Market volatility driven by the coronavirus pandemic and unprecedented political climate this year has put conventional investing wisdom to the test.

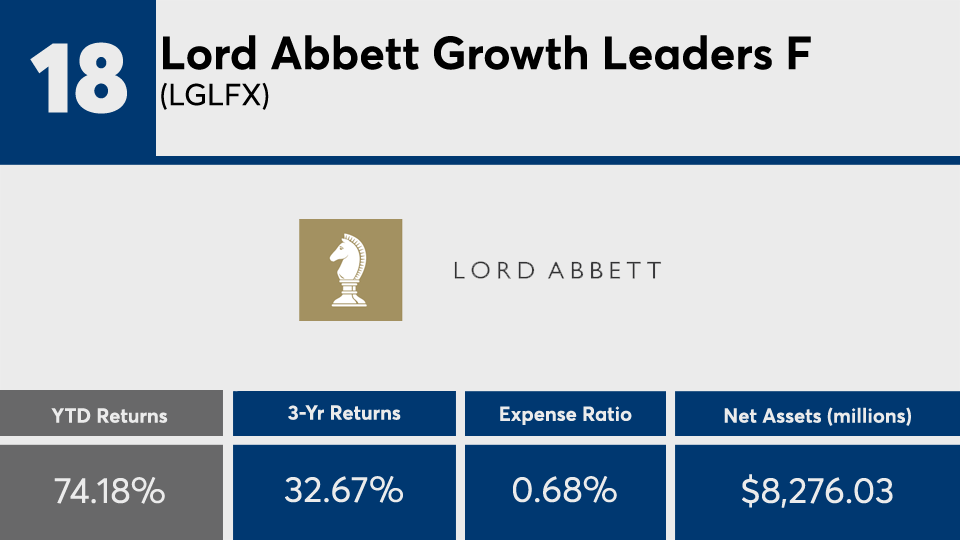

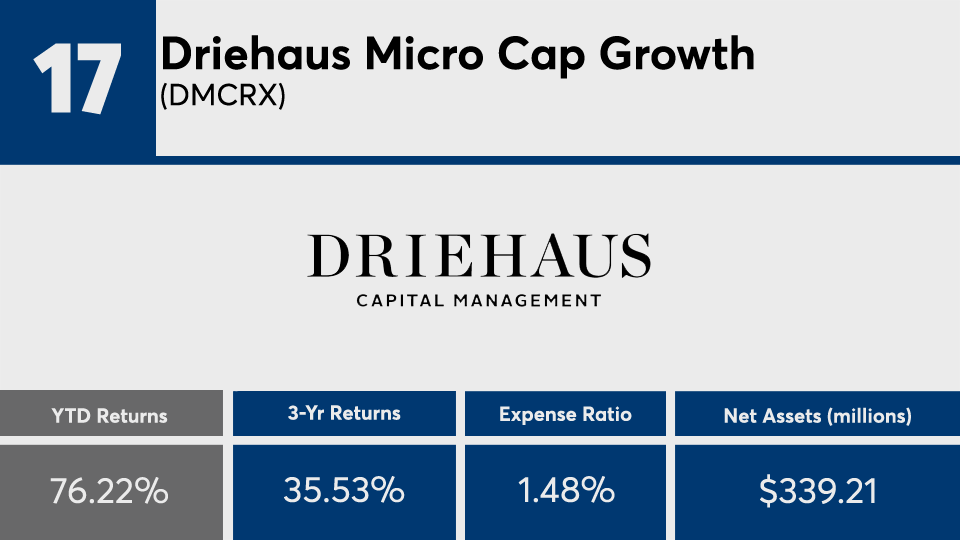

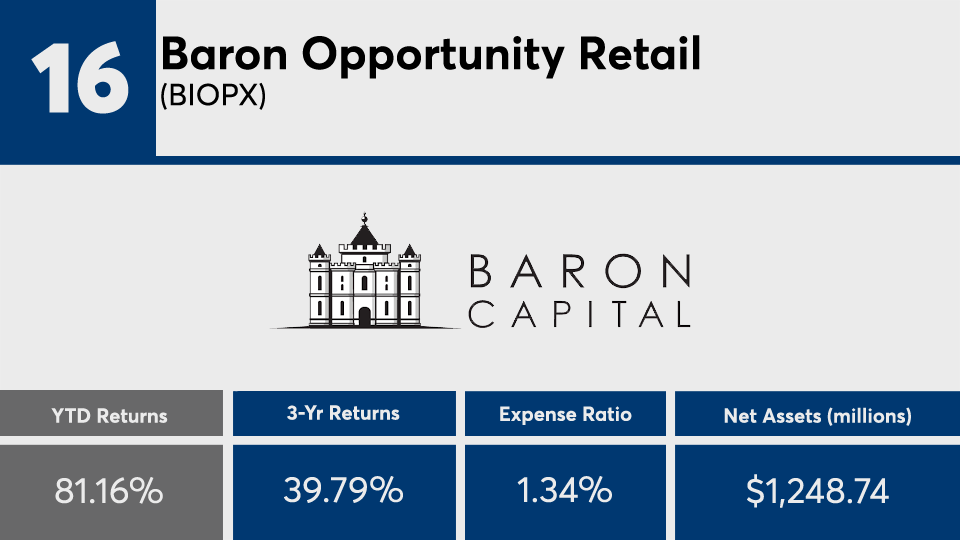

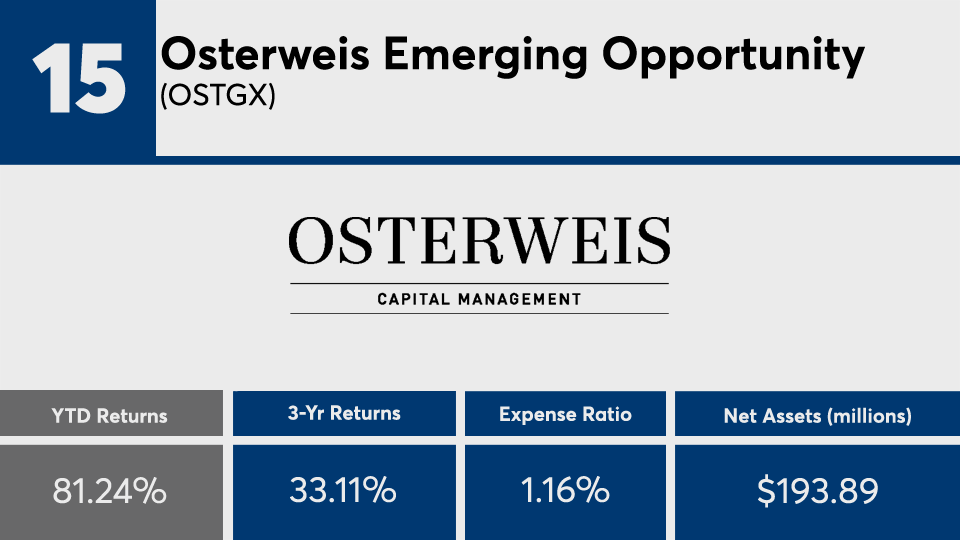

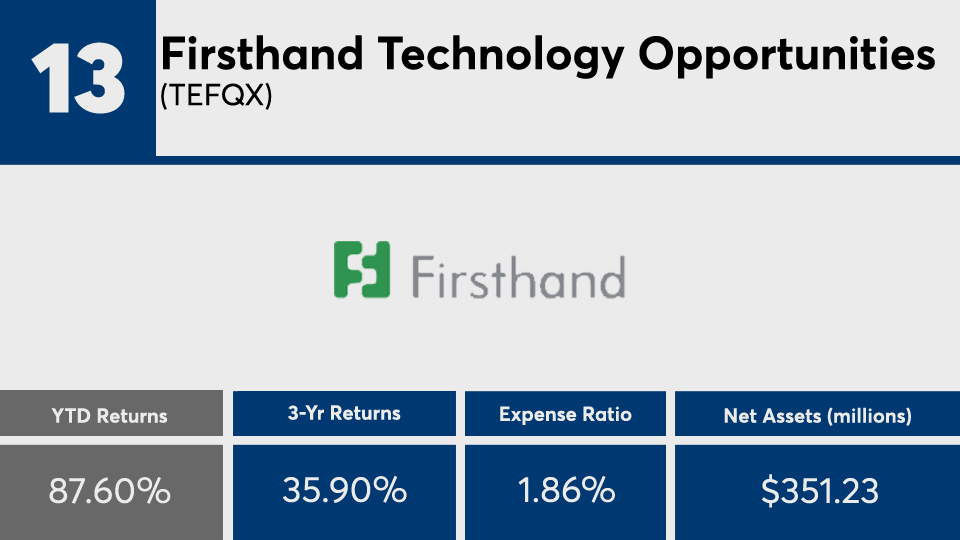

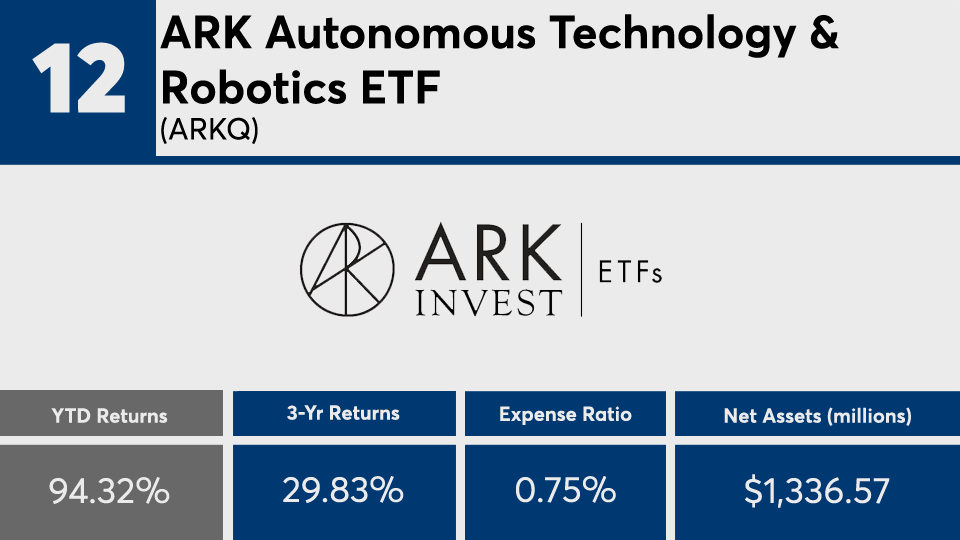

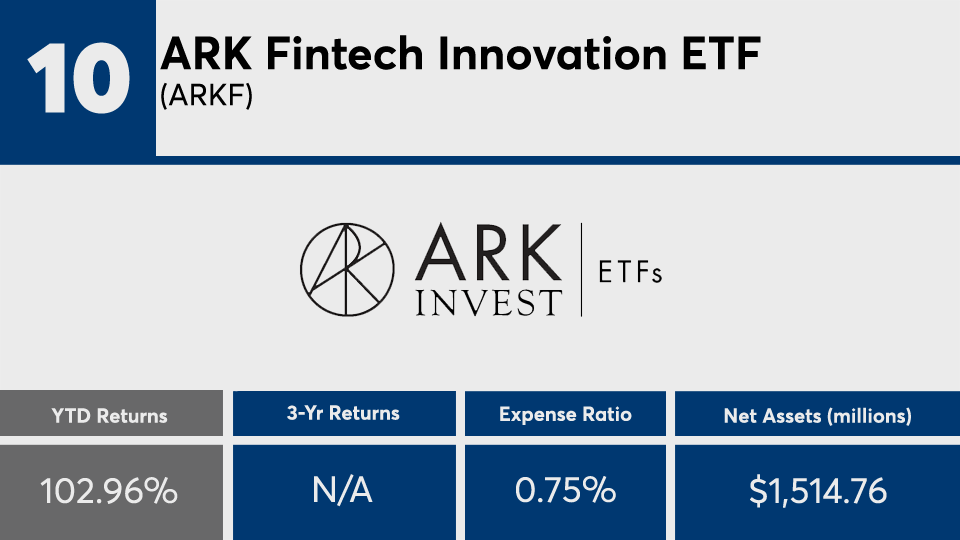

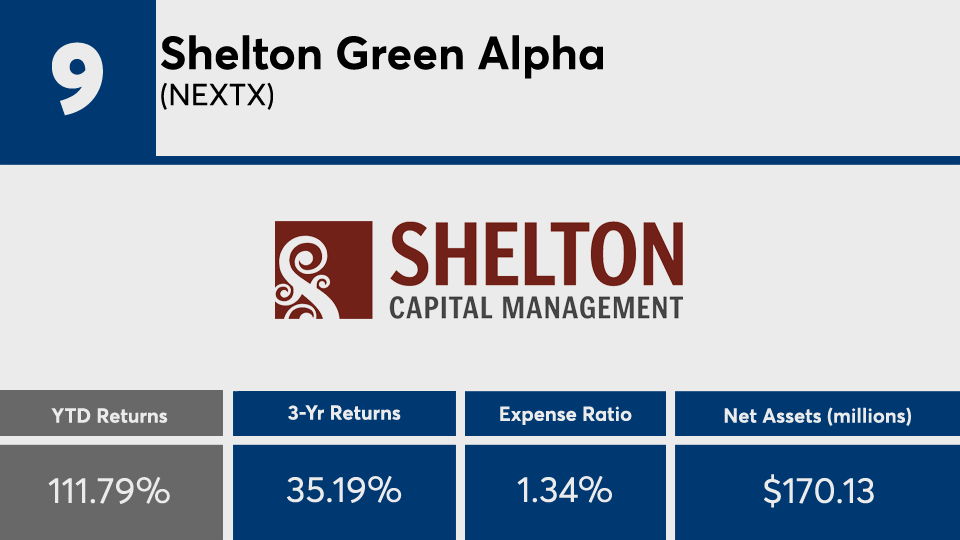

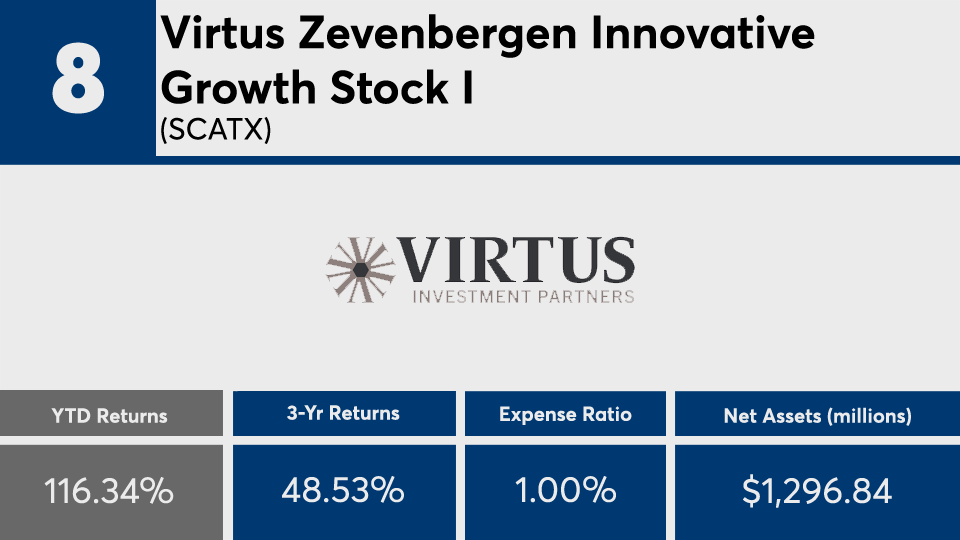

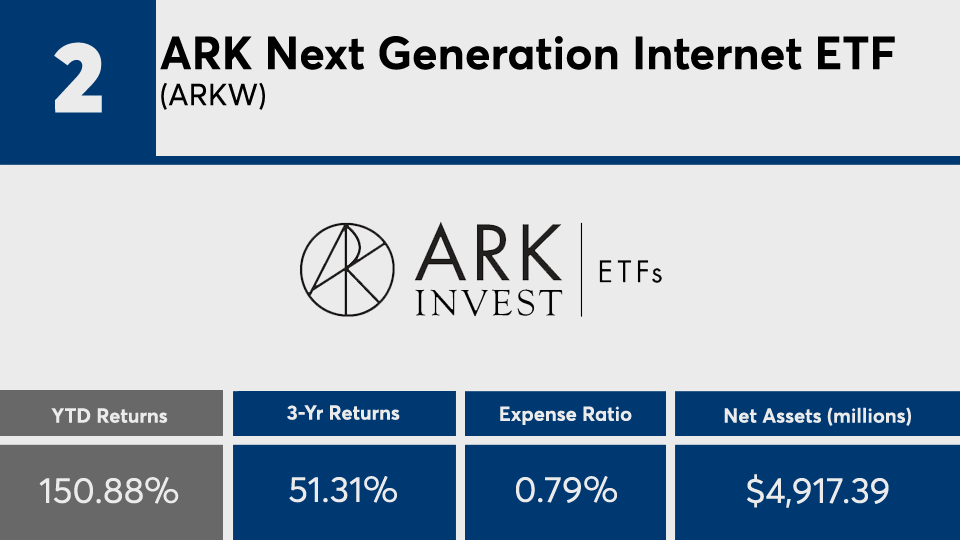

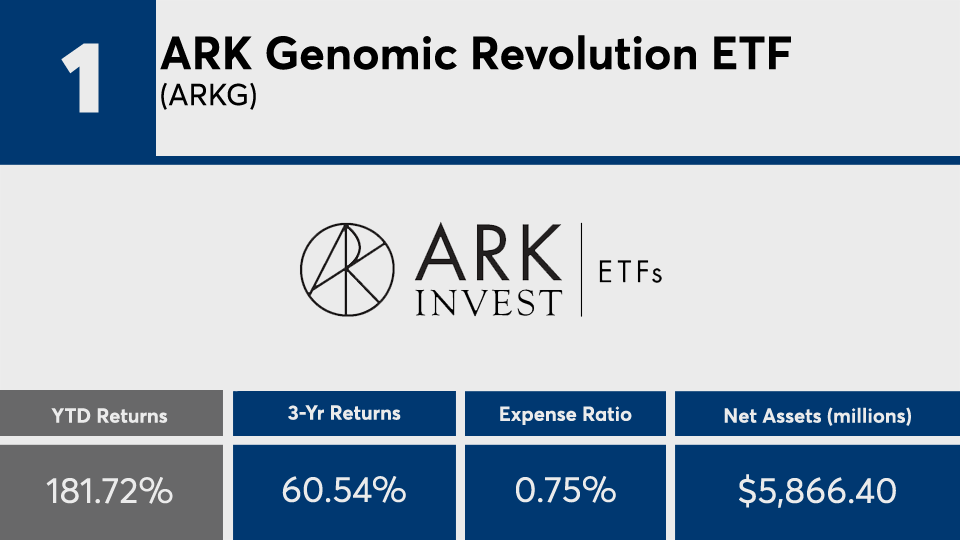

