The 20 mutual funds with the biggest inflows of the last decade have raked in a combined $742 billion in combined assets, Morningstar Direct data show. Marc Pfeffer, CIO of CLS Investments, says there’s one glaring similarity among the leaders; their fund family.

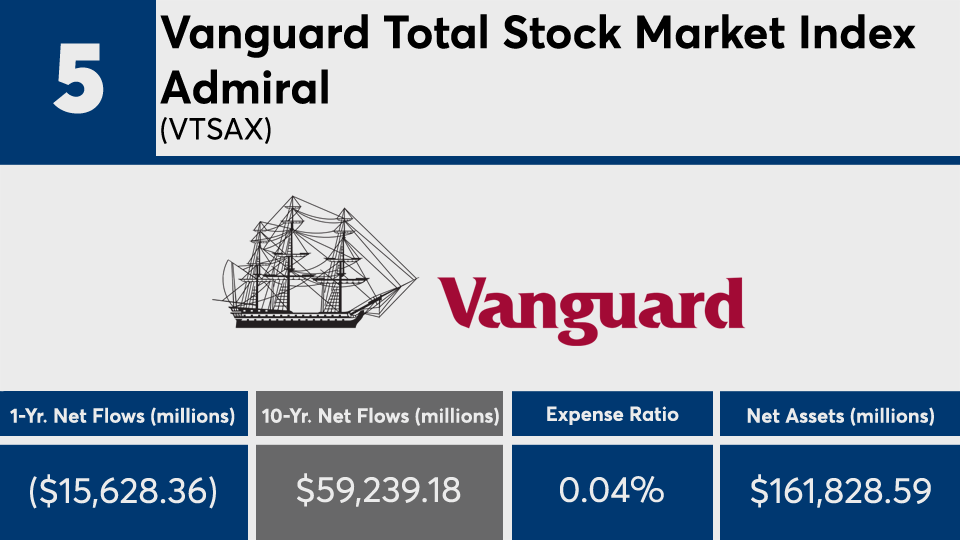

“What you're getting here is that there are many investors and advisors who have said to their clients that ‘active management hasn't worked and if you just want to beat the market, Vanguard is the best place to be,’” Pfeffer says. “That doesn't mean that you should ignore active management. I think there is still a place for [passive investing], but I don't think it should be the only strategy.”

Compared with broader markets, the lineup of largely passive stock and bond funds — 13 from Vanguard — generated an average 10-year gain of 6.65%, many of which outpacing their respective peers. Stock trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) recorded 10-year gains of 14.13% and 12.98%, respectively. In bonds, the iShares Core US Aggregate Bond ETF (AGG) generated a gain of 3.65%.

Over the last year, funds with the biggest 10-year flows had an average return of 8.87%. So far this year, SPY and DIA have returned 6.65% and recorded a loss of 0.43%, respectively, while the AGG has generated a YTD gain of 6.75%.

The largest mutual fund, the Fidelity 500 Index (FXAIX), which has $259.2 billion in assets under management and 0.015% expense ratio, has generated a 12.75% gain since it’s inception on May 4, 2011, data show. So far this year, FXAIX has returned 6.61%.

