Managers behind fixed-income funds with the biggest long-term gains nearly double their peers. After a year marked by a global pandemic and near-zero rate environment, their shorter term returns were subsequently even more impressive.

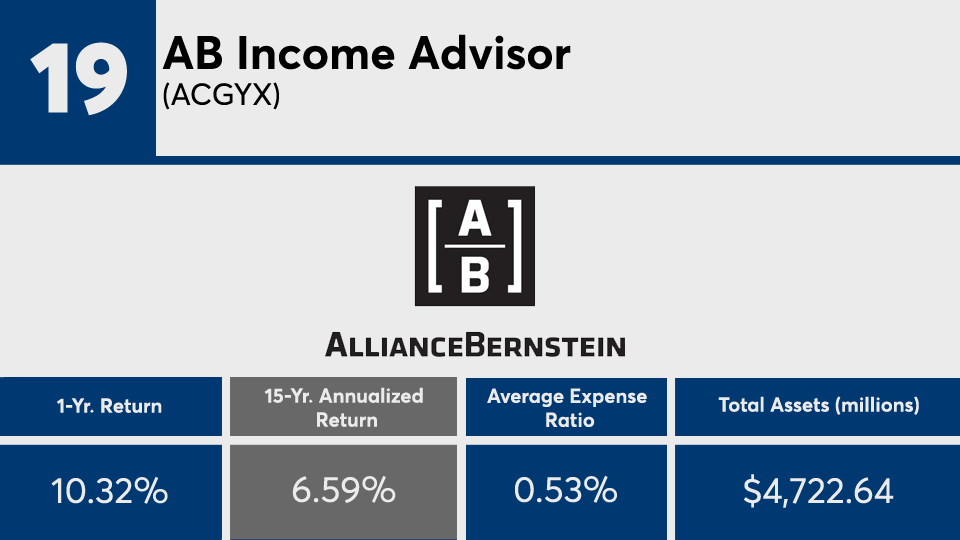

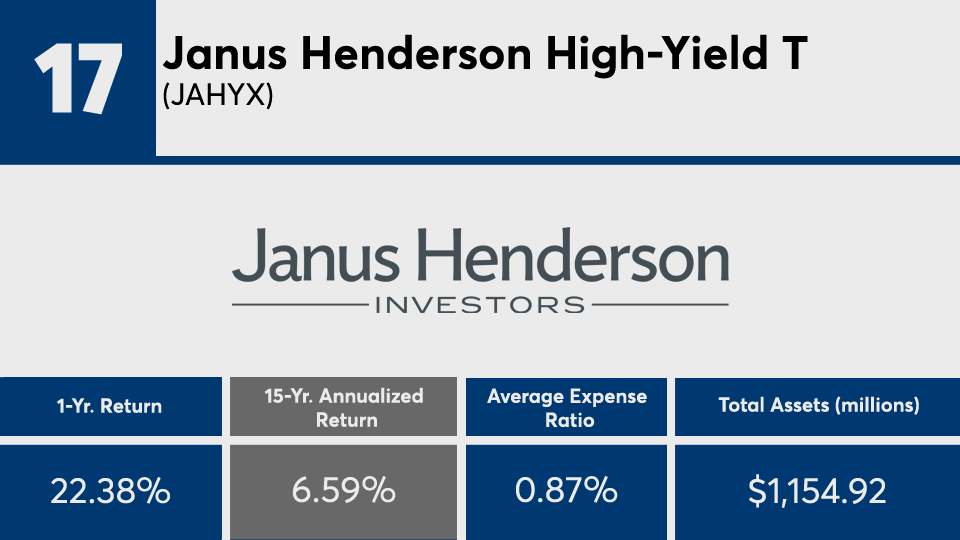

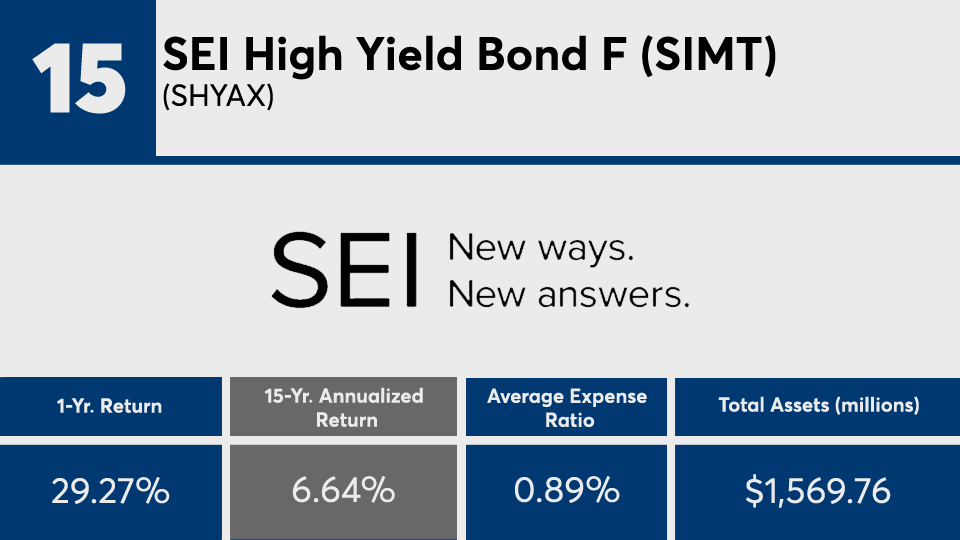

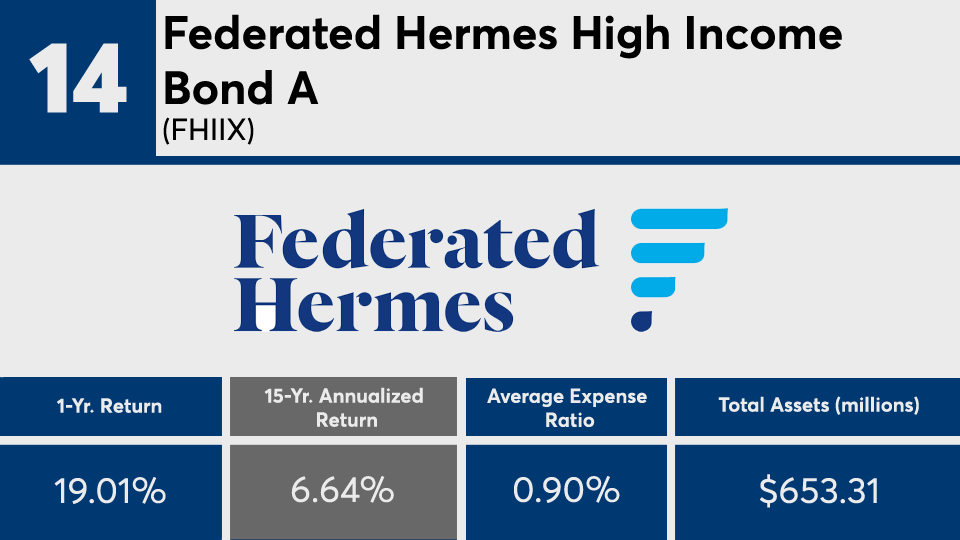

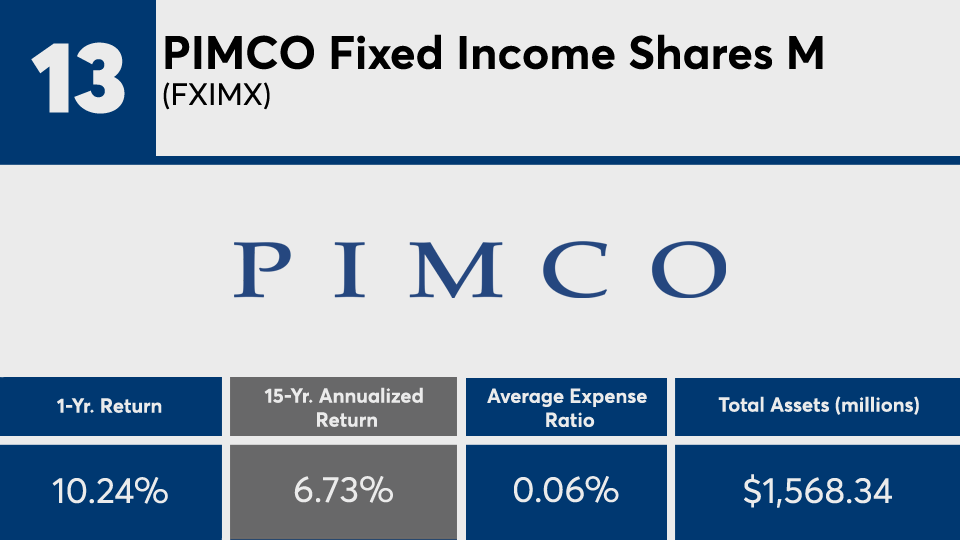

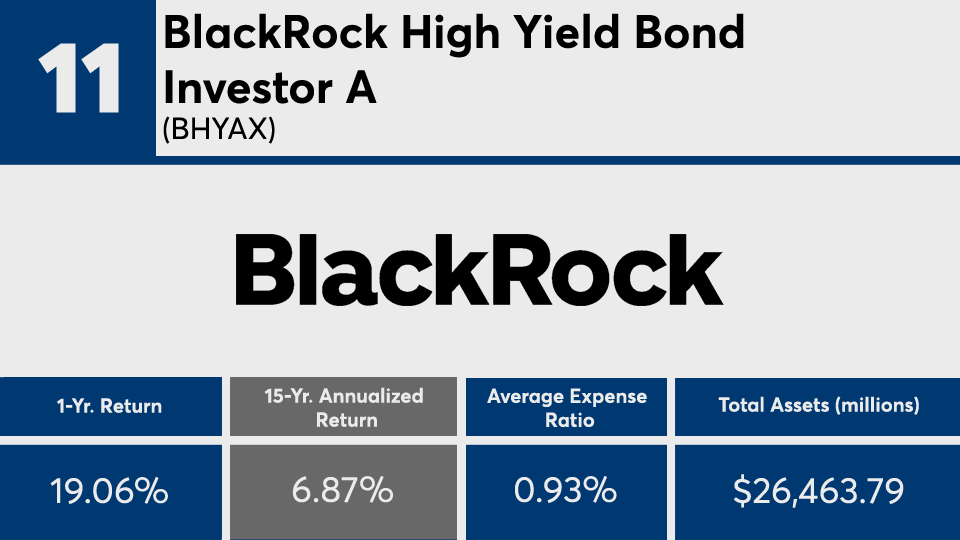

