It has been about three decades since the first ETF became available to investors. Since then, the industry has grown to more than $4 trillion.

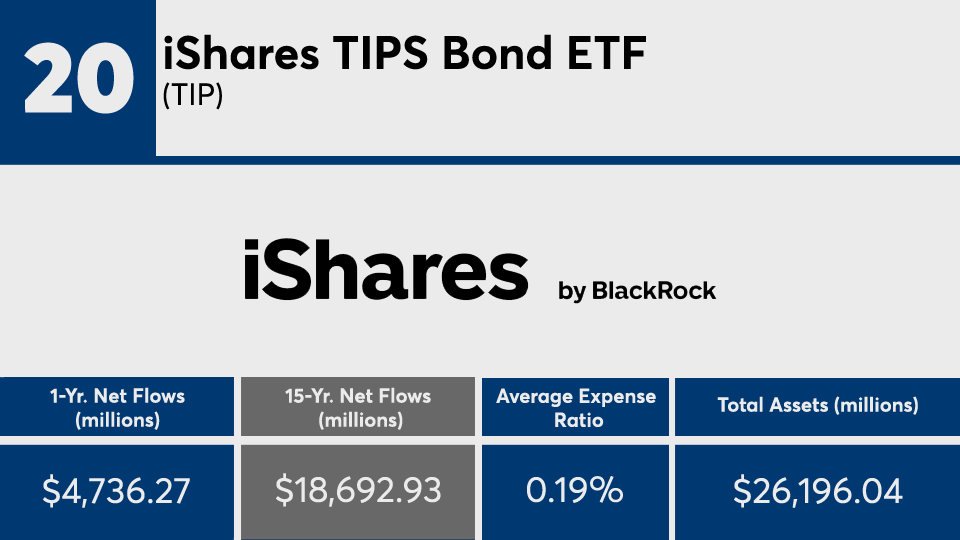

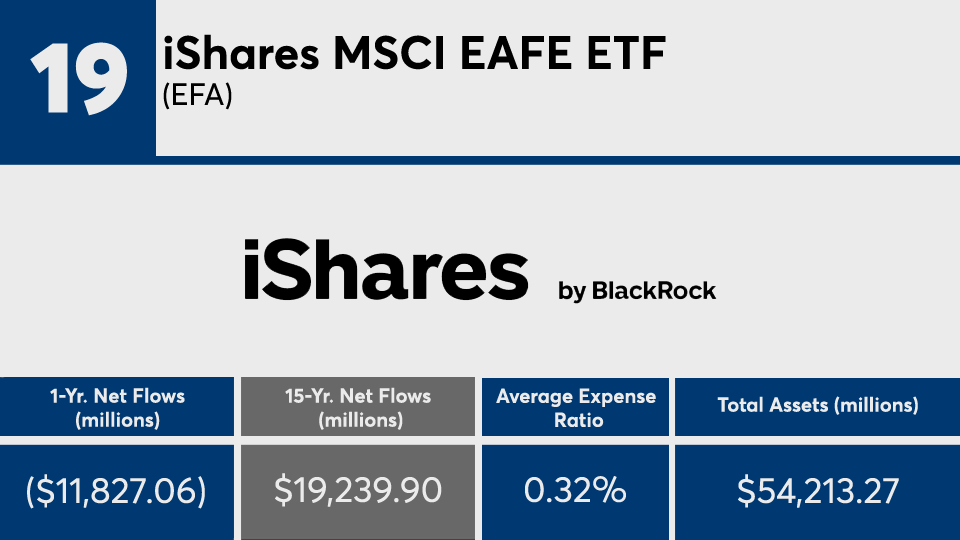

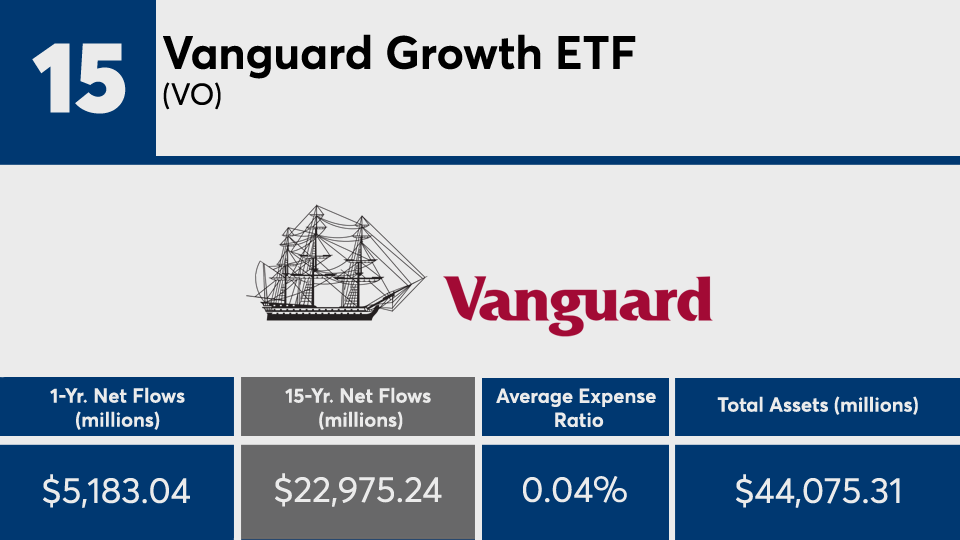

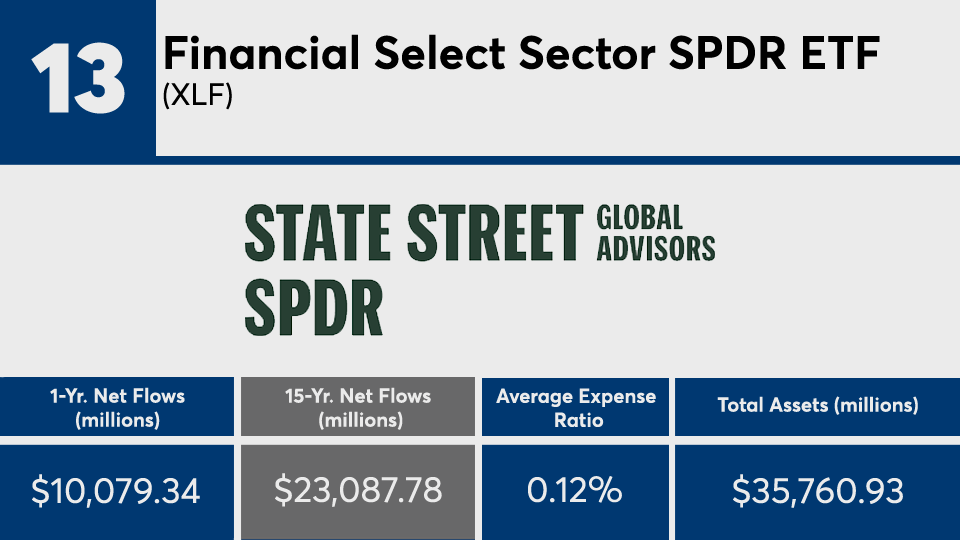

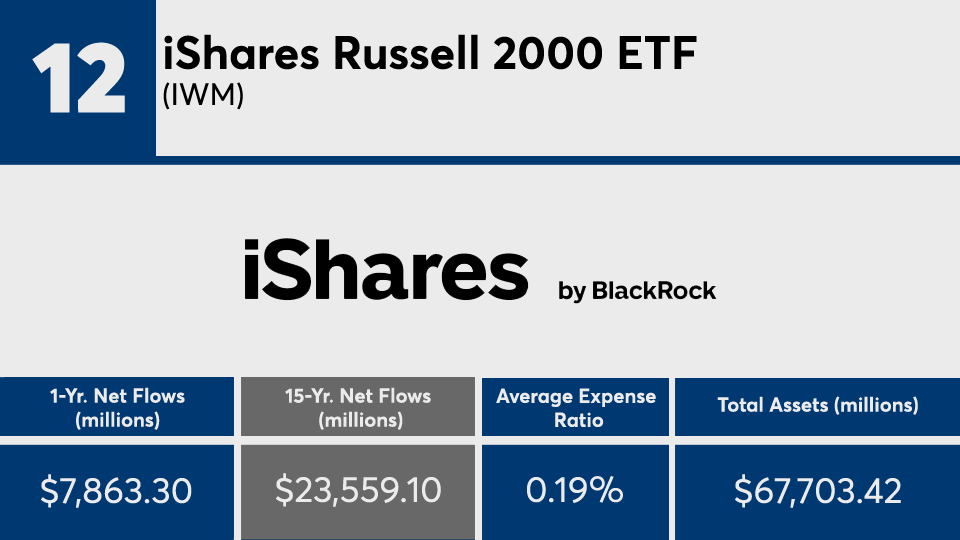

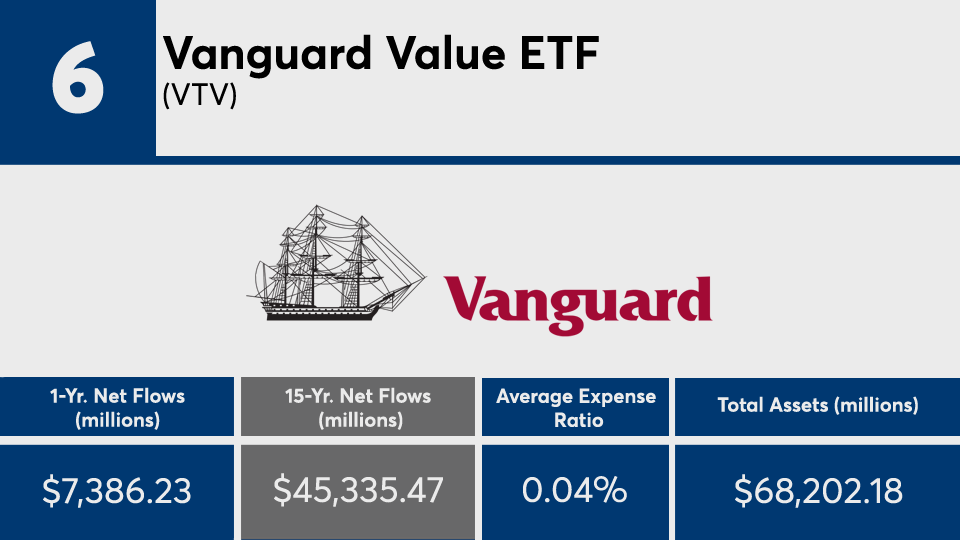

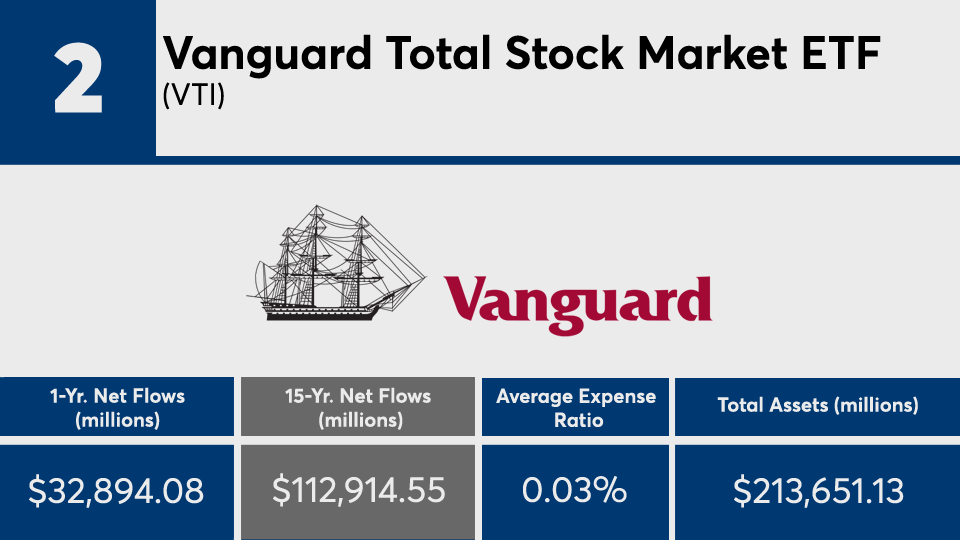

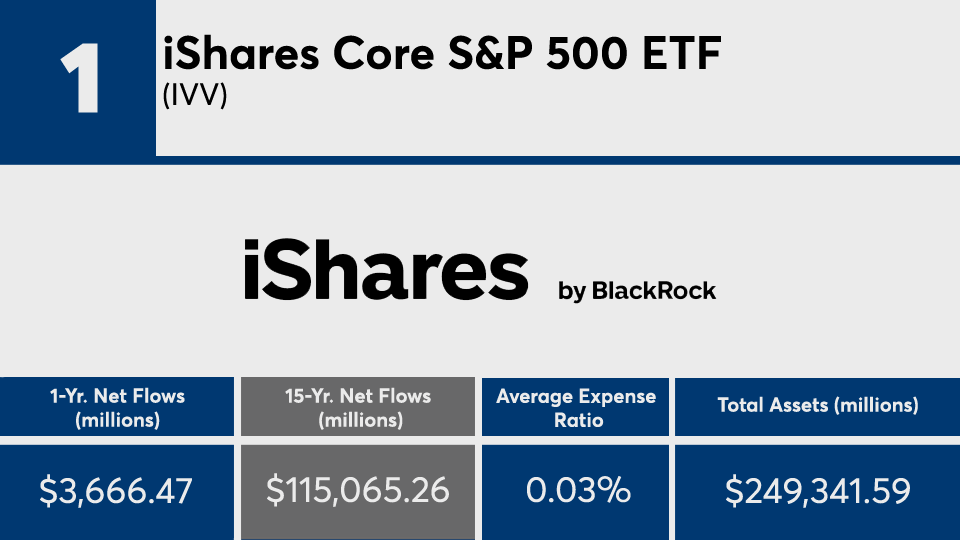

Over the last 15 years, the 20 ETFs with the largest net inflows, and at least $100 million in assets under management, brought in a combined $808.93 billion, Morningstar Direct data show. In the past year, the same funds had net inflows of roughly $95 billion.

