Popularity in the fixed-income universe, similar to nearly all other corners of the fund industry, comes at a price; and the lower that is, the better. For advisors closely monitoring the trend to passive, it should be expected that low-cost fixed-income products most suited to navigate volatile markets and minimize interest rate risk over the past three years dominated the list.

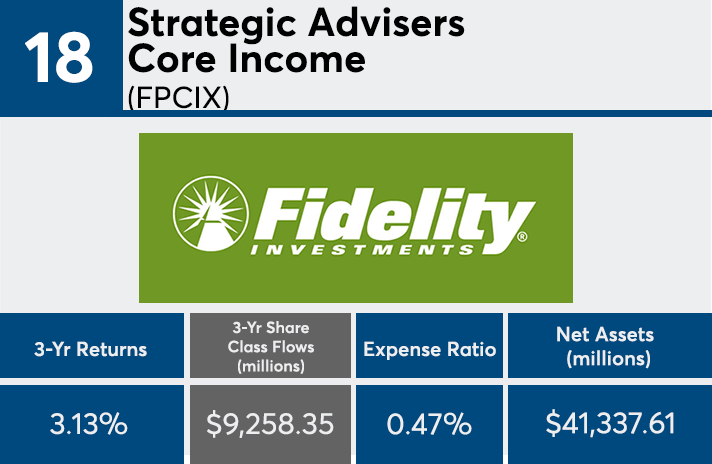

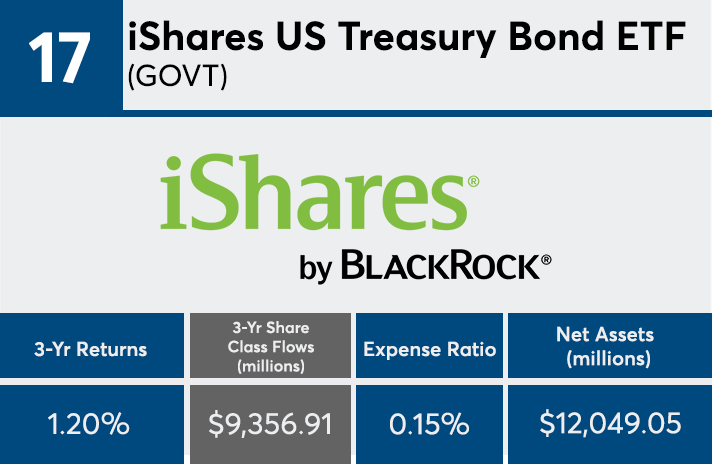

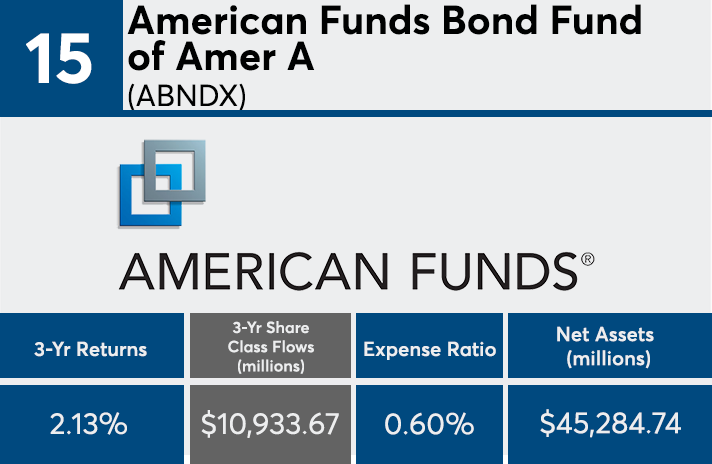

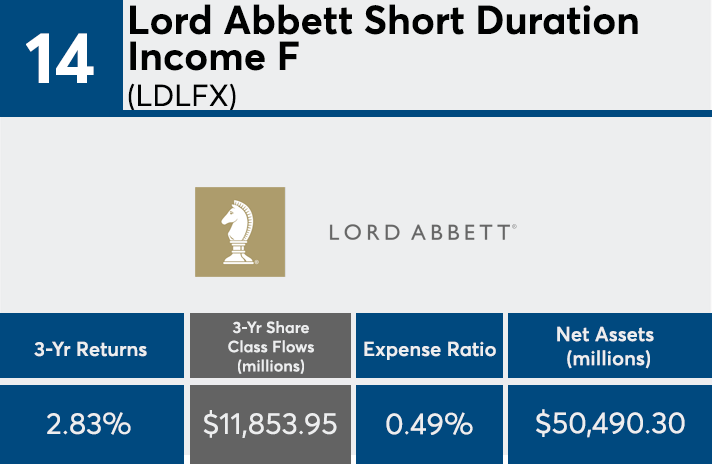