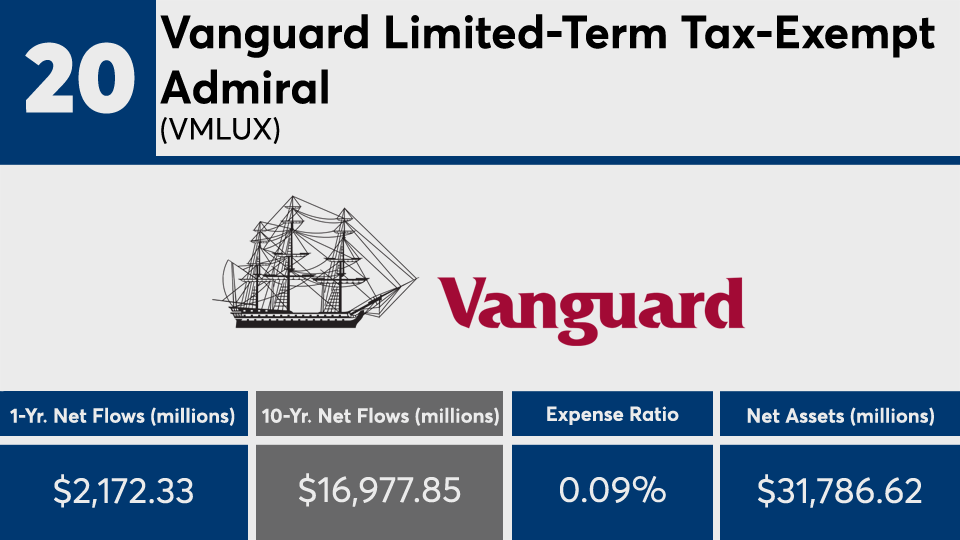

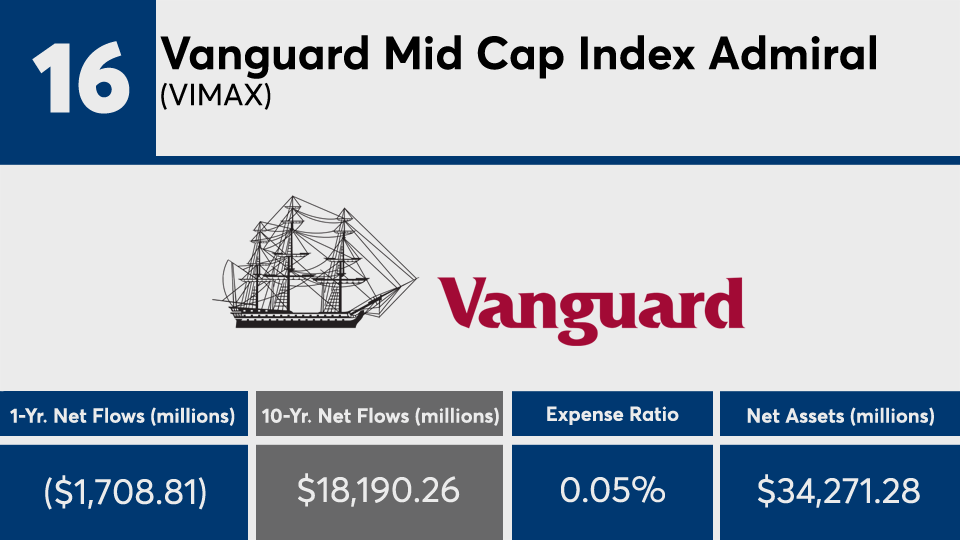

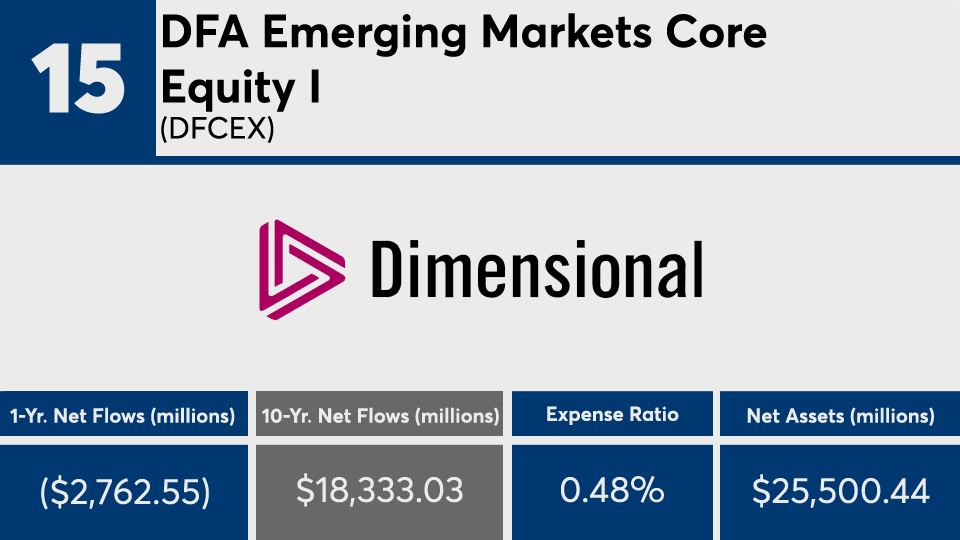

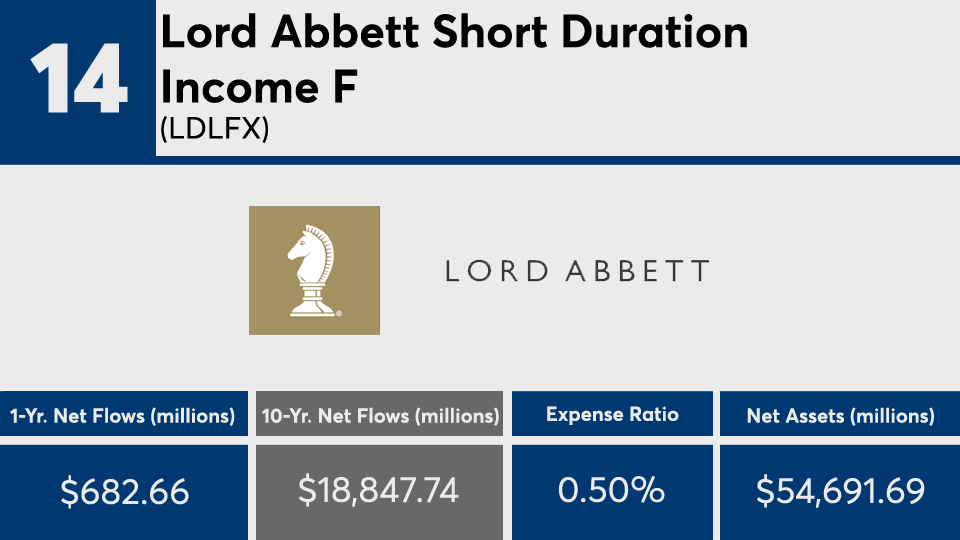

As with many passive funds, especially those from Vanguard, fees are rock bottom. With an average net expense ratio of 0.24%, these funds were almost half the 0.45% investors paid on average for fund investing overall last year, according to