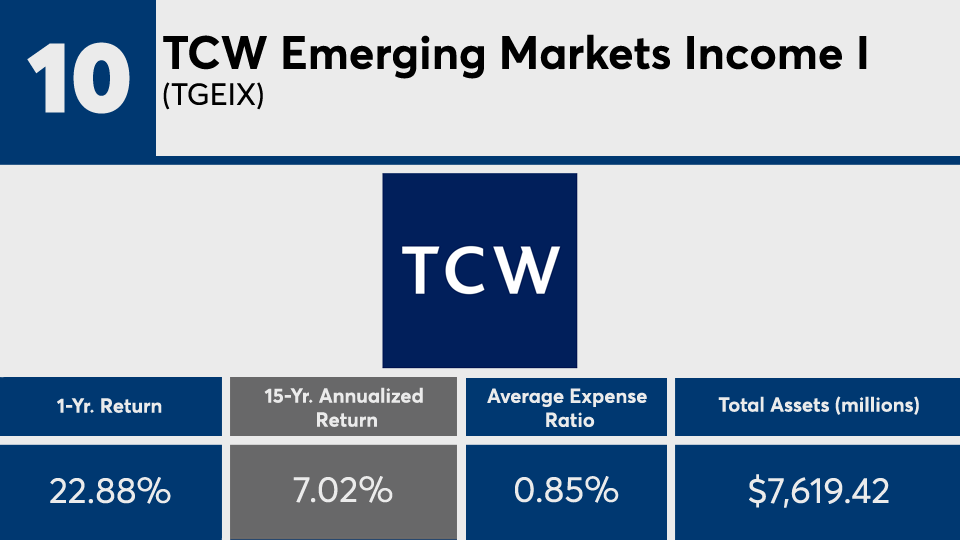

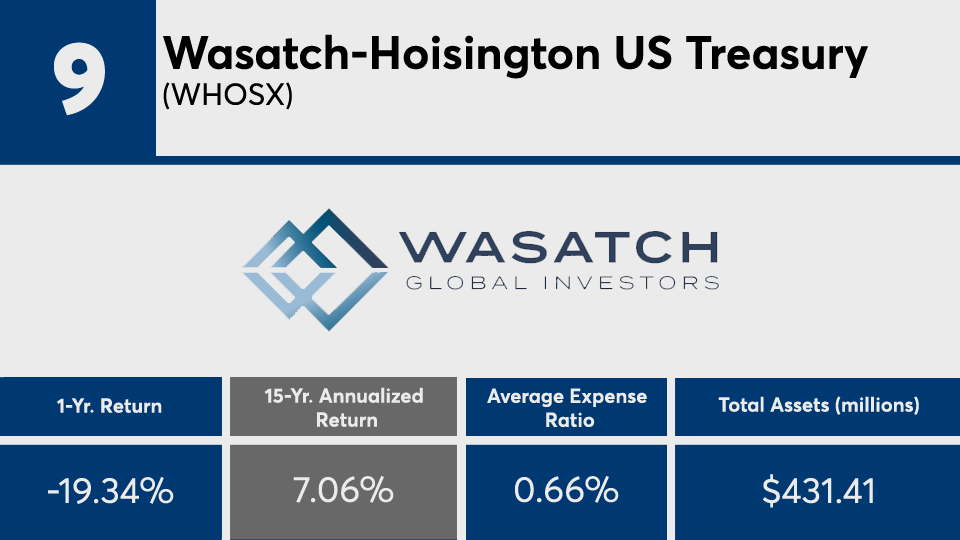

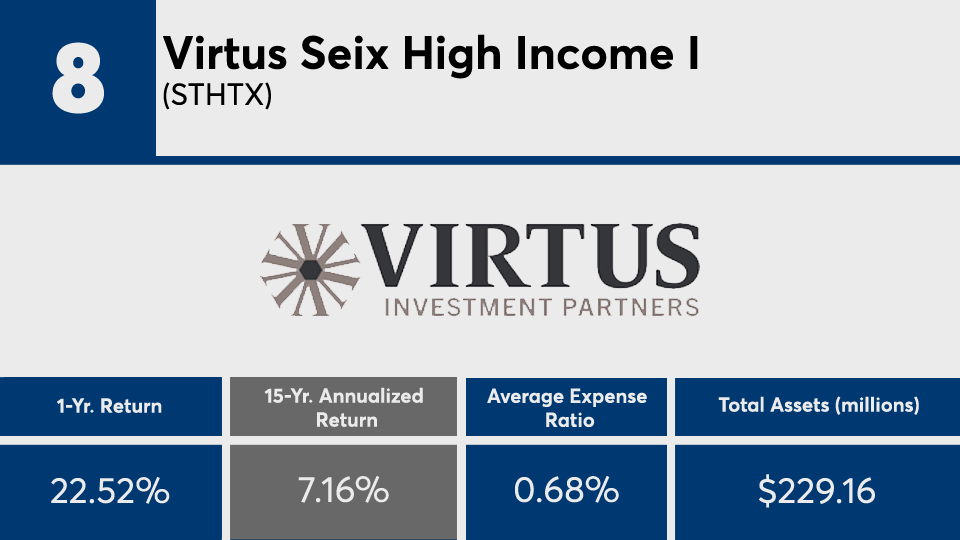

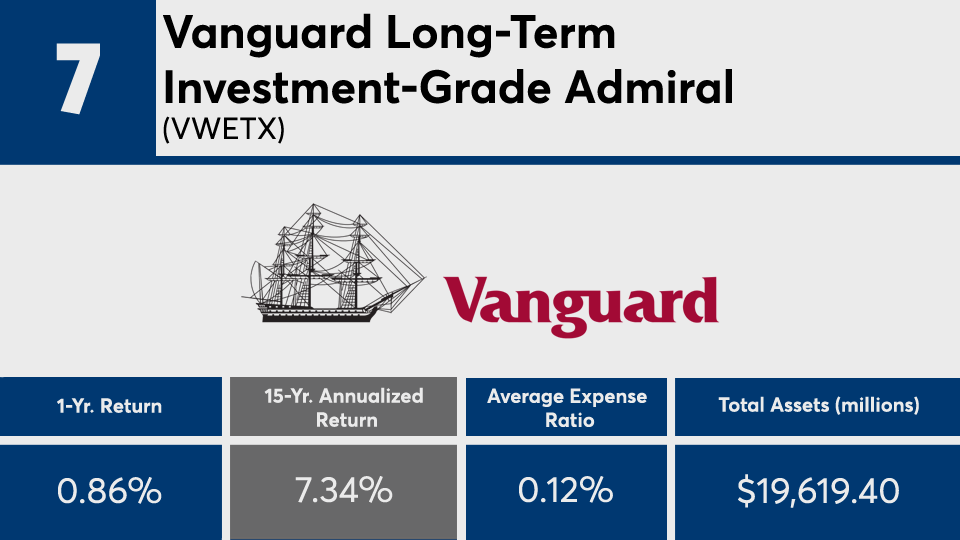

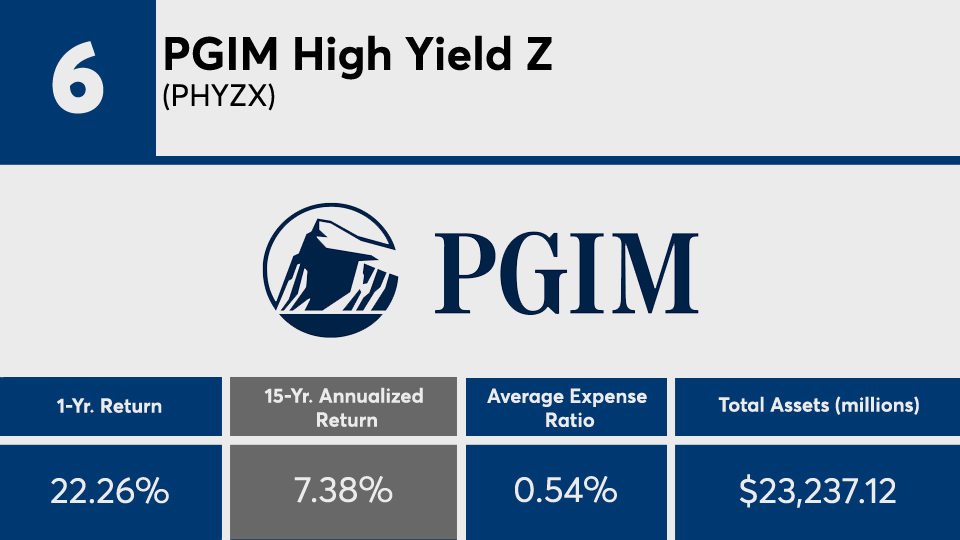

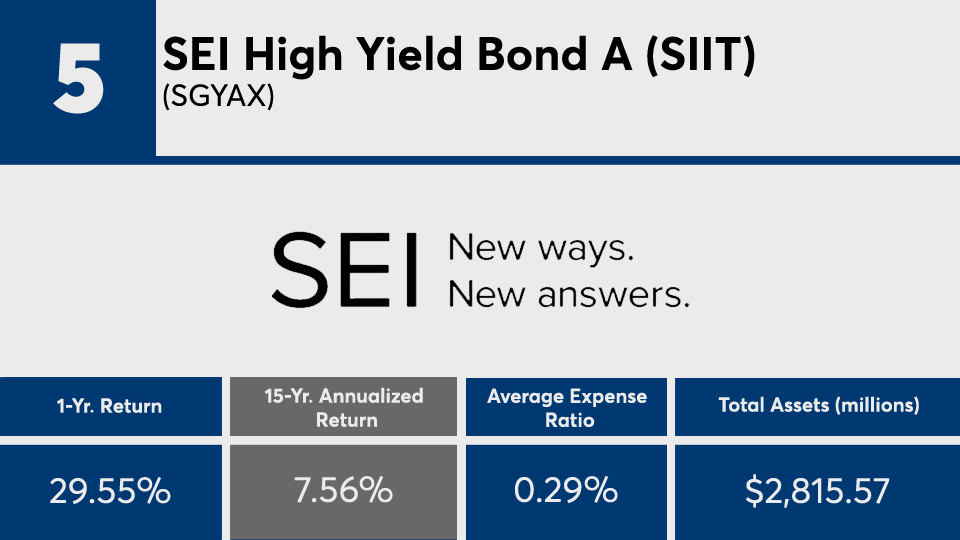

The 20 top-performing bond funds of the past 15 years, with at least $100 million in assets under management, had an average gain of more than 7%, Morningstar Direct data show. Over the past 12 months, the same funds notched an average return of almost 18%.