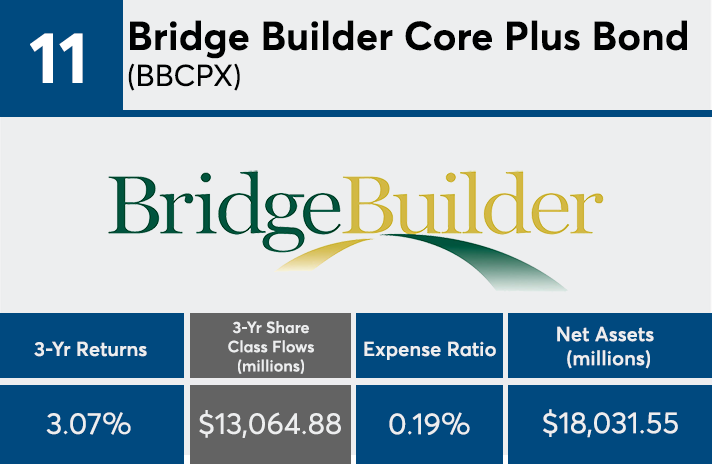

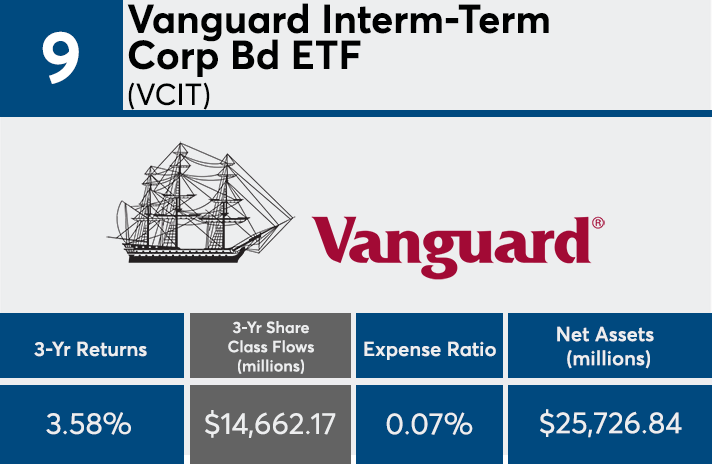

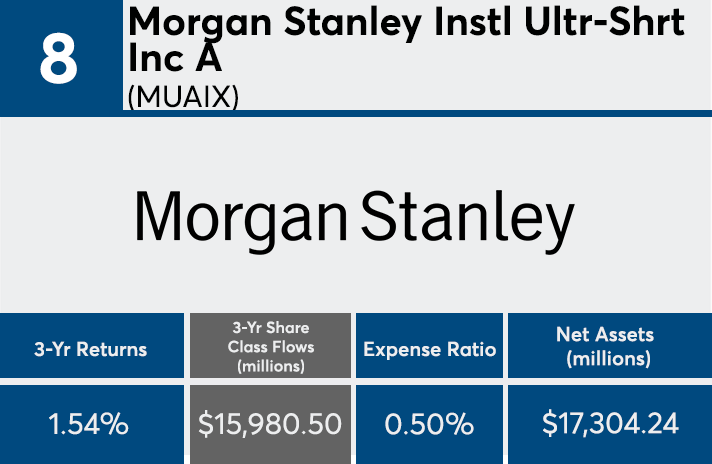

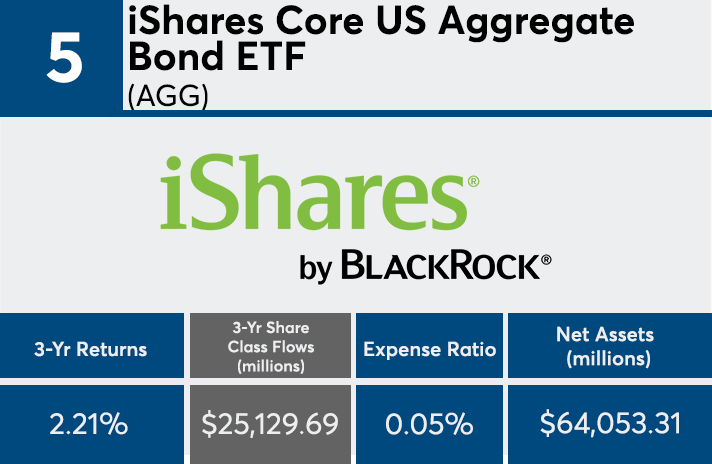

The 20 fixed income mutual funds and ETFs, ranked by their largest inflows over three years (with at least $500 million in AUM), hold just over $1 trillion in assets under management. Those funds brought in a combined $431 billion over the period. Many of these products, according to Bankrate senior analyst Greg McBride, have benefited from investors aiming to shed risk and navigate choppy markets.

