In the latest demonstration of the secular shift reshaping wealth management, RIAs are growing twice as fast as the S&P 500 and the U.S. economy.

Regulatory assets under management at a record 12,993 firms registered with the SEC have expanded by a compound annual growth rate of 8.2% to $83.7 trillion since 2001, according to an annual Investment Adviser Association and National Regulatory Services study

Every kind of firm that had filed an SEC Form ADV when the advocacy group and compliance consultancy compiled the data in April is counted in the AUM. The figures span sole practitioners, affiliates of broker-dealers, asset managers, private funds and other formal RIAs.

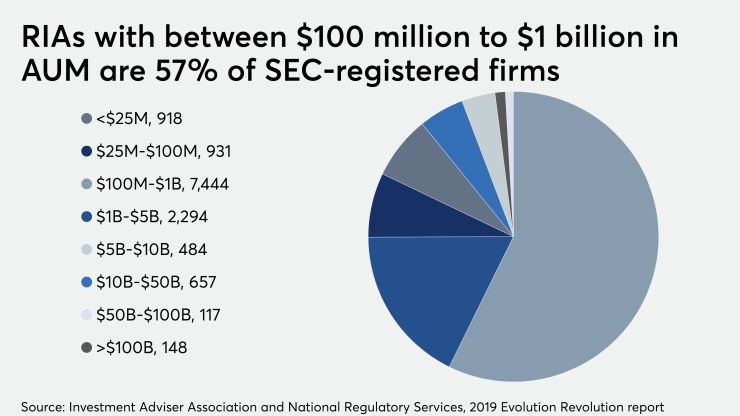

RIAs with at least $100 billion in AUM manage 60% of total advisory AUM or $49.9 trillion — even though they comprise just 1.1% of firms. RIAs with between $100 million and $1 billion in AUM make up 57% of firms but have only $2.5 trillion in AUM, or 3% of the total.

Still, equity trading and aspects of asset management and custody are turning increasingly commoditized, while advice isn’t, according to analyst Devin Ryan of JMP Securities. Fee compression and cyclical pressures haven’t altered Ryan’s bullish outlook on RIAs.

The number of RIAs could tumble in future years if consolidation in other parts of the industry is any indication. But, despite all of the ways the big firms are getting bigger, at least 88% of SEC-registered RIAs employ 50 or fewer people, NRS and IAA point out in the study.

“It’s clear that investors are turning to fiduciaries for ongoing advice and investment management,” says Karen Barr, CEO of IAA. “Investment advisors are transforming to meet this demand.”

The number of RIA clients has soared 85% over the past eight years to 43 million, according to the annual “evolution revolution” study. Clients receiving only one-time financial plans and certain other non-discretionary services has more than doubled in the past year to 7.3 million.

While not contributing to AUM figures, the notable rise in one-time plans and other non-managed account services helped boost the RIA client base by 9 million year-over-year. Digital advice platforms like robo advisors have been a factor in the growth, says NRS President John Gebauer.

“It's been a great way to get larger numbers of clients into the ecosystem,” Gebauer says. He notes that, as such clients gather more investable assets, the question is, “Will they naturally move to less digital and more personal [advice]? And I think that's likely.”

Technological capabilities figure in the consolidation of assets to the four largest custodians — Charles Schwab, Fidelity Clearing & Custody Solutions, TD Ameritrade and Pershing, Ryan noted in an industry

JMP is bullish on firms providing tech and other infrastructure to advisors, especially fee-only RIAs. Pressure on revenue from cyclical factors like falling equity values or interest rates won’t hurt advice, which has “less commoditization risk” than other financial services, Ryan says.

BDs, custodians and other vendors are putting “the focus on the advisor and providing the appropriate platform for them with technology, product, service and also fees,” he says. “Firms have been more competitive and aggressive around compensation and fees for advisors.”

Consolidation is also reducing the number of BDs each year, with the count falling by 16% to 3,607 FINRA-registered firms over the past eight years, according to the IAA and NRS study. In that span, the amount of RIAs of all types has surged 24% to nearly 13,000.

Fee compression amid growing tech and compliance expenses have been prompting BDs or parent firms to sell to larger players, who are adjusting to the RIA movement by migrating brokerage assets to advisory accounts and supporting more dually registered representatives.

Counts of registered reps show the industry’s flux even though they extend to a wider group than the number of client-facing advisors. The number of RIA employees who are dually registered with BDs has climbed 4% year-over-year to 399,013, and the amount who are investment advisory representatives in more than one state is up 6% to 312,471.

Total employment at RIAs also keeps spreading their footprint across the country, with a 16% increase over the past five years to 835,124 non-clerical staff members. The largest 116 firms employ 53% of the staff, according to IAA and NRS.

The RIAs with more than $100 billion in AUM collectively boosted it by 2.2% year-over-year — compared to a 3.7% gain by those with under $1 billion. The fact that the smallest tier of firms took in the largest rise displays the “great opportunities” for entrepreneurs, Gebauer says.

People often forget that RIAs are a “small-business industry,” according to Barr, noting another factor working in their favor that is also shared by the larger firms.

“Fundamentally, all of these firms are managing other people's money as fiduciaries,” Barr says, “and that is a core, common thread that ties all of these firms together.”

Ryan’s report cites other studies that have

“Advisors are going to have to do more because there are going to be growing assets over time,” Ryan says. “Each advisor will be managing more assets and more customers.”