The

The cost of health care has risen at a pace that far outpaces inflation and health care needs typically increase as individuals age, so it’s no surprise that such expenses would be a major concern. In fact, according to a

Though not all-encompassing, the most effective way of mitigating large health care expenses is through insurance. To that end, over 90% of Americans have

But if employer-based health care is so critical to so many individuals’ well-being, what happens when the coverage disappears? If coverage is available via a spouse, the sting may not even register. But for other retirees — whether by choice or by misfortune — when employer-provided health care terminates and no spousal coverage is available, other options must be explored.

THE LOGICAL CHOICE

For those who go until at least age 65 before retiring, health insurance is usually not much of an issue at all. That’s because once an individual reaches 65, they are generally eligible for Medicare.

Aside from the basis of age, an individual qualifies for Medicare if they or their spouse have worked and paid Medicare taxes for at least 10 years. Medicare is also available for certain younger disabled persons and those with permanent kidney failure, regardless of age.

For those who qualify on the basis of age, a seven-month initial enrollment period begins at the start of the month three months prior to the month in which they turn 65, and ends at the end of the month three months after the month they turn 65.

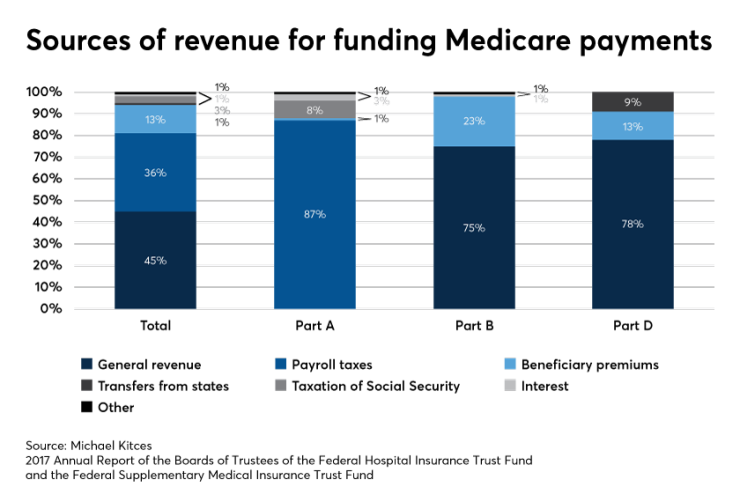

Reaching Medicare-eligibility age is a key milestone because the program provides extremely affordable health care coverage, thanks in large part to premium sharing with the Federal government. This is achieved via the Medicare taxes deducted from workers’ wages and/or self-employment income, which cover anywhere from 77% to 99% of the actual costs.

Traditional Medicare comes in three parts: Part A, Part B and Part D, each of which have separate premiums.

Part A, commonly known as hospital insurance, covers expenses such as inpatient hospital visits, hospice and care provided in skilled nursing facilities for a limited amount of time. Notably, the cost of this insurance is generally borne 100% by Uncle Sam, and is free for enrolled individuals.

Medicare Part B, or medical insurance, covers outpatient, preventative and most doctor services. Though not free, premium sharing helps keep costs down. For instance, most Medicare Part B participants

Finally, Medicare Part D, or prescription drug coverage, varies in cost depending on the specific plan selected, but

The typical retiree with an average Part D plan has a total monthly Medicare cost of just $168, comprised of a $135.50 Part B premium and a $32.50 average Part D premium. It’s worth noting that this is just the cost of the Medicare insurance premiums. Other costs such as deductibles and coinsurance may apply when care is received, if not covered by another insurance policy. Fortunately these costs are relatively stable, averaging just slightly more than

