A busy year in recruiting reveals one of the biggest challenges in the independent broker-dealer space: As RIAs and acquisitions drive the largest moves of advisors and assets, how can the sector support both independence and ties to BDs at the same time?

Recruiters in the IBD sector are increasingly consumed by the question of how to keep large hybrid RIAs, even though their outside advisory assets cut into revenue. Another important factor they grapple with: The need to retain as many productive teams as possible following an acquisition.

Together, the 50 biggest moves in 2018 span thousands of advisors and more than $82.5 billion in client brokerage and advisory assets under management.

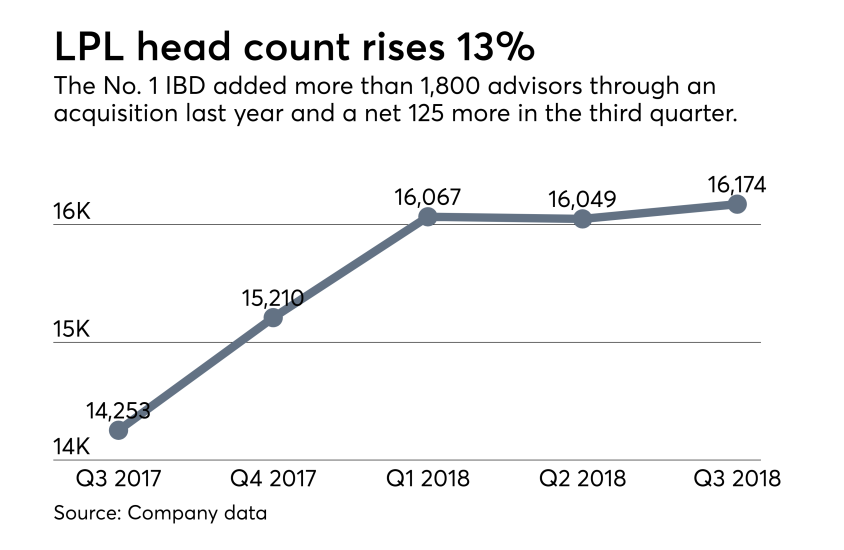

Two of the sector's largest firms embody the two trends and firms’ responses to the issues. LPL Financial and Advisor Group grabbed the largest number of teams or offices of supervisory jurisdiction, with a combined 32 of the top 50 moves in 2018.

Five hybrid RIA practices who left LPL after the company

LPL later

In a sign of the threat from the RIA channel, eight moves involved so-called friendly BDs who only service the portion of the OSJ and practice assets on the brokerage side. Platform providers and RIA consolidators are allowing wirehouse breakaways to bypass traditional IBDs.

The eight moves to friendly, hybrid-serving BDs like Mutual Securities, Purshe Kaplan Sterling Investments and Private Client Services plus two new fully independent RIAs add up to $18.5 billion in client assets held away from larger, established firms.

One such powerful incumbent, Advisor Group, rendered the issue partly moot by boosting scale with three acquisition deals. The M&A activity could grow the 5,000-advisor network by some 2,500 more representatives early next year, upon its

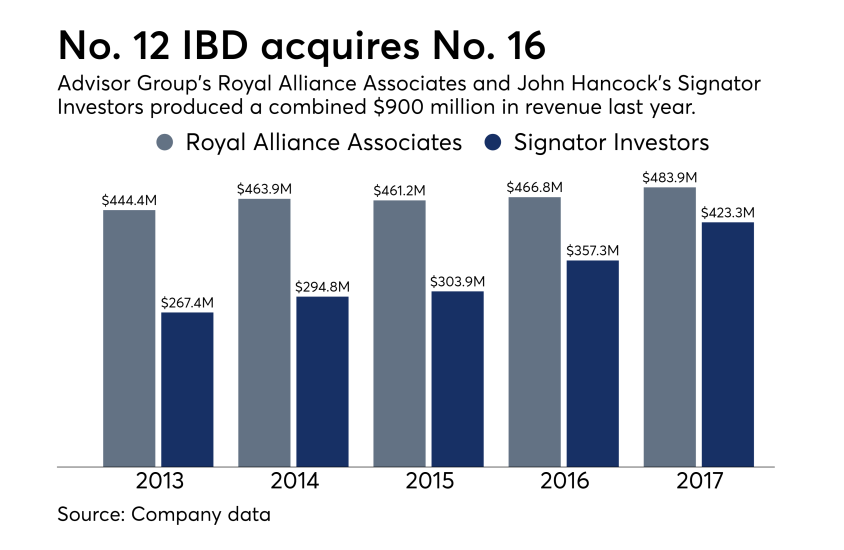

Former Signator Investors OSJs made the list in droves by joining the Advisor Group’s largest subsidiary IBD, Royal Alliance Associates, after it

The Signator deal led to 22 of the largest moves of 2018, spanning $45.3 billion in client assets among Royal Alliance’s incoming crop of 1,860 ex-Signator advisors. Similarly, LPL’s acquisition of the assets of National Planning Holdings

Seven other ex-NPH teams made this year’s edition, with LPL retaining six bank-based practices from Invest Financial and a mid-size firm, Independent Financial Group, taking the other. LPL made 10 of the largest grabs, adding advisors with $11.8 billion in total client assets.

However, this list would look much different without including teams joining new firms after an acquisition or those using friendly BDs for the brokerage sliver of their assets. Note, some IBDs also don’t announce their largest recruiting moves.

The list only includes teams that changed BD affiliations in this calendar year, according to FINRA BrokerCheck. Scroll through to o see the biggest moves in the ever-changing IBD sector for 2018.