There are challenges reshaping the sector, but the big independent broker-dealers keep getting bigger. And that doesn’t mean all their smaller rivals are waning.

In fact, only two of the 10 fastest-growing IBDs reporting their annual metrics as part of Financial Planning’s

To be sure, gains in annual revenue will register more significantly when one firm starts at a lower base than another. And most IBDs

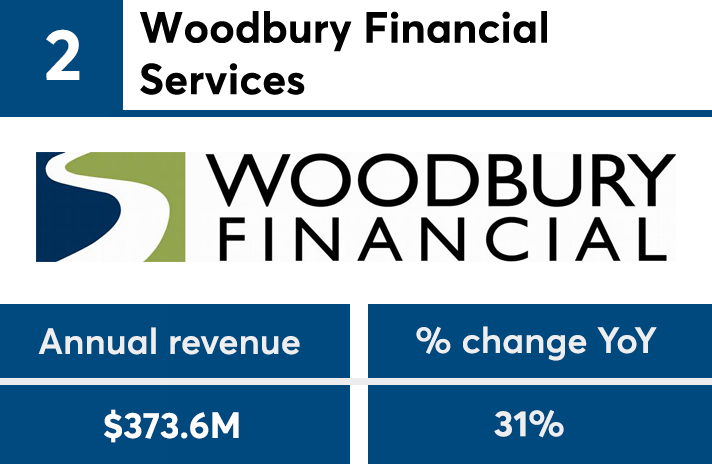

The median annual revenue for the 52 firms voluntarily disclosing their data jumped 18% year-over-year to $280.7 million in 2018. Firms’ combined revenue surged 12% to $28.8 billion — higher than the gross domestic product of more than 100 individual countries.

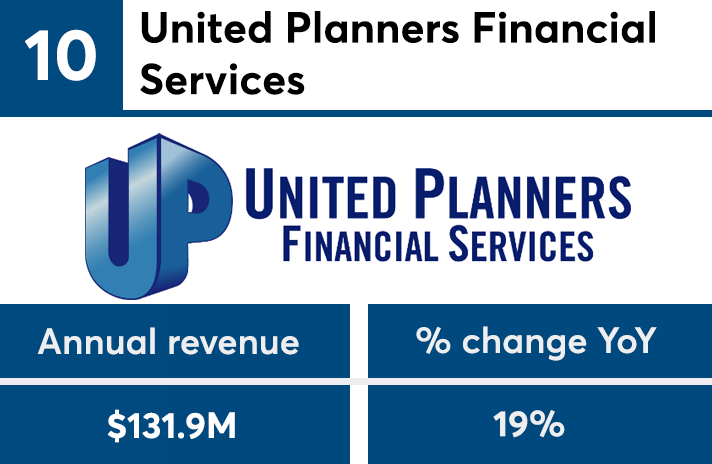

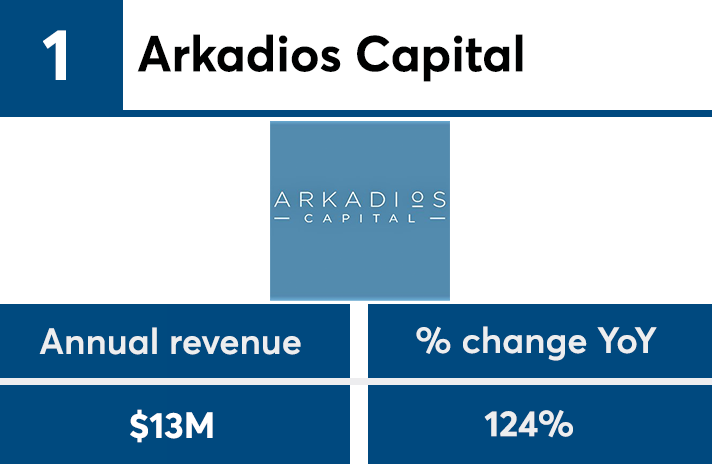

Arkadios Capital, Independent Financial Group, O.N. Equity Sales and United Planners Financial Services stand out as small and midsize firms supercharging this growth. Many advisors enjoy the service and C-suite relationships that come with working at a smaller firm.

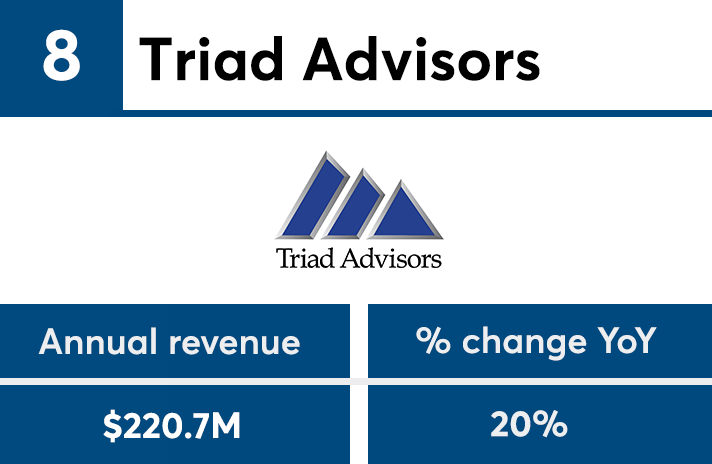

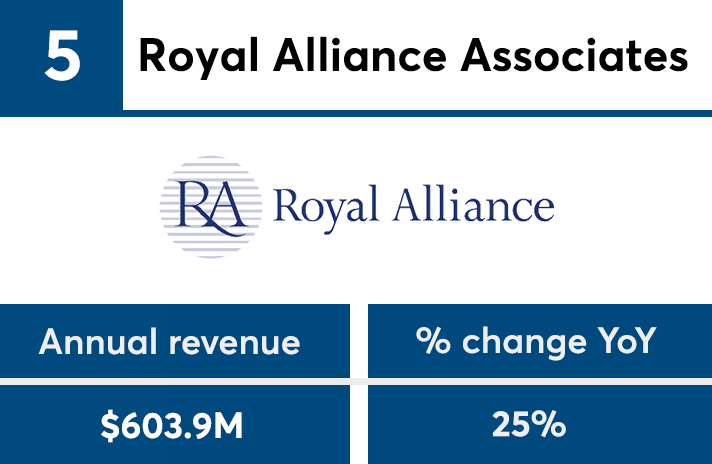

On the other hand, the presence of five firms that are respectively part of the Cetera Financial Group, Ladenburg Thalmann and Advisor Group networks displays how larger players are also growing by combining their big resources with small-firm structures across their IBDs.

With individual financial advisors using their own criteria when assessing a BD relationship, there’s more than one effective way to do business in the fast-changing sector. Despite the positive numbers, traditional revenue sources like mutual fund fees are drying up more and more each year while the cost of technology and regulatory compliance rises.

The only wrong way to go about competing in the IBD sector, then, would be to ignore such facts. The firms that are ahead of the curve have already altered their approach or sold to larger rivals, such as the Advisor Group firms

For every statistic compiled in the past eight years of the IBD Elite survey,