Although outpaced by broader markets, clients about a decade away from the traditional retirement age of 65 enjoyed impressive gains from their 2030 target-date funds.

With nearly $140 billion in combined assets under management, the 20 target-date 2030 funds with the biggest gains of 2019 largely benefited from both their fee structures and asset allocation strategies, according to Greg McBride, a senior analyst at Bankrate.

“Not all 2030 target-date funds are the same,” McBride says. “Investment allocations can differ from one fund to another, and so do the expense ratios. These are the factors impacting the relative performance of funds with the same 2030 target.”

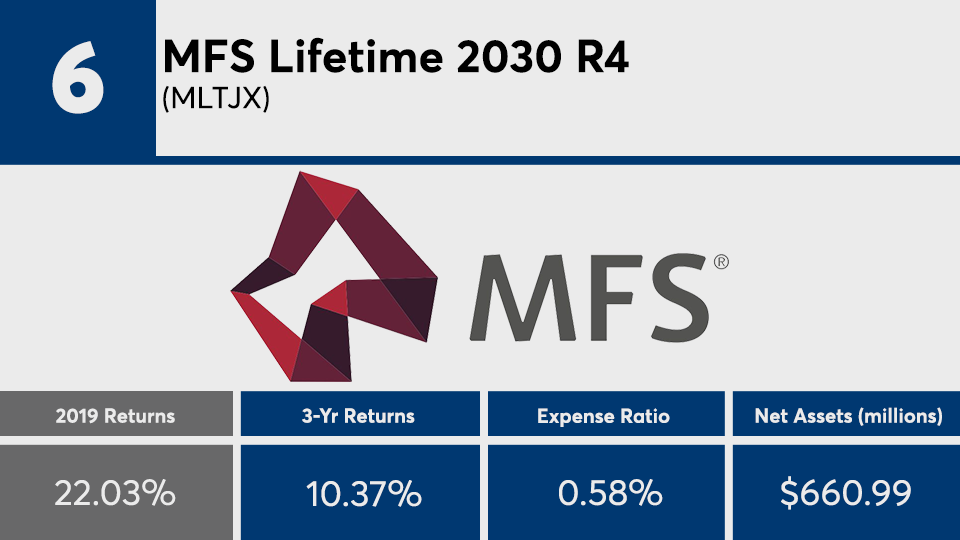

Holdings in the top-performers would have rendered a gain right on target with the target-date market, data show. With an average return more than 21%, returns among the top-performers were slightly shy of the Morningstar Lifetime Moderate 2030 Index, as tracked by the MFS Lifetime 2030 Fund (MLTAX). All, however were bested by the S&P 500’s stellar 31.22% gain last year, as tracked by SPDR S&P 500 ETF Trust (SPY), as well as the Dow’s 25.01% gain, as tracked by the SPDR Dow Jones Industrial Average ETF (DIA) over the same period, data show.

“With the stock market rising 30% in 2019, those funds carrying a higher allocation to U.S. stocks had the wind at their backs,” McBride says. “But that can cut both ways, and those with a higher allocation to stocks will lag when the market has a down year.”