When considering the bond-market landscape over the shorter timer, it may be hard to fathom the same success in the years to come, says Tom Bradley, managing director and head of capital markets at Miami-based fixed-income software vendor YieldX.

“Last year was an aggressive year for fixed-income performance with global central banks slashing rates as a result of COVID-19, and at the same time re-engaging in secondary market bond purchasing — the perfect combination for high-yield performance,” Bradley says. “Now that markets have plateaued and interest rates globally look grounded (possibly trending higher in the U.S.), fixed income will become a more nuanced sector to invest in as opposed to the ‘rising tide lifts all ships’ mantra of the last few years.”

Compared with broader markets, the iShares Core U.S. Aggregate Bond ETF (AGG), which has a 0.04% net expense ratio, recorded a 15-year gain of just 4.23%, data show. Over the past year, the fund had a gain of 0.32%.

In stocks, the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF (DIA) have had 15-year returns of 10.20% and 10.28%, respectively. In the past 12 months, SPY and DIA had gains of 50.29% and 45.30%. The funds have net expense ratios of 0.09% and 0.16%.

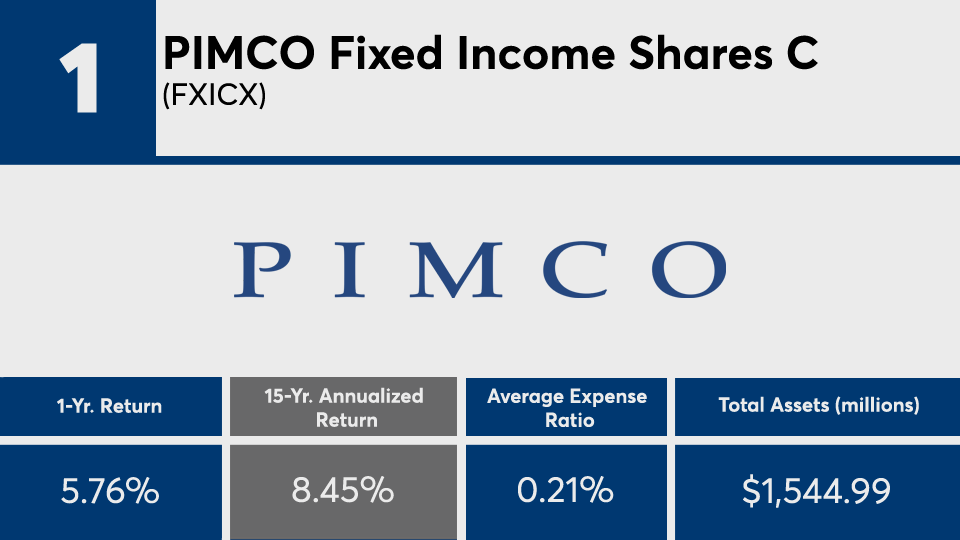

Fees among the fixed-income leaders in this ranking, all of which are actively managed, were expectedly higher than the industry average. With an average net expense ratio of 0.65%, funds here were 20 basis points pricier than the 0.45% investors paid for fund investing in 2019, according to

When discussing fixed-income holdings with clients, Steven Skancke, chief economic advisor at Huntsville, Alabama-based independent investment advisory firm Keel Point, says it’s important for advisors to discuss a product’s overall management objectives and current interest rate cycle.

