The industry’s top-performing tax-efficient funds, while pricier than their peers, have paid off over the past decade.

Top returns among mutual funds and ETFs with 0% tax-cost ratios range from about 7% to nearly 25% over the past decade, Morningstar Direct data show. With an average 10-year return of 10.14%, the ranking is led by ETFs, a detail Grant Engelbart, director of research and senior portfolio manager at CLS Investments, says should come as no surprise.

“The ETF structure is great for minimizing capital gains, as low cost basis/high gain positions can be transferred out of the ETF without tax consequence using the creation/redemption mechanism,” Englebart says. “These funds have also grown assets fairly well over the period.”

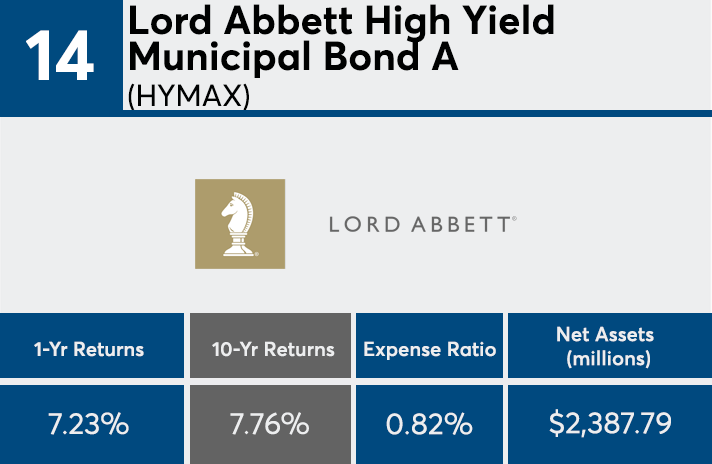

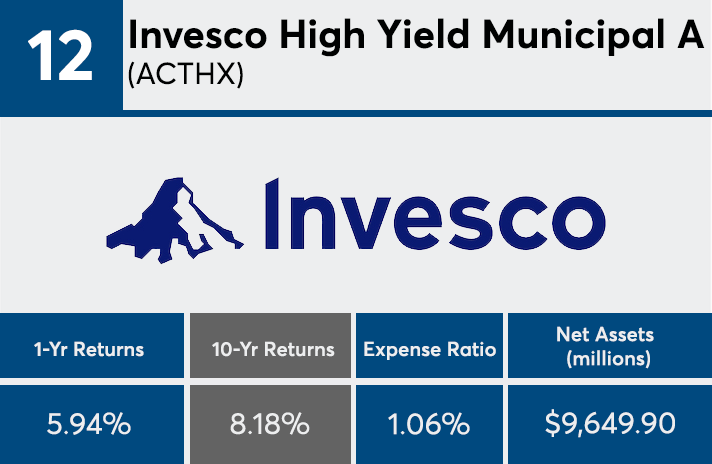

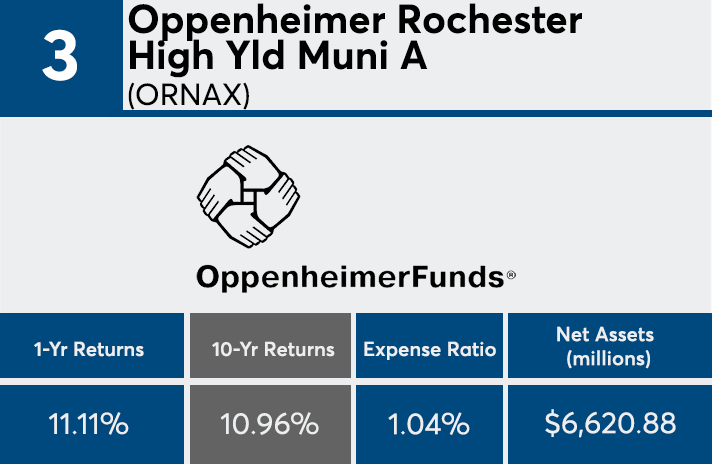

Muni and high-yield bond funds dominate the list, data show. “The muni bonds showing up makes sense,” Engelbart says, adding, “This was a strong period for fixed-income returns, and municipal bonds have federal tax-free income produced, which leads to the low tax cost ratios.”