Upon deeper analysis, the lineup of flow leaders shows just how entrenched the usage of ETF model portfolios has become by advisors and their clients over the past decade-and-a-half, says Donald G. Bennyhoff, investment committee chairman and director of investor education at Portfolio Solutions, a full-service, fee-only financial advisory firm.

“When viewed in aggregate, most of these funds would be very common holdings in a broadly diversified portfolio of stocks and bonds,” Bennyhoff explains. “ETF model portfolios have become a valuable tool for advisors, enabling them to shift their time and attention from portfolio management to relationship management. Time no longer spent building portfolios is time available to dedicate to better knowing and serving their clients.”

The leaders, most of which launched several years after the SPDR S&P 500 (

When compared with the broader industry, index trackers such as SPY and the SPDR Dow Jones Industrial Average ETF (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

With fees ranging from as low as three basis points to as high as 0.32%, it’s easy to see why so much client cash has found its way to the funds in this ranking. The top 20 carried an average net expense ratio of 11 basis points, just a fraction of the 0.45% investors paid for fund investing in 2019, according to

Despite the low fees, the funds’ overall performance figures show why it’s important to have a detailed discussion with clients about the relationship between returns and long-term goals and objectives, says Amy Magnotta, co-head of discretionary portfolios at Brinker Capital Investments.

“Since the performance of passive ETFs will be in line with performance of the index or specific asset class they track, it will not require conversations regarding reasons for outperformance or underperformance by an active manager,” Magnotta says. “Instead, conversations can be tailored to portfolio construction, the potential need for rebalancing, and the suitability of certain asset classes given the client’s goals and risk tolerance, as well as the market environment.”

Scroll through to see the 20 funds, with more than $100 million in AUM, and the biggest month-end 15-year net flows through March 1. Assets and average expense ratios, as well as year-to-date, one-, three-, five, 10- and 15-year returns through March 3 are also listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.