HIGHER INCOMES

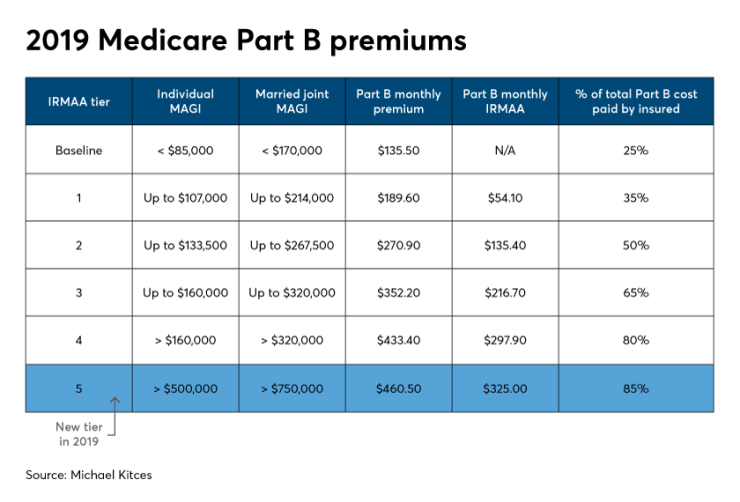

Regardless of a retiree’s annual income, the cost of Medicare Part A generally is fully absorbed by the Federal government. That said, the cost for both Medicare Part B and Part D increases as the premium sharing provided by the Federal government is reduced, and as a retiree’s income exceeds certain threshold amounts. The additional premium amount that a Medicare participant must pay as a result of their income is the aforementioned

In 2019 the Part B and D IRMAA begins to kick in once a single filer’s modified AGI exceeds $85,000, and twice that amount, $170,000, for joint filers. At the first IRMAA tier, a Medicare Part B participant’s premium will be increased by only $54.10 per month per person. By contrast, as the chart below shows, retirees with the highest incomes have an IRMAA of $325 per month per person, which is equal to 85% of the actual Medicare Part B premium cost in 2019.

Thus, when combined with the base premium, those retirees with the highest income have a total Medicare Part B monthly cost of $460.50.

Like Part B, high-income Part D participants are subject to an IRMAA. As illustrated by the chart below, the lowest IRMAA tier for 2019 adds $12.40 per month per person to the base cost of a high-income individual’s Part D plan. On the other hand, those at the highest end of the income spectrum must add $77.40 per month per person to the cost of their selected Part D drug plan.

With a $168 monthly all-in Medicare premium, the average retiree has a strong claim to having the best deal in town when it comes to health insurance coverage. And while the IRMAA can significantly increase the cost of coverage for a high-income participant, when viewed in the proper context, even those with the highest incomes fair pretty well under Medicare. After all, Uncle Sam is still picking up all the cost for Part A and at least some of the cost for Part B and Part D.

Consider for instance that for the same Part A, Part B and average Part D coverage noted above, individuals with the highest income will have a monthly Medicare bill of $570.40 ($135.50 Part B Base premium + $325.00 maximum Part B IRMAA + $32.50 average Part D premium + $77.40 maximum Part D IRMAAa).

Sure, that $570.40 monthly amount is more than the $135.50 amount that would be paid by most Medicare beneficiaries for the same coverage, but it’s still much less than the

ROBUST AND ACCEPTED

While premiums matter, they are far from the only factor to consider when evaluating health coverage strategies. It’s critical to evaluate what expenses are covered by a policy, and what additional expenses — i.e., coinsurance, deductibles, etc. — will be borne by a participant when seeking care. Compared to other types of policies, Medicare tends to shine in these areas, especially when paired with an effective Medigap Medicare supplement policy.

While adding a Medigap Plan F might produce another $300 – $400 per month of total health insurance costs, it can virtually eliminate any additional costs for health services covered under Medicare, as such plans cover virtually all of the copay, coinsurance and other out-of-pocket obligations. Even with this additional cost, the total annual premium outlay for the highest-income Medicare participants would still be less than the cost of an average Silver plan policy for a 64-year-old.

Medicare is also widely accepted by doctors. In fact, more than 90% of non-pediatric primary care physicians

Alternatively, some retirees may wish to opt out of traditional Medicare and instead enroll in Medicare Part C, more commonly known as Medicare Advantage plans. Such plans are offered through private insurers and often provide

COBRA FOR GAPS

The

When an individual retires from an employer with more than 20 employees — though exceptions apply for Federal government employees and certain religious organizations — the employer is required to offer the employee, as well as their spouse and dependent children, the option to continue their existing health insurance coverage. Upon separation the employer will provide the employee with a COBRA election notice and a 60-day window in which the retiree and any family members eligible for coverage must make a decision with respect to electing coverage.

Technically, the 60-day election window begins at the later of the date the employee separates from service or their COBRA election notice is provided. However, in practice employers will not provide such a notice to a former employee until separation of service occurs.

