With wealth managers consolidating at record pace, the largest network of independent broker-dealers selected an executive with experience in transitions to lead one of its firms.

Advisor Group promoted Jeff Sills, a senior vice president of business and field development with Woodbury Financial Services, to be CEO of another of the six firms in its private equity-backed network, Atlanta-based FSC Securities. Effective

With about 700 financial advisors and $35 billion in client assets, FSC is operating in the competitive IBD landscape as a midsize firm that acts as the crucial shared back office for Advisor Group and gets the benefits of scale from a larger parent than many comparable rivals. Technology and compliance expenses for BDs with increasingly demanding expectations among advisors and clients have prompted many wealth managers and their owners to spin off their companies and leave the industry in recent years. For example, Sills’ prior firm, Capital One Investing, folded its more than

“Advisor Group has been very clear since I've been here that they empower the individual firms to deliver their best particular support to advisors,” Sills said in an interview. “It was a very comfortable fit within Advisor Group. Every one of them does business a little bit differently and appeals to a different type of advisor.”

Sills will take over the role after playing a pivotal one as part of Advisor Group’s focus on what Executive Vice President of Advisor Engagement Erinn Ford described as the “segmentation” of the network’s more than 10,000 advisors into groups of similarly sized practices and enterprises in order to tailor the firm’s services, Ford said. He had been leading the firm’s programming for ensemble practices, those with a single advisor and multiple, often specialized support staff.

“If we think about ensembles, they would like to interact and be in study groups with like-minded professionals,” Ford said. “We can help deliver a lot of value by really opening up the whole ecosystem of our advisors.”

While very few wealth managers are as large as Phoenix-based Advisor Group, with its more than $3 billion in annual revenue, competitors are taking a similar approach in offering ranges of services and resources to advisors through families of firms.

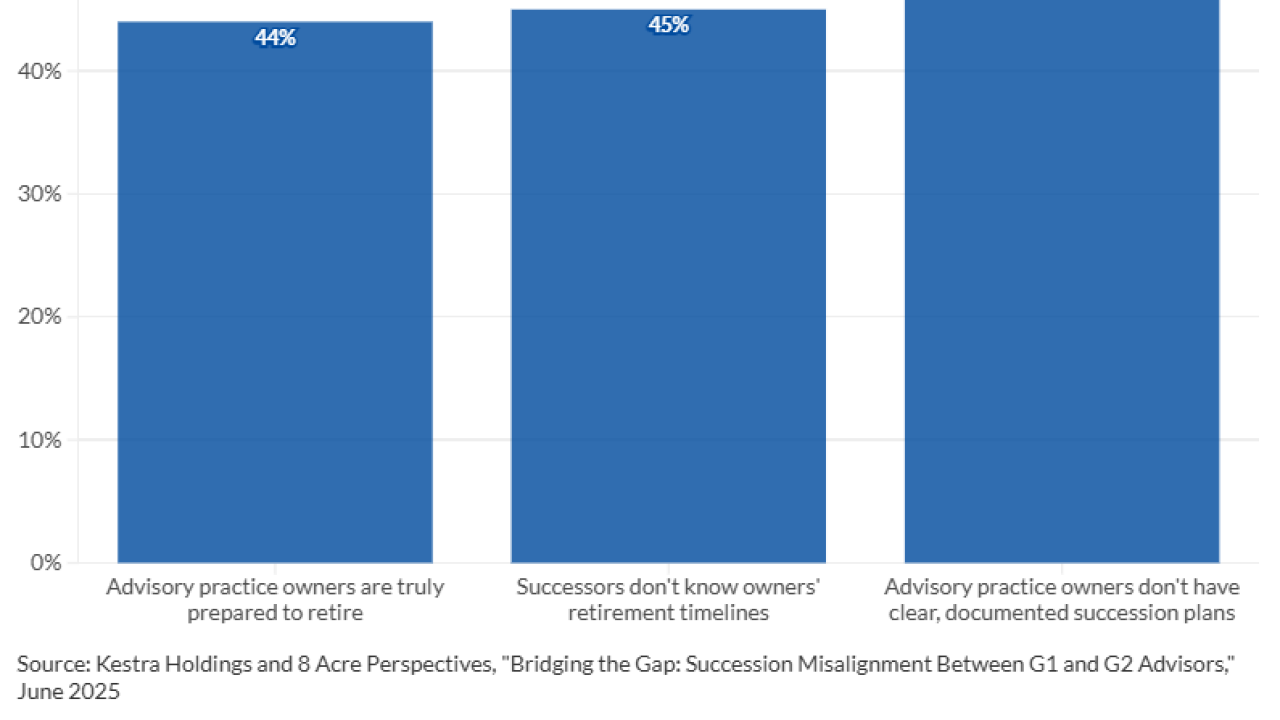

Parsippany, New Jersey-based Summit Financial dropped its legacy broker-dealer in 2019 to use Purshe Kaplan Sterling Investments as its main trade executor, but it has six companies under its umbrella for asset management, planning, insurance, tech, finance and other services for advisors, according to CEO Stan Gregor. The IBD industry “is different now than it was even 10 years ago,” he said, noting that independent practices have more challenges around pricing, capital and succession in addition to tech and compliance.

“It all falls back on you as the advisor, and that's not fair, and that's very difficult,” Gregor said. “If you're an IBD, if you can't make money on commissions or $5.95 doesnt exactly cut it, it gets old pretty quick. It's a difficult business to be in for a shrinking percentage of an advisor's revenue.”

Indeed, firms like Advisor Group that have ready capital from its backers in Reverence Capital Partners and the reach of multiple giant wealth managers are gobbling up the small and midsize firms. Advisor Group grew significantly last year when it

This year, the firm hasn’t made any deals of a similar size. However, it boosted net new assets to surpass $1 billion in a single month for

Sills’ first goal atop FSC is to “sit down and talk to advisors” in order to “identify opportunities for them” in how best to expand their practices, find greater efficiencies and better support them with the company’s resources, he said. He and Burke will work together over the next several weeks to carry out the CEO transition.

“Time and again during his tenure as a senior executive with Woodbury, Jeff has demonstrated an unwavering commitment to serving financial advisors,” Greg Cornick, Advisor Group’s president of advice and wealth management, said in a statement. “He has established strong relationships across Advisor Group, with first-hand knowledge of the systems, solutions and opportunities ahead.”