FINRA’s bottom line took a hit last year, yet the CEO of the brokerage industry’s self-regulator took home nearly double the pay he did the year before.

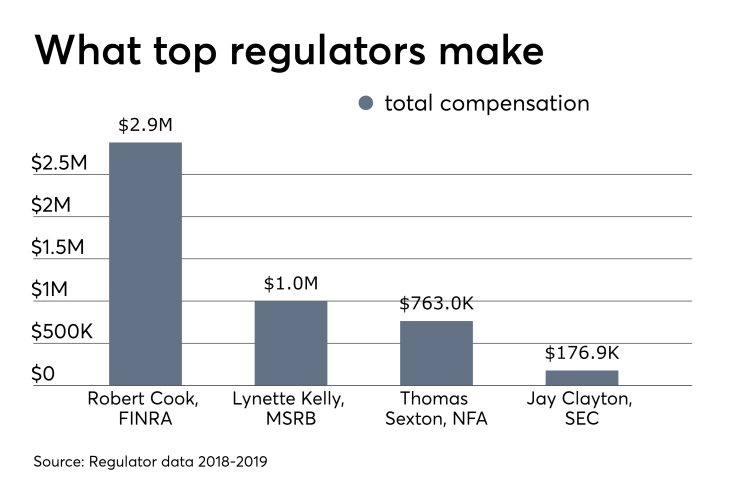

Robert Cook’s total compensation in 2018 jumped to $2.9 million from $1.5 million for the prior year, according to FINRA’s annual report.

FINRA, meanwhile, reported a net loss of $68.7 million despite higher revenue and cost-cutting measures. The regulator blamed the loss — net income fell by over $110 million from the year-ago period — on operating losses, low returns in its externally managed portfolio and other expenses.

Cook’s boost in salary was largely due to his accepting incentive compensation he had qualified for — but refused — the year prior. He has served as CEO of FINRA since 2016. Prior to that he held positions at law firm Cleary Gottlieb and the SEC.

By contrast, Lynette Kelly, CEO of the Municipal Securities Rulemaking Board, took home a little over $1 million in total compensation in fiscal year 2017-18, according to the regulator’s latest

Of the other 10 senior executives at FINRA, six saw their salaries fall, while the remaining three were either promoted or hired in 2018.

FINRA’s annual report states that Cook elected to contribute $675,000 of his 2017 incentive compensation, and $150,000 in 2018, to the FINRA Investor Education Foundation. A FINRA spokesman declined to provide further comment on questions relating to Cook’s salary.

FINRA anticipates another net loss this year, projecting expenses that “will again exceed our operating revenues in 2019,” according to a statement from Cook in the annual report.

Indeed, the shortfall may reach $186 million this year, according to FINRA’s

“If [trading] volumes don’t return, or we do not receive positive returns in the investment portfolio, this could be happening again. It could be recurring in nature,” Diganci said of the projected 2019 income loss, adding that he was confident it would be resolved in later years, based on time available to improve efficiencies. “My sense is that somehow between expenses, volumes and pricing, we’ll be able to solve this,” he said.

FINRA does not use fines for its operational budget, according to its

The SRO will not increase member fees in 2019, marking the sixth consecutive year it has declined to do so, according to its

FINRA will continue to use reserves to fund regulatory operations; “while drawing down our reserves may result in net losses, this measure is part of a longer-term plan to reduce reserves before increasing member firm fees,” Cook stated in the organization’s annual report, adding that member fees will rise once the reserves fall below a certain threshold. A FINRA spokesman declined to provide what that exact level would be.

-

The regulator and one of its largest members, LPL Financial, engaged in a back-and-forth on the controversial initiative.

May 16 -

The presidential hopeful ups the pressure on FINRA and lays down another plank in a platform seen as hostile to Wall Street.

April 1 -

A Financial Action Task Force note on digital asset oversight is “one of the biggest threats to crypto today,” a research executive said.

June 12

Diganci said in the podcast that the decision to raise member fees would be a combination of operating efficiently and the reserve depleting enough to no longer cover expenditures.

While trading volume can be erratic, positive returns in FINRA’s externally managed portfolio could help cushion cash flow losses and defer member firm fee increases.

The self-regulatory organization has held its own portfolio since 2004, according to the

In 2018, the markets didn’t work in the regulator’s favor. FINRA reported a 2.3% loss from its investments, according to the regulator’s annual report, which said the loss was “modest relative to broader equity market declines.” In 2017, FINRA benefited from 8.8% returns.

FINRA doesn’t plan on portfolio gains or losses as source of revenue to fund operations, Diganci said.

In a bid to lower operating expenses, FINRA will reduce its square footage in New York by 25% and plans to expand its regional offices in Long Island and Woodbridge, New Jersey, according to Diganci. The regulator will continue to “have a footprint in lower Manhattan where we are today,” he said.

Last year, FINRA expelled 16 member firms in addition to suspending 472 and barring 386 brokers from the industry. The regulator levied $61 million in fines — a $3.9 million decrease from 2017 — and gave back $25.5 million to investors.

FINRA employs 3,400 workers — about 100 fewer than it did last year, according to the annual report.