Engelbart notes that several of the funds that are explicitly labeled high yield are from California, “a state typically associated with lower-quality higher yielding municipal bonds,” ultimately contributing to the “high returns over this period as we have seen limited credit events in the municipal space outside of maybe Puerto Rico.”

With $63.3 billion in AUM and a 10-year return of 4.23%, the biggest fund with a 0% tax-cost ratio — the Vanguard Intermediate-Term Tax-Exempt Fund Admiral Shares (VWIUX) — has an expense ratio of 0.09%, Morningstar Direct data show.

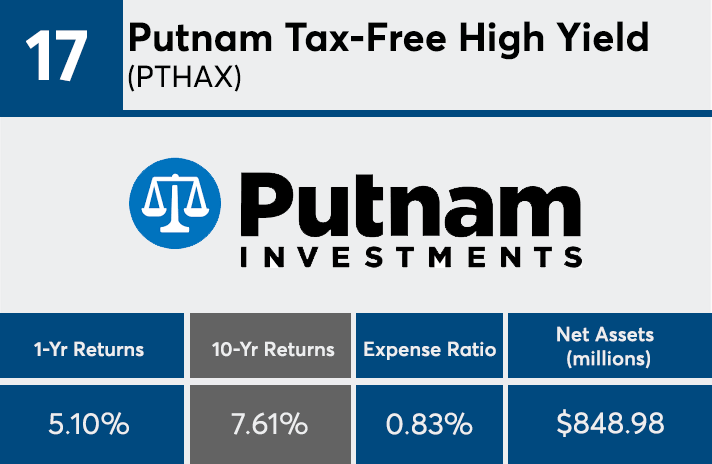

The average expense ratio among the top-performers, which hold a combined $69.9 billion in AUM, came in at 0.92%; 40 basis points higher than the industry average, data show. Investors paid an average 0.52% for fund investing in 2017, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs. For advisors with clients eyeing the benefits of tax-free distributions, Engelbart says to proceed with caution and to always read the fine print and follow the proper due diligence.

“Even the ETF expense ratios are on the high-end,” Engelbart notes. “A lot of times there is an index option (either mutual fund or ETF) that will be cheaper and deliver similar if not better, and sometimes more reliable, performance.”

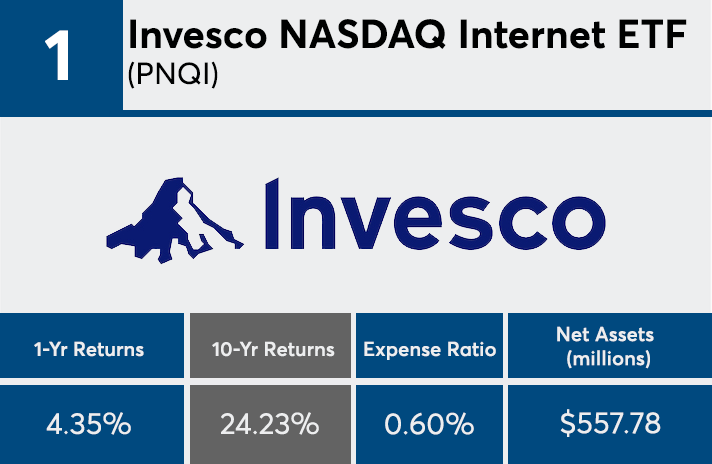

Scroll through to see the 20 mutual funds and ETFs with 0% tax-cost ratios (month-end data) and the highest 10-year returns through March 27. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund are also listed. The data shows each funds’ primary share class.