-

The GENIUS and Clarity Acts and SEC guidance on custody clear a path for advisors recommending digital asset strategies, albeit with expanded diligence protocols.

December 19 Gemini

Gemini -

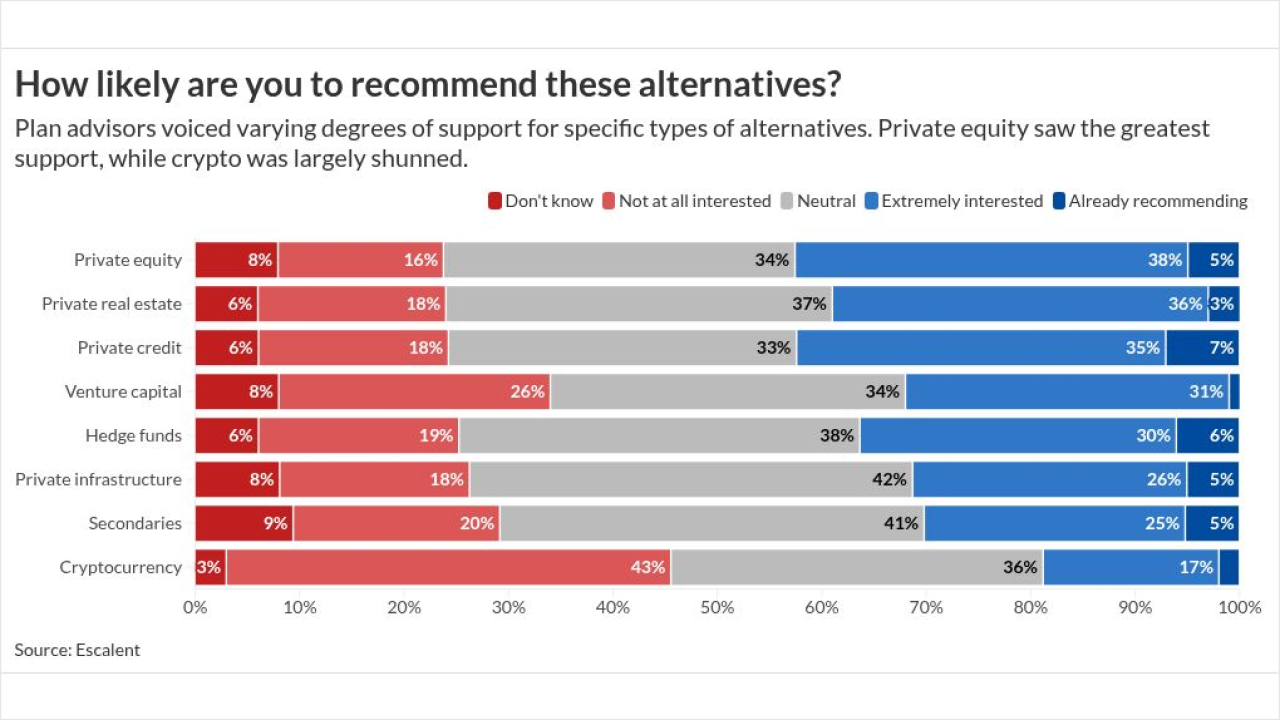

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

Also, DayMark Wealth Partners sells a minority stake to Constellation Wealth Capital.

December 18 -

FINRA identifies new ways firms and investors are using technology like AI to spot changes in market sentiment and asks the industry to chime in on how finfluencers and others are using social media.

December 17 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

The broker-dealer veteran saw her firm's revenue model as a fair trade — even a badge of honor — before going independent.

December 17 The Erskine Group

The Erskine Group -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

An industry lawyer warns that RIAs often don't do enough to delineate their responsibilities and shield themselves from liability when they add tax preparation to their service offerings.

December 16 -

From crypto to private markets to AI and beyond, here are the investing trends and themes to watch in the new year.

December 16