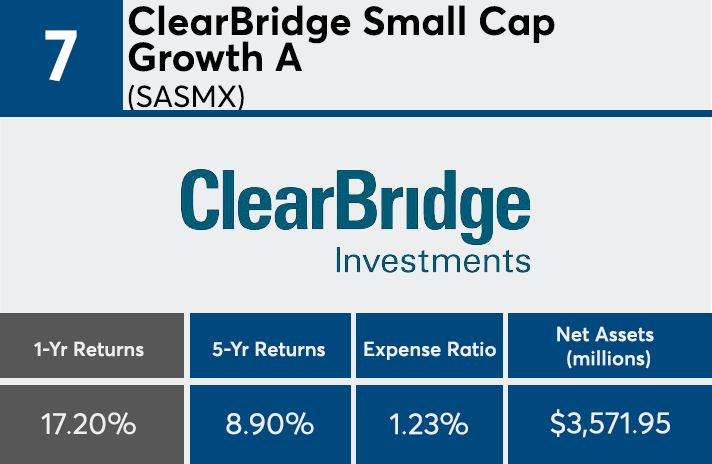

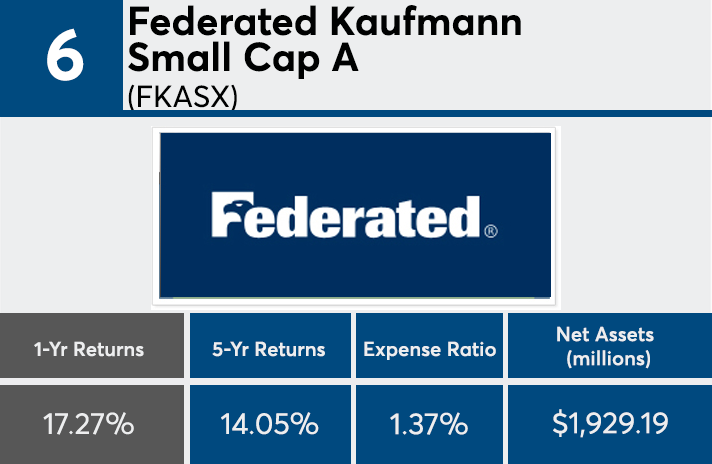

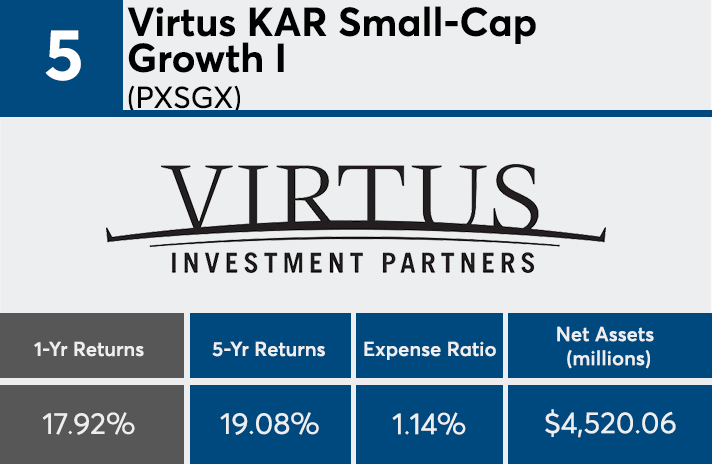

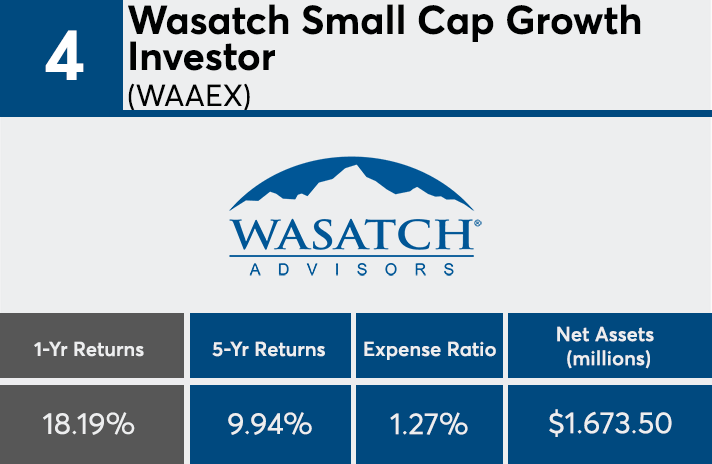

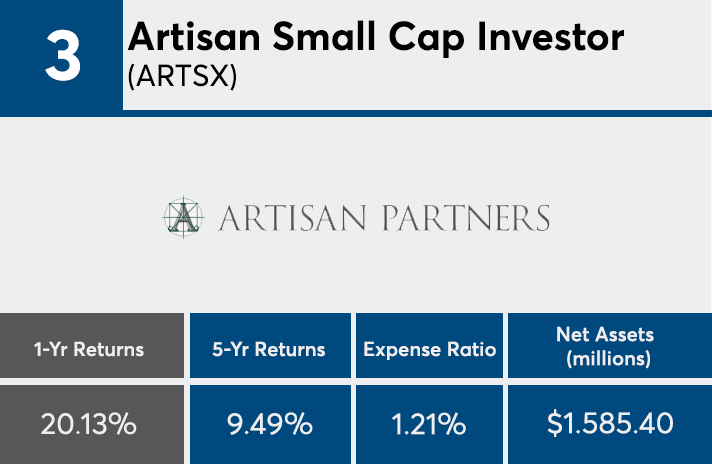

Scroll through to see the 20 small-cap category mutual funds and ETFs with the highest one-year returns through Feb. 14. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund are also listed. The data includes funds in which assets were transferred from one share class to another. All data from Morningstar Direct.