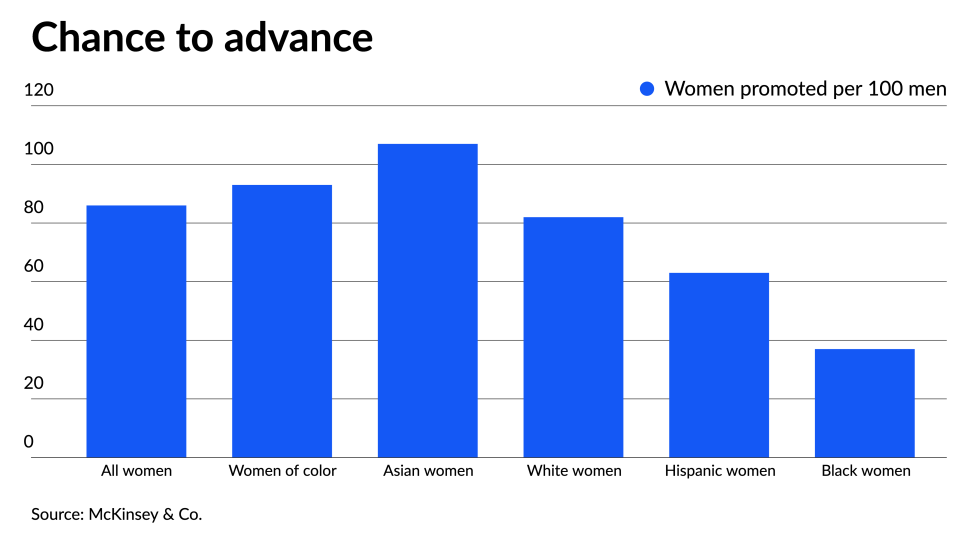

Women are still very underrepresented in leadership roles at financial services institutions, despite incremental progress in closing gender and racial gaps, according to new data from McKinsey.

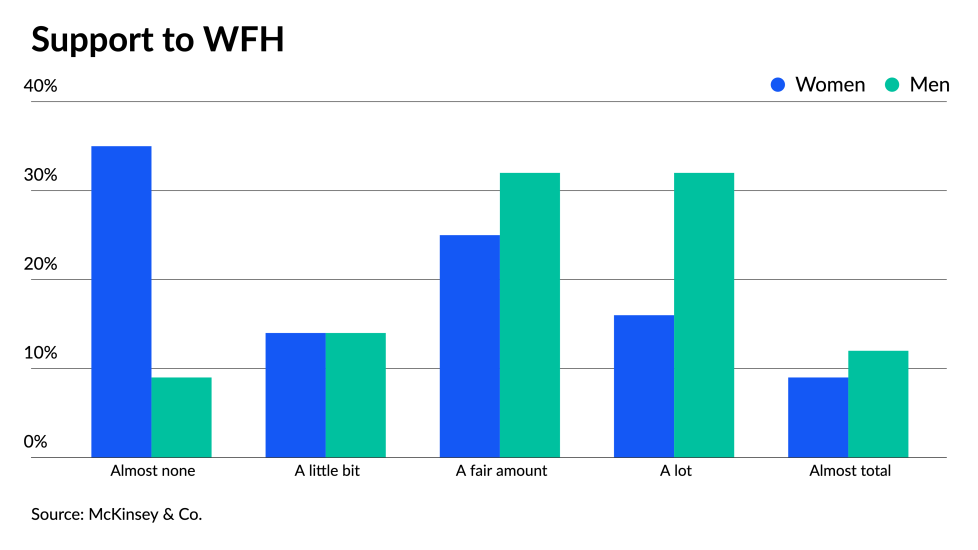

But companies have a rare opportunity right now, thanks to the pandemic’s workplace upheavals, to make changes that could permanently improve the situation for women, according to Jill Zucker, a senior partner at McKinsey, who co-authored McKinsey’s latest

“We challenge companies to not go back to the status quo, and take this chance to redefine the way we ensure diversity of thought and leadership in our ranks,” Zucker said.

Financial services companies can take concrete steps to reduce bias in hiring, performance reviews and promotions to help women and people of color break down barriers to corporate advancement, she said.

“I think organizations could reset the way we handle diversity and inclusion, race and gender issues now and we’d start to get better results,” Zucker said.

McKinsey’s data draws on information provided by 423 employers in the U.S. and Canada and a survey conducted among 65,000 people at 88 companies between May and August 2021.