There was $2.034 trillion invested in 1,847 exchange-traded funds as of the end of January, according to Morningstar.

That makes it difficult to pick the right funds. And what about smart beta?

One rule of thumb that I embrace is that bigger and broader is almost always better because not only are bigger ETFs typically more liquid, they are better constructed as well.

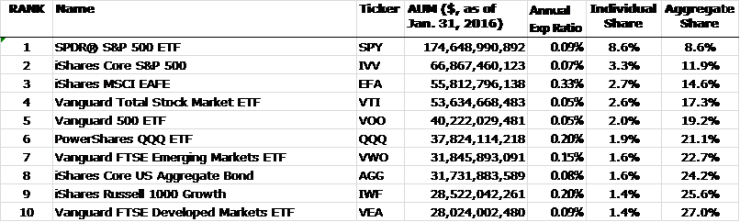

The largest 100 ETFs have attracted nearly 75% of the assets, and the largest 10 alone have 27% of all ETF assets, according to Ben Johnson, Morningstar’s director of global ETF research.

All these funds have four things in common: They have low expense ratios averaging 0.13% annually; they are broad, owning large parts or sometimes even the whole market; they are all market capitalization-weighted; and there are no “hot” performers.

Note that none of these funds are so called smart-beta funds. Smart beta was on fire a few years ago but has cooled off quite a bit now that the

Those who thought smart beta was a free lunch ignored the research of Eugene Fama and Kenneth French at the University of Chicago Booth School of Business and Dartmouth College’s Tuck School of Business, respectively, noting that extra return was compensation for taking on more risk.

The professors also stated that risk isn’t just measured in terms of standard deviation.

None of the broad funds made the

Johnson said, “Bet on broad low-cost, broad exposures.”

ETFs give a very low cost and tax-efficient exposure to markets. This is known as beta.

But trying to outsmart the market has become an ever popular use of ETFs, and this isn’t a good thing. We now have levered inverse ETFs that don’t seem to have anything to do with indexing.

Low cost active is far superior to ETFs trying to outsmart the market.

Not only do the narrow funds tend to be expensive and underperforming, both advisors and individual investors tend to buy them when they are hot and dump them when they aren’t, leading to investor performance significantly lagging the funds themselves.

So never forget to stick to big, broad and boring ETFs with ultra-low fees. Hot funds can quickly turn frigid.

Although smart beta is a viable active strategy, never confuse it with indexing or a free lunch.

This story is part of a 30-30 series on Smart Strategies for RIAs