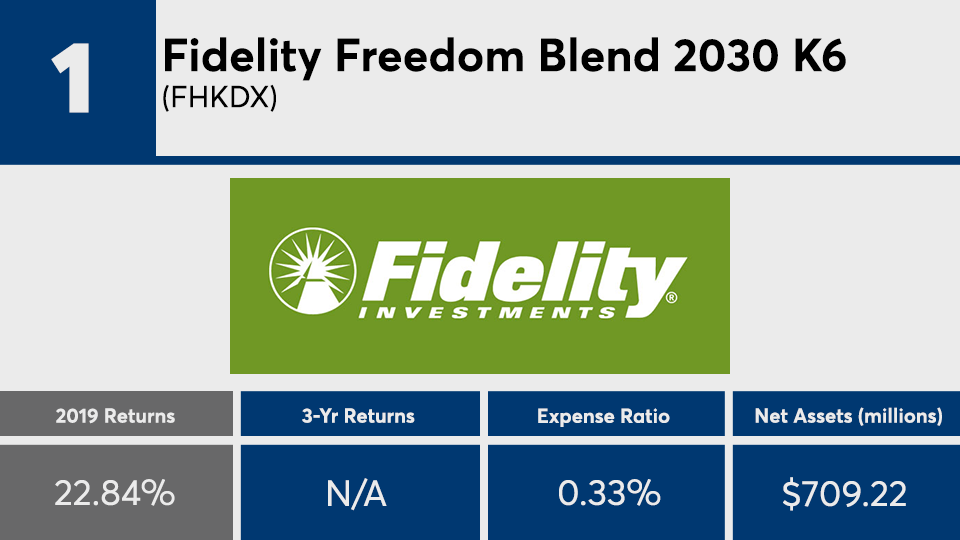

Fees were on target with the broader industry. With an average net expense ratio of 0.49%, these funds were only slightly pricier than the 0.48% investors were charged, on average, for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

The largest target-date 2030 fund, the $41.6 billion Vanguard Target Retirement 2030 Investor Shares (VTHRX), had a 0.14% expense ratio and 21.07% gain in 2019, data show. The biggest overall fund, the $897.7 billion Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), had a 0.04% expense ratio and a 30.8% return over the same period.

“Investors should make sure they are comfortable with the investment allocation of a particular target-date fund before investing,” McBride says. “It may be more aggressive or more conservative than comparable funds, largely based on whether it devotes a higher percentage or lower percentage to stocks.”

