Want unlimited access to top ideas and insights?

Analysis of long-term mutual fund outflows reflects an industry in flux.

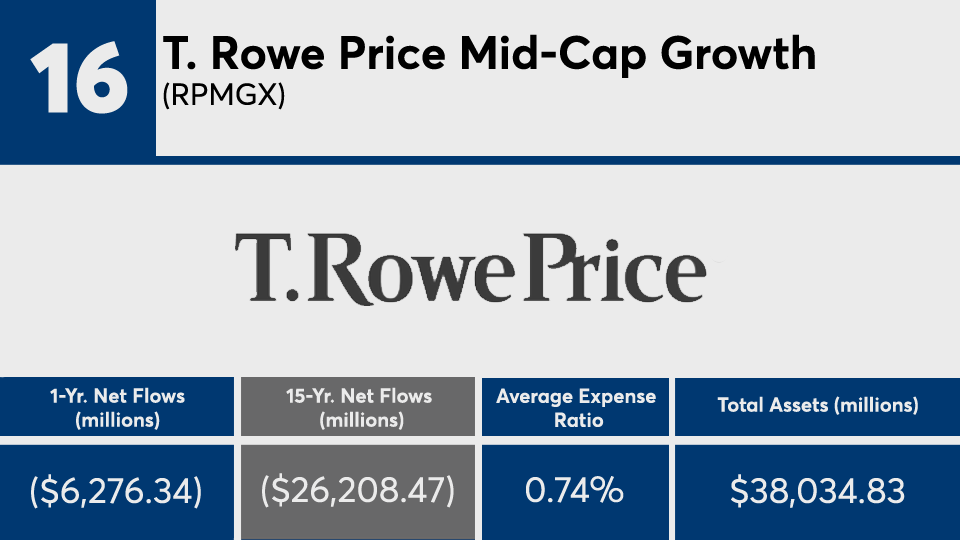

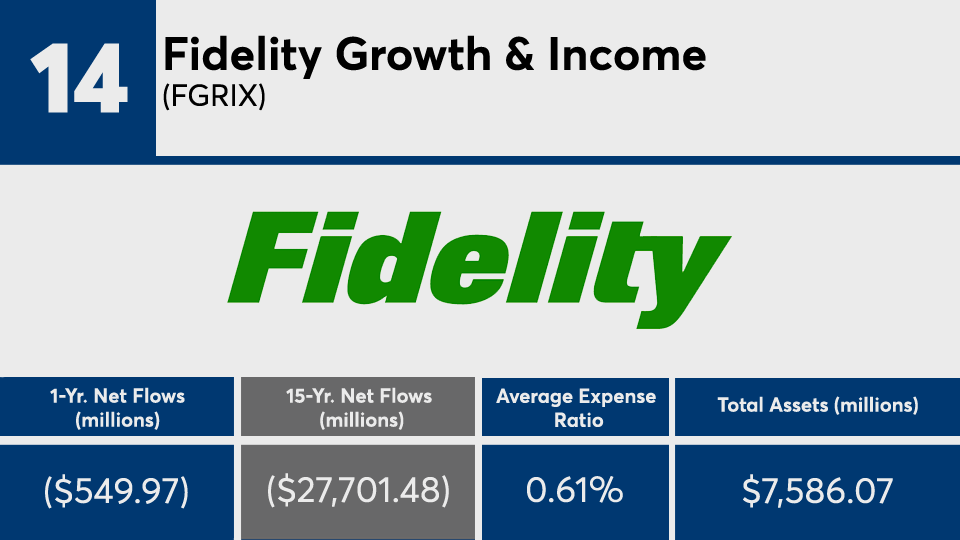

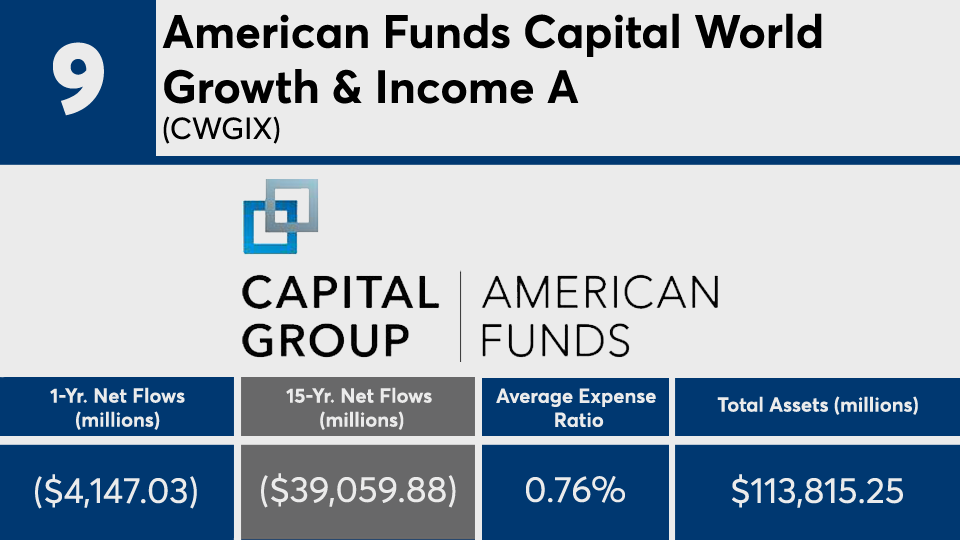

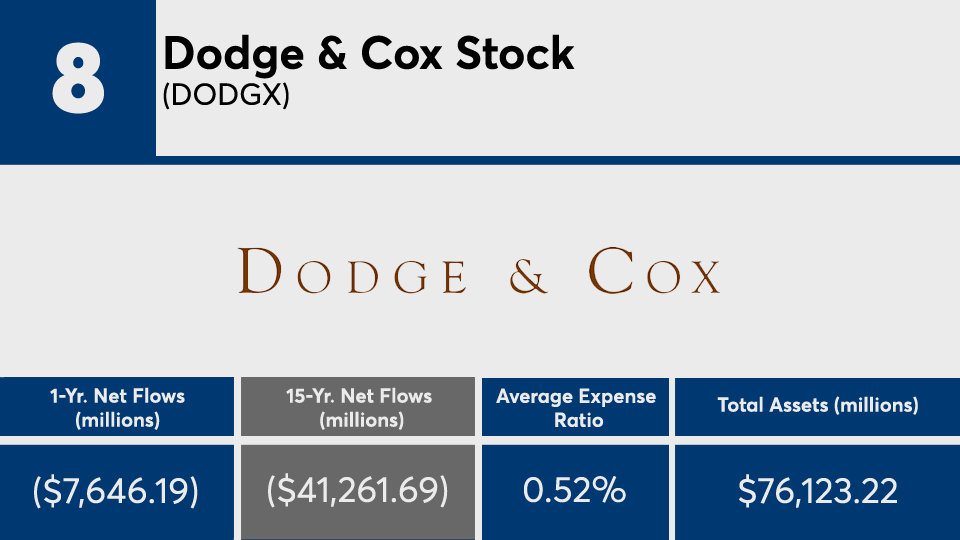

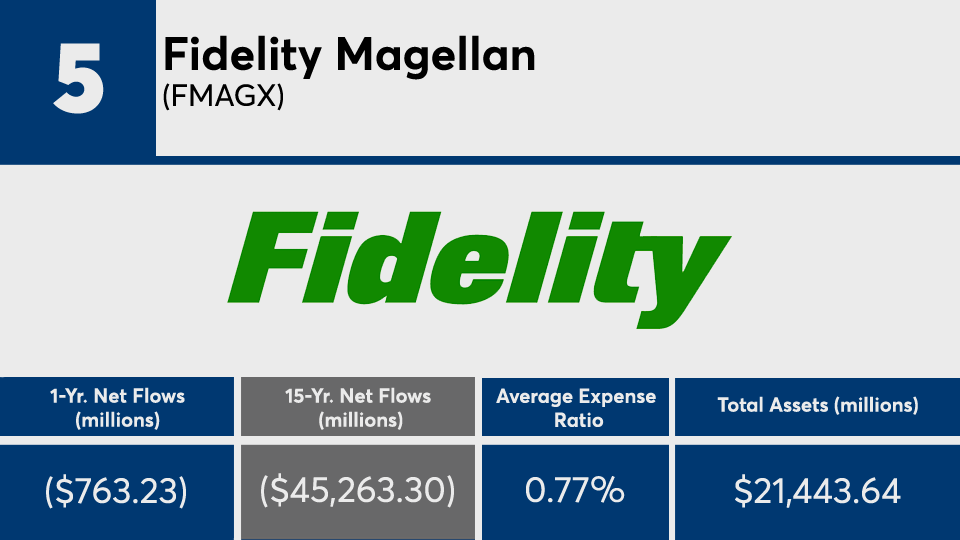

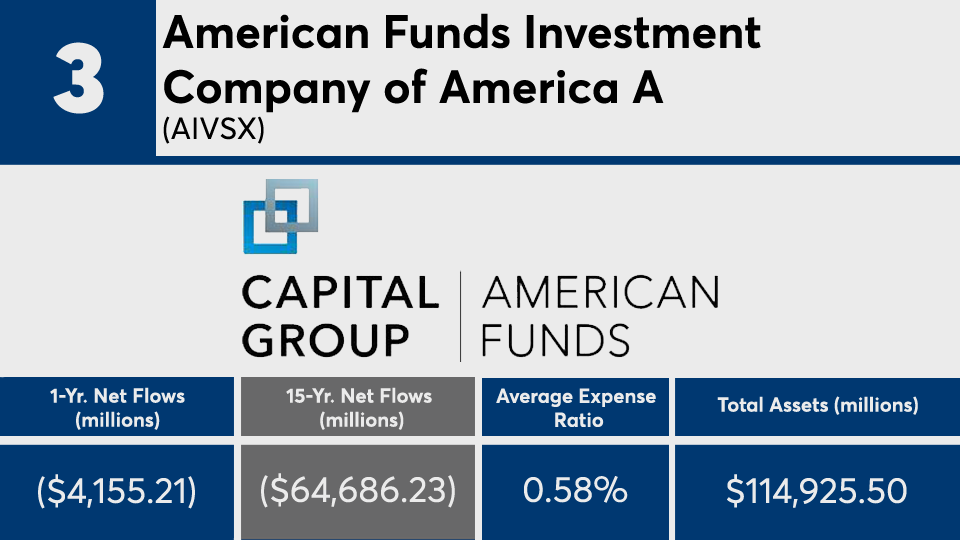

The 20 mutual funds with the biggest net outflows of the past 15 years, and at least $100 million in assets under management, shed nearly $793.4 billion over the period, Morningstar Direct data show. In the past year, the same funds lost almost $83.5 billion.

Outflows aside, the same funds had a 15-year gain of nearly 8.9%. In the past year, the same funds averaged a return of around 70.98%.

When compared with broader index trackers, ETFs such as the SPDR S&P 500 ETF Trust (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

There’s been a broad industry shift to passive and near-zero expense ratios, according to industry consultant Marc Pfeffer.

“If you threw a dart at almost anything in the last year in equities, it would be hard to find something that has been losing money,” Pfeffer says. “I just think there's been a general trend in the last 15 years to low-cost funds. All of these seem to be negative in flows on all time frames. This has been a trend that's been going on for a while and it’s been picking up speed.”

Fee analysis shows that while many mutual funds with big outflows have notched sizable gains, there is a stark contrast in overall fees from

“Even if you look at the performance on some of these funds, they're not bad. These are reputable funds,” Pfeffer says, adding, however, “if you look at their expense ratios, you don’t see anything with less than 50 basis points on here.”

Scroll through to see the 20 mutual funds, with more than $100 million in AUM, and the biggest month-end 15-year net outflows through March 1. Assets and average expense ratios, as well as year-to-date, one-, three-, five, 10- and 15-year returns through March 19 are also listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.