To see how much the world has changed for IBDs, look no further than the expanding gap between the amount of advisory fees and commissions.

Fees outpaced commissions

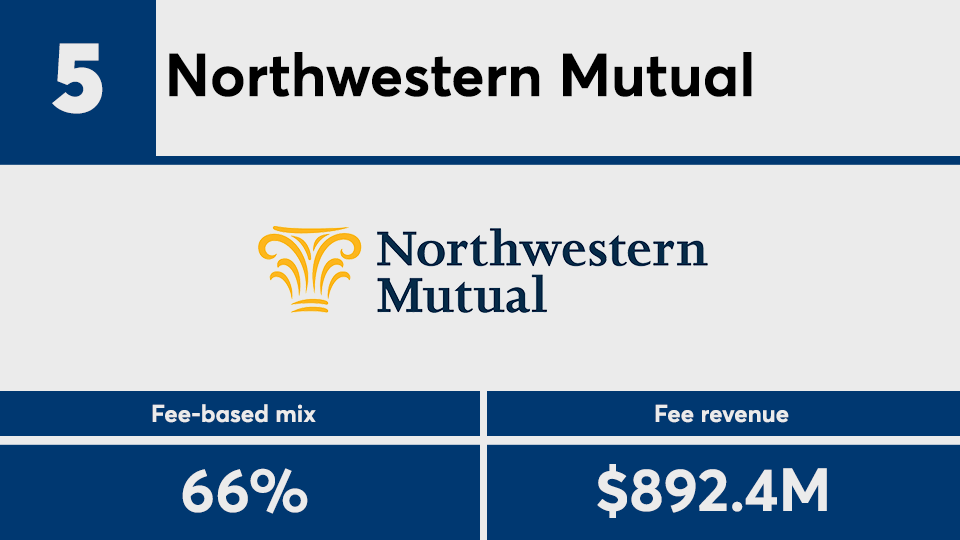

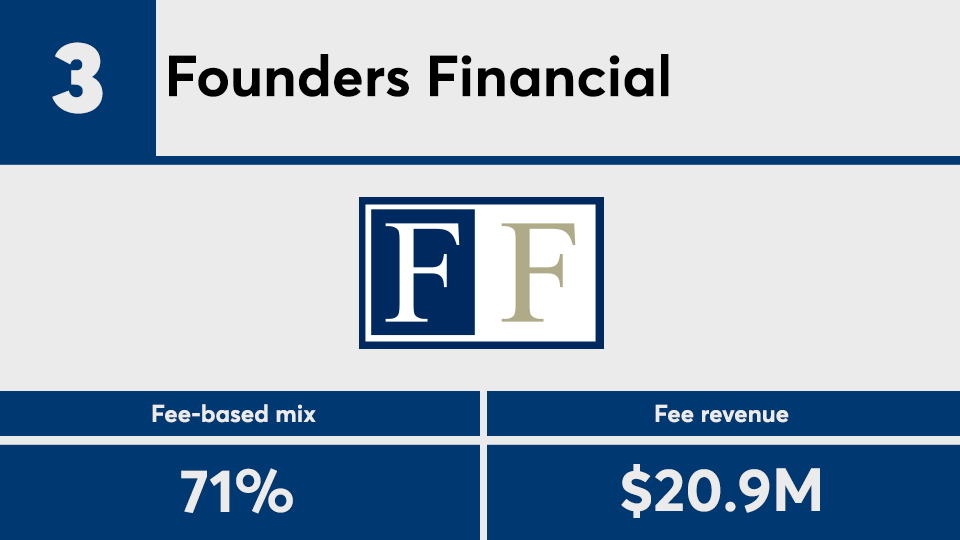

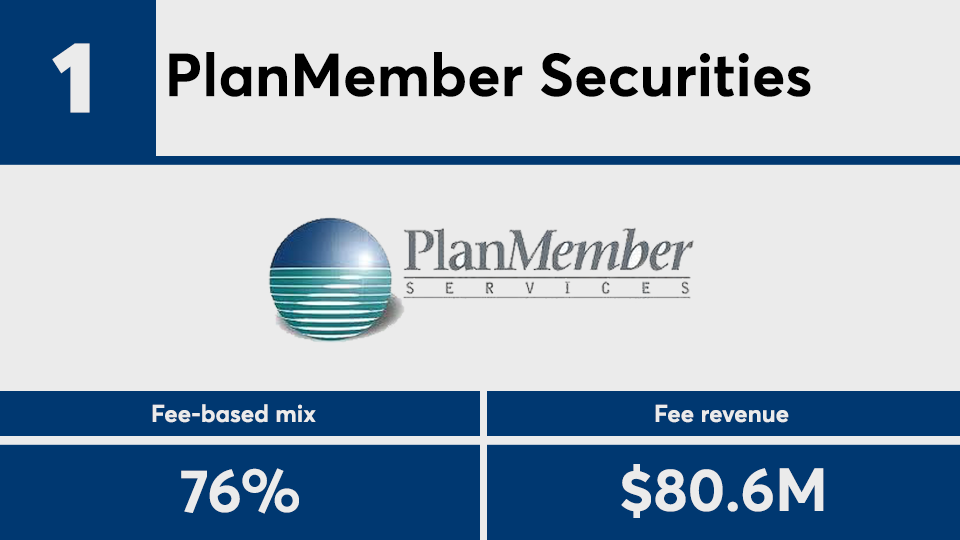

The below list shows the 10 IBDs with the highest percentage of their revenue derived from advisory fees. Corporate RIAs generate a larger share of IBD business every year. In 2007, $3 billion in fees comprised 23% of the sector’s $13.2 billion in revenue; last year, $15 billion in fees made up 48% of its $31.2 billion.

In addition, the discrepancy between advisory fees and commissions keeps growing. After

Furthermore, the SEC’s Regulation Best Interest and the wider fiduciary debate on advisory rules are contributing to the pivot. Conflicts of interest such as cash sweeps, 12b-1 fees and revenue sharing represent significant parts of the traditional IBD business model. Experts say

As advisors add more fee-based clients and migrate their brokerage accounts into advisory services, the marketplace -- rather than regulation -- may well forge different practices. This year’s presidential election might also upend Reg BI and the

In this complex picture spanning the retirement accounts of tens of millions of Americans, 10 IBDs stand out for spearheading the sector’s embrace of fee-based planning. To see which IBDs have the largest fee-based mix of business, scroll down our slideshow. For last year’s ranking,