“Investor preference for short-term bonds is very clear by looking at the largest inflows over the past three years,” McBride says. “This is entirely appropriate, as shorter-duration bonds minimized the interest rate risk of the rising rate environment from 2016 to 2018.”

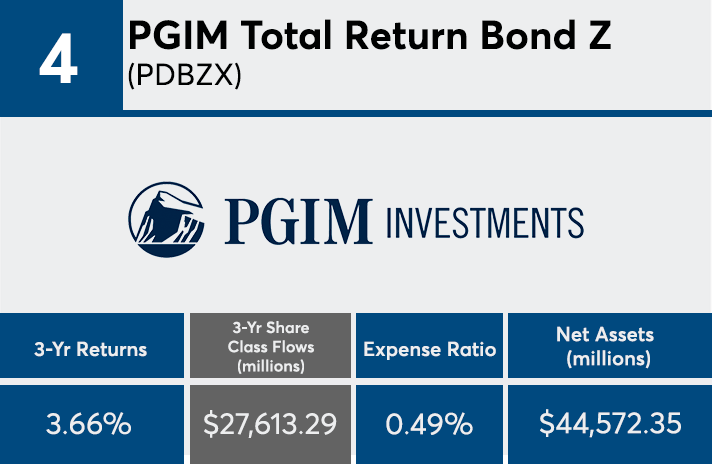

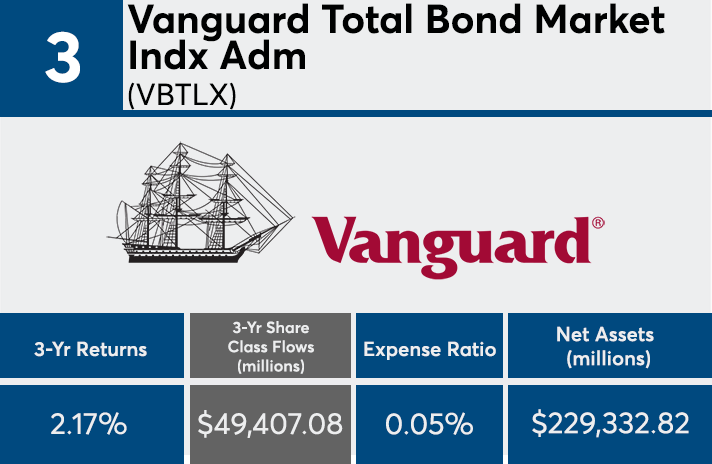

Fees, as expected, are low. With an average expense ratio of 24 basis points, fixed-income funds with the biggest net inflows were around 61 basis points cheaper than the average bond fund fee of 0.85%, data show. Compared with the rest of the fund industry, the leaders were half the price of the 0.48% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. With $229 billion in AUM, the industry’s largest bond fund, the Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX), has an expense ratio of 0.05% and net three-year inflows of $49 billion, data show.

Annualized returns, when compared with all other bond funds, show another reason why these products have maintained popularity. With an average three-year gain of 2.50%, the funds bested the Bloomberg Barclays U.S. Aggregate Bond Index’s 2.21%, as measured by the iShares Core US Aggregate Bond ETF (AGG), over the same period, according to data. For advisors with clients invested in these products, McBride points to volatility — partly behind why these funds made the top inflow list — as the same characteristic that could one day reverse the tide.

“While U.S. Treasurys are free from default risk, they are susceptible to interest rate risk — when rates rise, prices fall,” McBride says. “Even though rates are currently falling, boosting bond fund returns, investors must be mindful that a swift reversal can erase recent gains.”

McBride added that a highly anticipated short-term rate cut by the Fed would ultimately “generate less interest income over time as newer, lower-yielding bonds come into the funds, and older, higher-yielding bonds mature, or are refinanced.”

Scroll through to see the 20 fixed-income funds ranked by their estimated share class net inflows through June. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were ETNs, leveraged and institutional funds. Assets and expense ratios for each fund, as well as three-year daily returns through July 19, are also listed. The data is based on each fund's primary share class.