“A principal goal in bond allocations is low volatility and drawdown in times of economic and equity market stress,” Skancke says, adding that “investors should pay attention to how bond funds perform in adverse financial markets.”

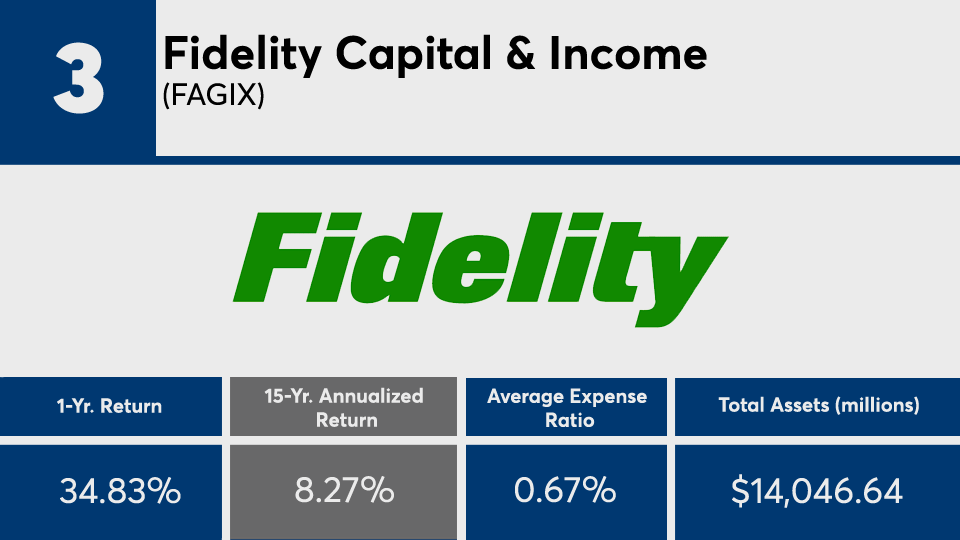

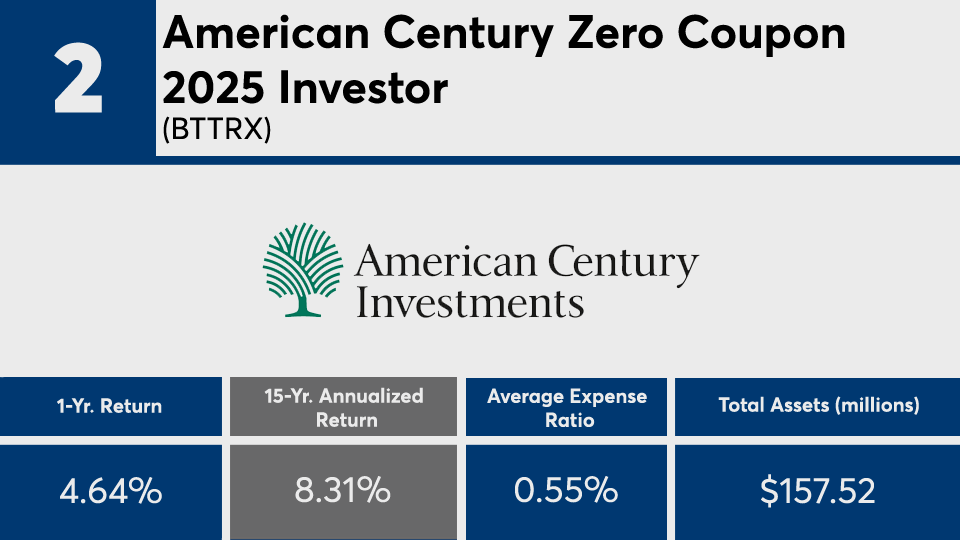

Scroll through to see the 20 bond funds with more than $100 million in AUM and the best 15-year returns through April 9. Assets and average expense ratios, as well as year-to-date, one-, three-, five and 10-year returns are also listed for each, as are YTD-, one-, three-, five-, 10- and 15-year net share class flows through April 1. The data show each fund's primary share class. All data is from Morningstar Direct.