Among the mutual funds with the largest net flows over 15 years, Vanguard isn’t just a leader. It dominates.

Nearly all of the funds in this ranking — 16 of the top 20 — came from Vanguard. For Greg McBride, chief financial analyst at Bankrate, the reason is simple: cost.

“The list is dominated by Vanguard funds as investors and their advisors favor low cost investment options, whether looking at actively managed or passive, equity or bond,” McBride explains.

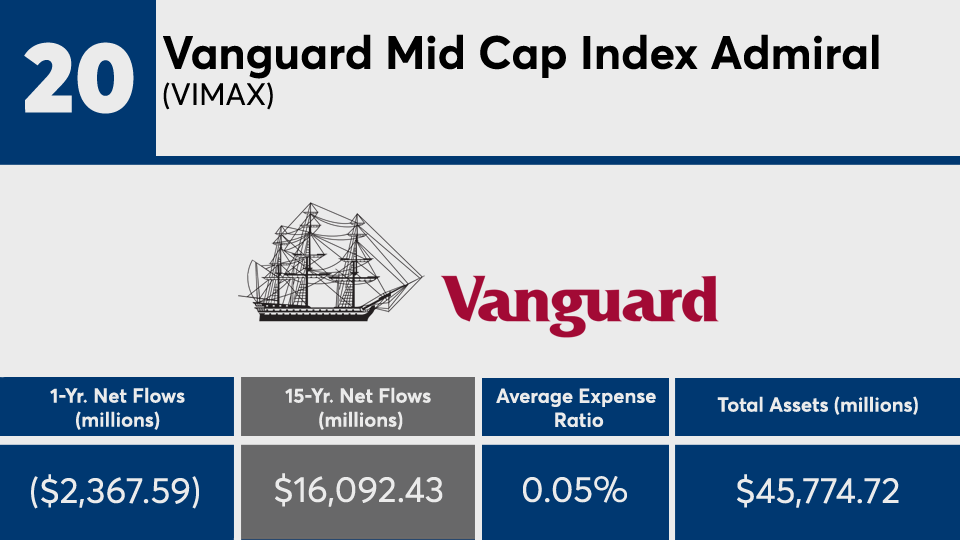

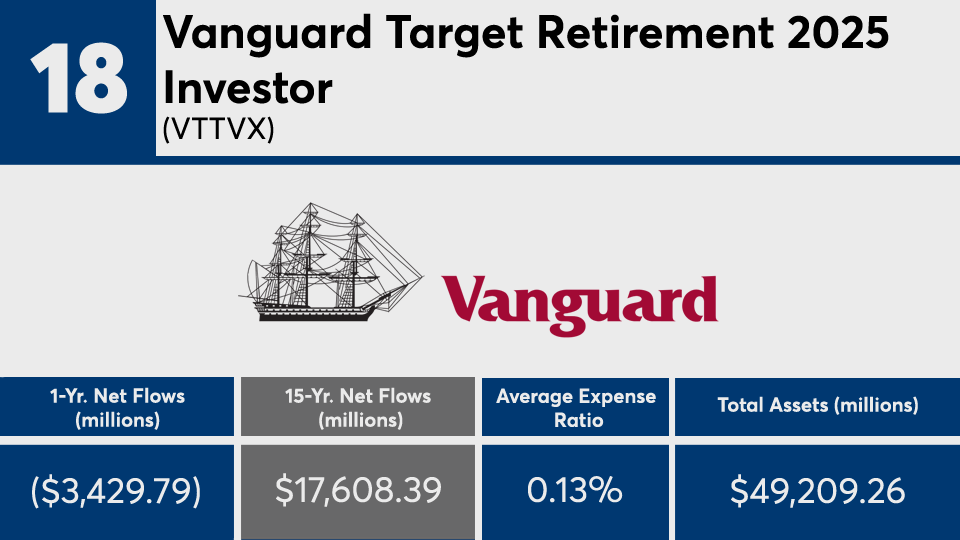

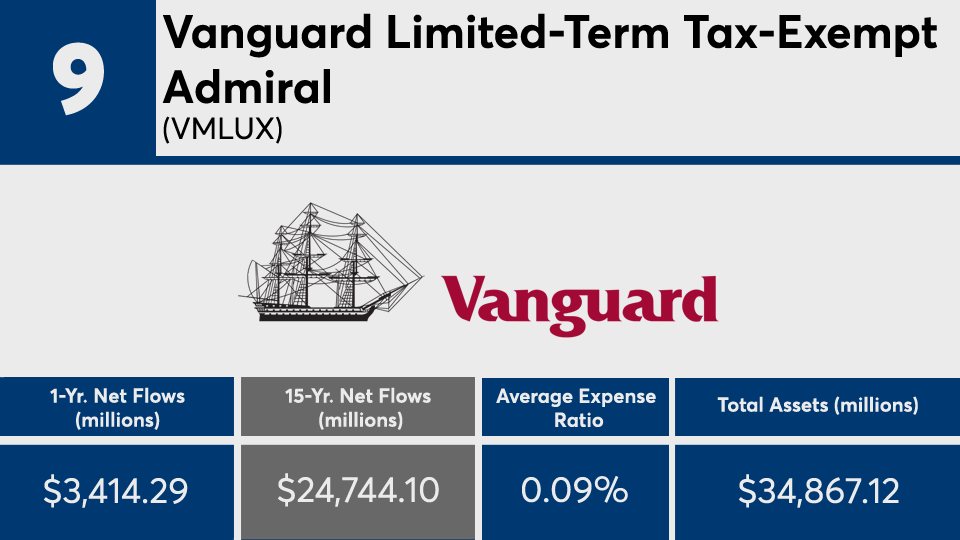

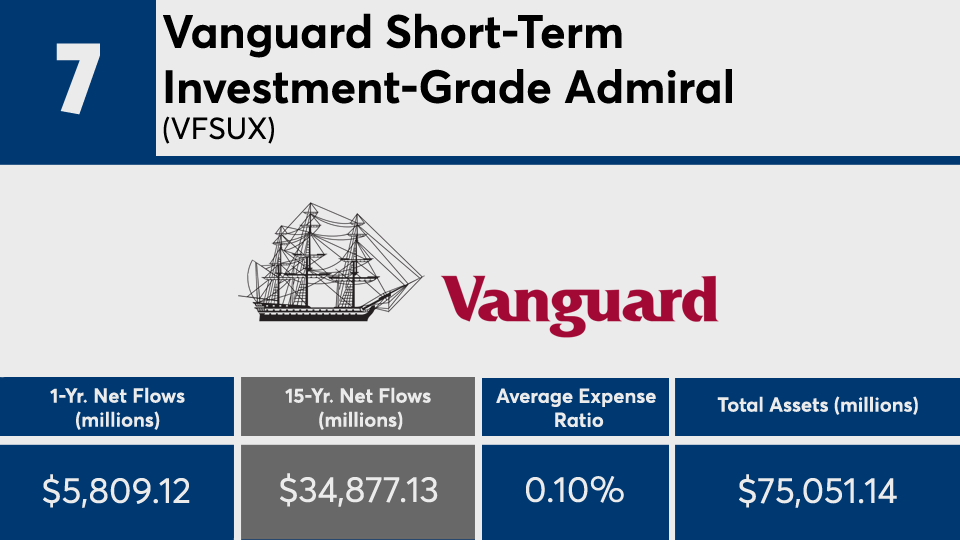

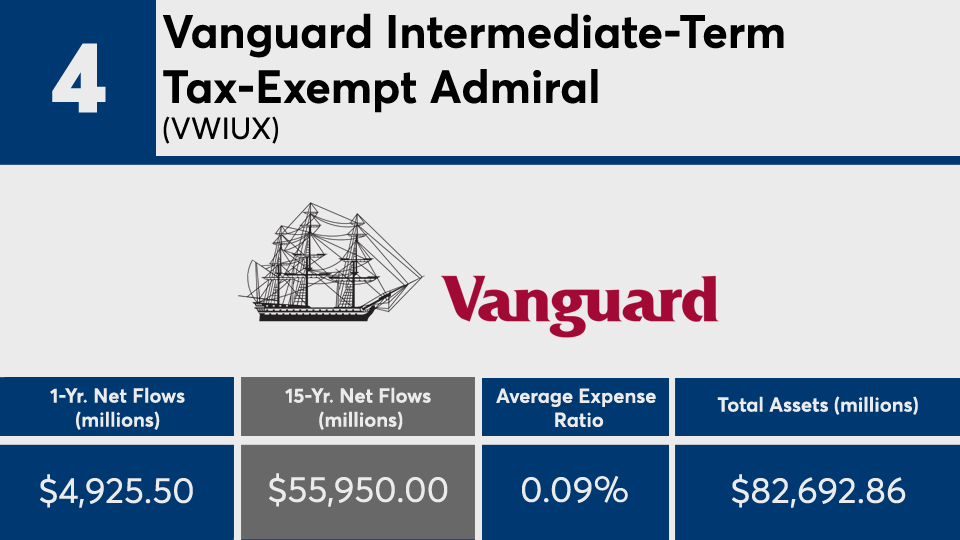

The 20 mutual funds with the largest net flows over 15 years, and with at least $100 million in assets under management, welcomed a combined $702.6 billion in client cash over the period, Morningstar Direct data show. In the last year, the same funds recorded net outflows of more than $45 billion.

For comparison,

Though many household names remain at the top of the mutual fund industry’s long-term flow leaders, analysis here paints a clear picture of investors’ growing appetite for low-cost investing, notes McBride. “The three funds with the biggest inflows over the past 15 years are all index funds, underscoring the move toward passive investing that has taken place in recent years,” McBride says.

Despite the large amount of netted cash over the period, funds here generated a 15-year return of just 6.75%. In the past year, the same funds averaged a gain of around 38%. When compared with broader index trackers, ETFs such as the SPDR S&P 500 ETF Trust (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

Pitted against the industry’s largest mutual fund, the $292.2 billion Fidelity 500 Index (

The mutual funds in this ranking carried fees no higher than 33 basis points. With an average net expense ratio of 0.17%, they were well below the 0.45% investors paid for fund investing in 2019, according to

Scroll through to see the 20 mutual funds, with more than $100 million in AUM, and the biggest month-end 15-year net flows through March 1. Assets and average expense ratios, as well as year-to-date, one-, three-, five, 10- and 15-year returns through March 15 are also listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.