“Expense ratios matter to most people, particularly when you're looking at these mostly passive funds,” Pfeffer says. “Unless you're a storied name like DoubleLine, or specific fund like Dodge and Cox Income and even one here from Lord Abbett, it just seems like Vanguard is continuing to eat everyone’s lunch.”

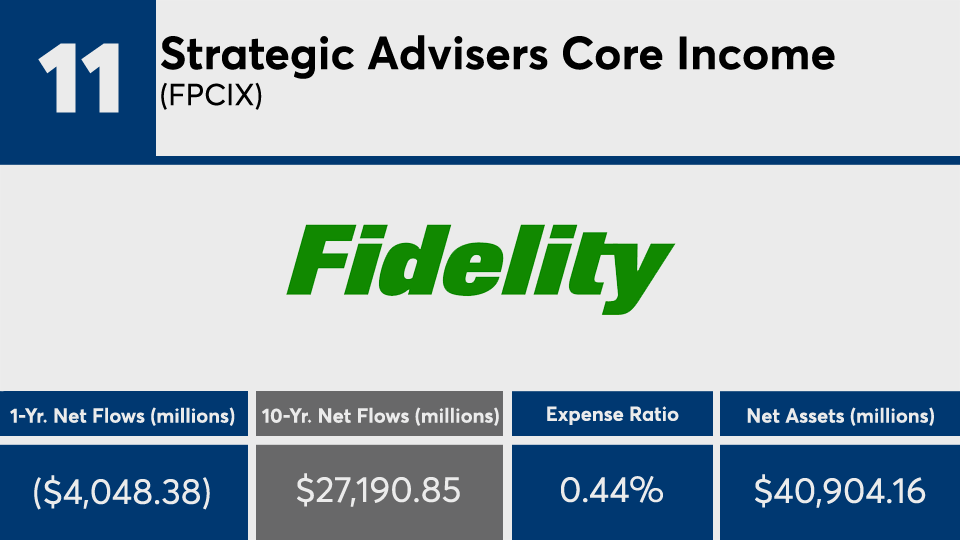

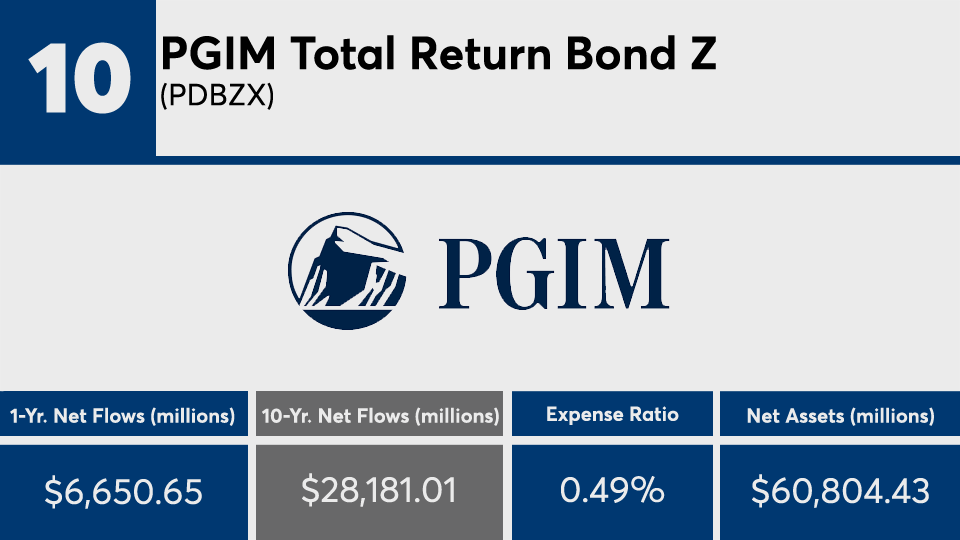

Scroll through to see the 20 mutual funds with the biggest 10-year flows through Aug 31. Funds less than $500 million in AUM and with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as YTD, one-, three-, five- and 10-year flows and returns are listed for each. Daily returns figures are as of Sept. 10. The data show each fund's primary share class. All data is from Morningstar Direct.