With an average gain of more than 108%, and at least $100 million in assets under management, the 20 mutual funds and ETFs with the biggest gains of 2020 also carry an average fee of more than twice the industry average, Morningstar Direct data show.

“The funds on the list all employ a growth-oriented investment approach and are focused on U.S. equities, both styles that have fared well in 2020,” says Amy Magnotta, co-head of discretionary portfolios at Brinker Capital Investments. “The COVID-19 pandemic resulted in more winners and losers from an individual company perspective, an environment that benefits active managers. These top-performing funds were able to take advantage of this environment, and their emphasis on technology, health care and some areas of the consumer sector led to very favorable returns.”

Index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) generated YTD returns of 16.41% and 8.18%, respectively, data show. SPY and DIA had three-year annualized gains of 13.44% and 9.36%. In bonds, the iShares Core U.S. Aggregate Bond ETF (AGG) had gains of 7.07% and 5.13% over the YTD and three-year periods.

With an average net expense ratio of 115 basis points, the top-performers were well above the 0.45% investors paid for fund investing last year, according to

“This is why it is important to not screen out investment opportunities based solely on expense ratios,” Magnotta says. “There are some highly skilled active managers that can consistently earn their fees, especially in less efficient areas of the market.”

When analyzing the year’s top-performers, Magnotta says it’s imperative for advisors to revisit their clients’ long-term plans.

“A client’s investment time horizon is often much longer than that short-term period,” she says, adding that “it is important to put short-term performance in perspective, and focus on whether an individual fund or strategy is well positioned to help a client meet his or her long-term goals and objectives going forward.”

Scroll through to see the 20 mutual funds and ETFs with the biggest YTD gains through Dec. 16. Funds with less than $100 million in AUM were excluded, as were funds with investment minimums above $100,000, leveraged and institutional funds. Assets and expense ratios, as well as one-, three-, five- and 10-year returns are also listed for each. Minimum initial investments and loads are also listed when applicable. The data show each fund's primary share class. All data is from Morningstar Direct.