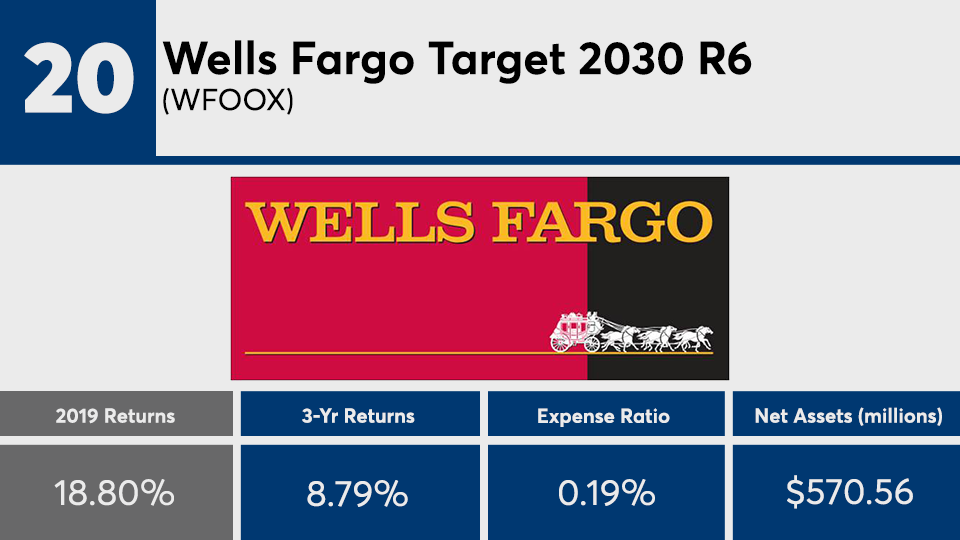

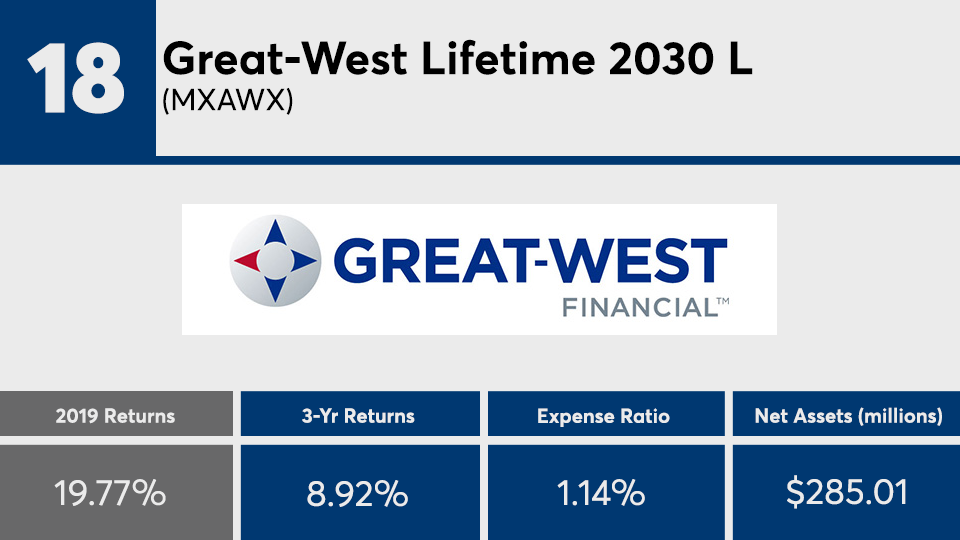

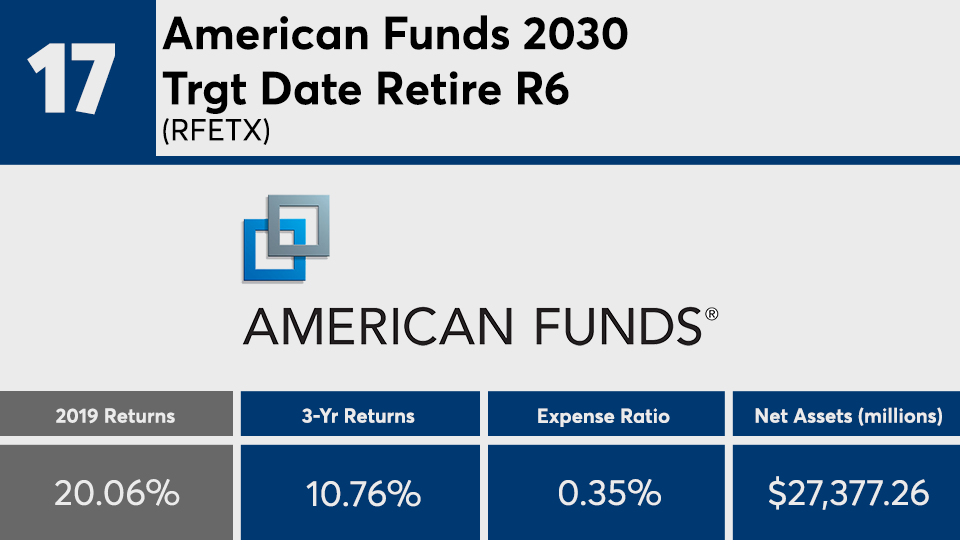

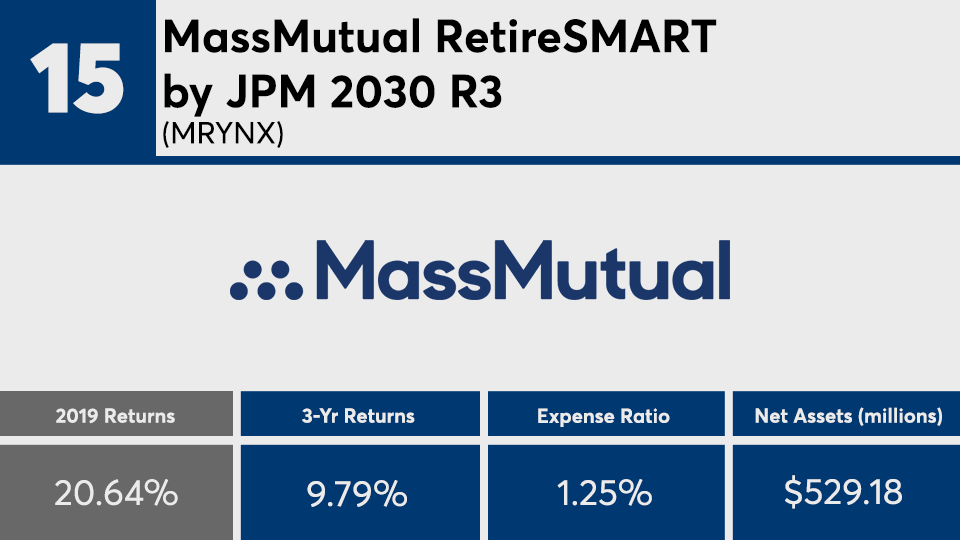

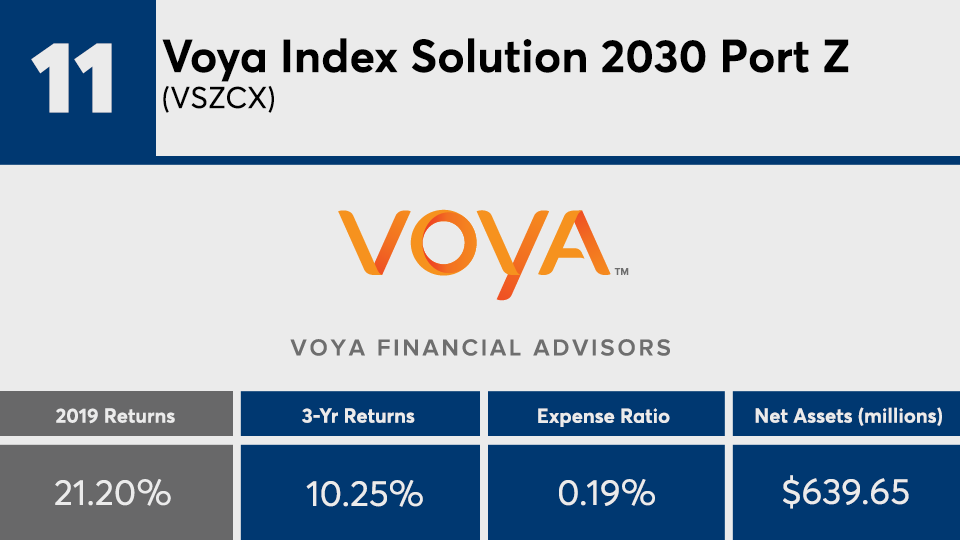

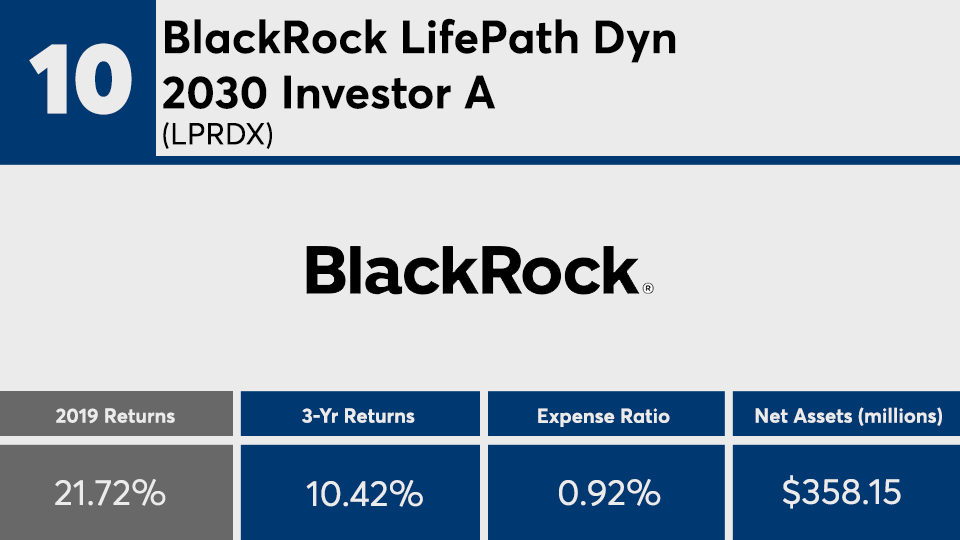

Scroll through to see the 20 target-date 2030 category funds with the best returns as of 2019. Funds with less than $100 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as three-year net flows and year-to-date returns, are also listed. The data shows each fund's primary share class. All data from Morningstar Direct.