-

Independent Financial’s haul includes a new affiliated RIA launched by five of the practices.

November 7 -

The firm has signed four big recruiting deals in the past three months.

November 6 -

The wirehouses have lost teams overseeing more than $12 billion in client assets over the past month, according to recent hiring announcements.

November 3 -

FINRA rejected the advisor's claims as the firm resolved two longstanding compliance issues.

November 3 -

Woodbury Financial has peeled off more than 80 advisors in the wake of LPL’s giant acquisition.

November 3 -

The Advisor Group BD has added 140 new advisors this year amid a tough recruiting fight.

November 2 -

Since investment programs are a small portion of an institution’s overall business, demonstrating the benefits to deposits and loans is instrumental in gaining support.

October 31 LPL Financial

LPL Financial -

CEO Dan Arnold said the acquisition of NPH’s assets will serve as a model for the future.

October 27 -

The practice opted for USA Financial after Jackson National sold National Planning's assets.

October 26 -

The team marks at least the second to opt for a smaller IBD over the nation’s largest.

October 19 -

IHT Wealth Management now has $2.4 billion in client assets.

October 19 -

The move marks the latest in a frenzied period one recruiter describes as “a feast.”

October 19 -

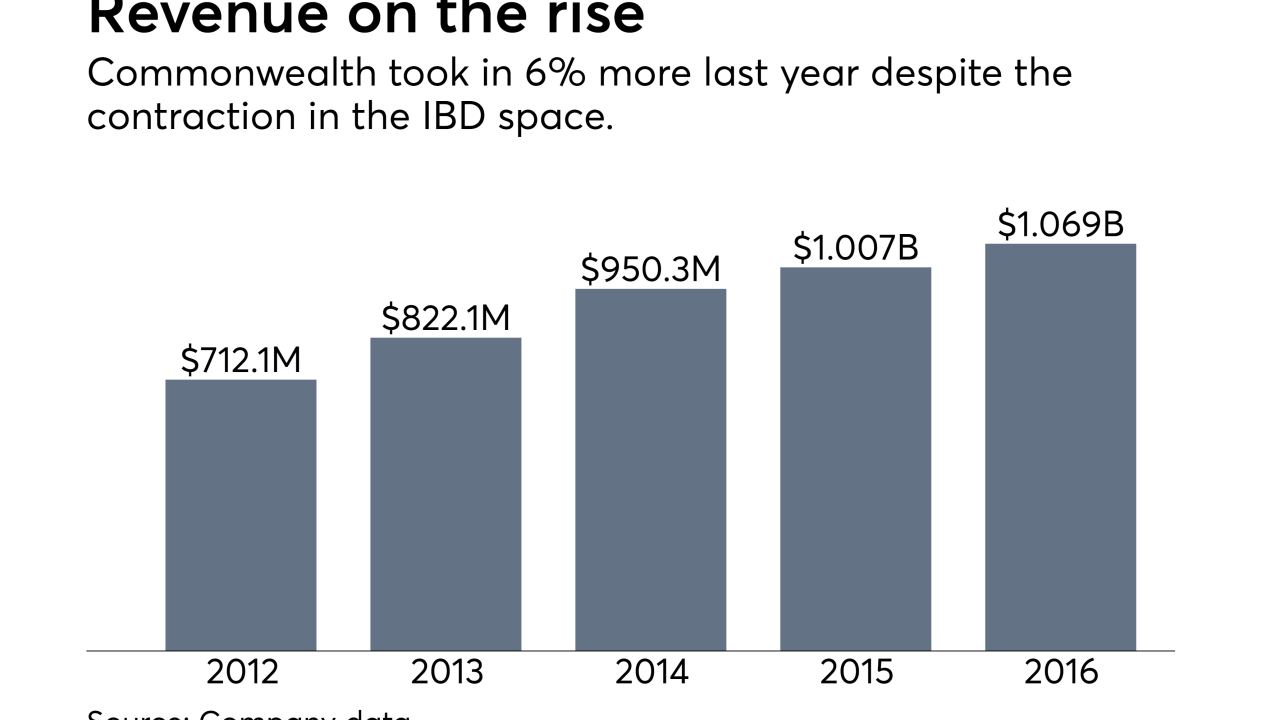

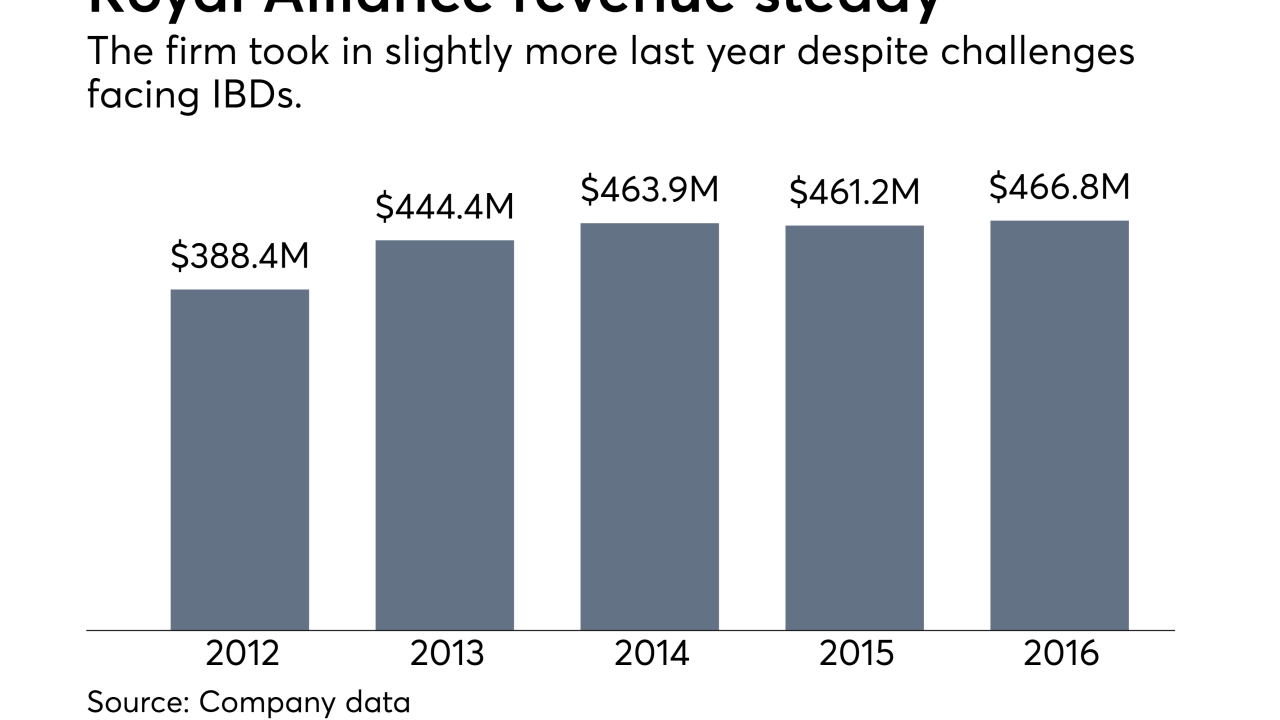

See which firms took in the most revenue last year amid an industry-wide slump.

October 13 -

As RIAs and regulations reshape the industry, the concern is real, a new Cerulli report says.

October 10 -

BNY Mellon, DST Systems and State Street are among the firms recognized for their excellence and operational achievements.

October 4 -

The BD says it has recruited 83 new reps this year as part of Advisor Group’s overall haul of 295.

September 29 -

Oct. 2: Honorees in NICSA's NOVA Awards are recognized for their attention to cost reduction and implementation of smarter technology.

September 29 -

Recent criminal charges parallel another case brought by the SEC against the broker.

September 28 -

27 firms have signed on to the standard, but state regulators and industry groups are pushing for more.

September 27 -

Eaton Vance, Morgan Stanley and Putnam executives want to learn how new technology can be leveraged.

September 27