The continuation-coverage requirement is not indefinite. In general, when an individual retires, goes part-time to such a degree they no longer qualify for employer-provided health insurance, or simply quits or is terminated from their job, COBRA coverage must be offered by the employer for a minimum of 18 months. Employers at their discretion can offer continuation coverage for longer than required by COBRA. Thus, if a retiree and their spouse are at least 63 ½ when the worker retires, COBRA will last long enough to bridge the gap between termination of employment and Medicare.

But while 18 months is the general COBRA rule, retirees should be aware of two key exceptions that can further extend the required-coverage period under COBRA.

THE 29-MONTH PLAN

One exception to the 18-month rule applies when, by the 60th day of COBRA coverage, a qualified beneficiary is certifiably disabled according to the Social Security Administration. For this purpose, a qualified beneficiary may be either the employee separating from service, the employee’s spouse or the employee’s child.

When applicable, the disability-related extension to the COBRA coverage window is 11 months. A verified disability claimed by any one qualified beneficiary triggers the 11-month extension for all qualified beneficiaries, providing such persons with a COBRA coverage widow of up to 29 months.

Example No. 1: Leslie, 61, is married to Ben, who is retired and just celebrated his 63rd birthday. For the last few years both Leslie and Ben have received health insurance though Leslie’s employer.

However, Leslie has recently become disabled and can no longer work. Upon her termination of employment Leslie and Ben would be able to continue their existing coverage under the regular 18-month COBRA window, plus the 11-month disability-related extension.

This would allow Ben to remain on the plan from his current age until he reached his 65th birthday and was entitled to Medicare — at which point the company can terminate his COBRA window. Additionally, Leslie would be able to keep her existing insurance for 29 months, at which point she would also be eligible for Medicare due to her disability.

From surcharge brackets to prescription drug plans, advisors need to understand how Medicare works.

Note that in general, workers disabled prior to age 65 are eligible to receive health insurance via Medicare. Such coverage is typically available, however, only after an individual has received Social Security disability benefits for at least 24 months, and such benefits don’t begin until five months after an individual is determined to be disabled.

Not coincidentally, the five-month waiting period for the Social Security disability benefit, combined with the 24 months an individual must receive Social Security disability benefits prior to qualifying for disability-related Medicare, equals 29 months — the same amount of time as the regular COBRA window upon separation of service, plus the 11-month extended window that applies in the event of disability.

THE OTHER 18

A second exception to the typical 18-month COBRA window that applies upon separation of service — and one that is very relevant for retirees — is applicable if the retiring worker became entitled to Medicare less than 18 months before the separation of service. As such, this exception often applies when an individual retires between 65 and 66 ½.

In such situations the COBRA window is extended until 36 months after the date the employee became entitled to Medicare coverage. Of course, since at this point the retiree can go on Medicare, he/she won’t need to use COBRA continuation coverage. The retiree, however, may have a younger spouse or a dependent child who still needs coverage, and the extended COBRA window can help such individuals remain covered.

Example No. 2: Andy is turning 65 in November 2019 and plans to retire the following month. His wife, April, who is covered by Andy’s group health insurance policy, is only just past her 62nd birthday, and won’t turn 65 until July 2022.

Since Andy will be over the age of 65 when he retires, he will use Medicare as his health insurance. April, on the other hand, still needs health insurance coverage to bridge the gap for nearly three years until her Medicare eligibility.

Normally, April’s COBRA continuation coverage would end in June 2021, leaving a roughly one-year gap between her current existing coverage and her Medicare eligibility. However, since Andy became entitled to the Medicare within the 18 months prior to his retirement, April is eligible for the special 36-month, Medicare-related COBRA window. That period would not end until December 2022, which conveniently falls after April turns 65. Thus, the extended Medicare-related window will allow April to bridge the full gap between Andy’s separation of service and her enrollment in Medicare.

BENEFITS OF COBRA

COBRA offers several benefits to prospective retirees. For one, getting COBRA continuation coverage is simple. There’s no underwriting, it’s guaranteed issue and coverage can be terminated at any time.

In situations where separation of service is a predetermined event, pre-planning may allow an individual enough time to appropriately evaluate a variety of coverage options and reduce the value of this benefit.

In situations where separation of service is unexpected, having an insurance policy with known benefits can be helpful and allows focus to remain on matters that are often more important at the time. If, for instance, an individual is terminated from employment, they may find it more valuable to search for a new job than for appropriate health coverage for themselves and their family. Similarly, if employment ends due to illness or injury, time may be best spent focusing on healing.

Another key benefit of COBRA is that, since it is the same coverage an individual had while employed, there should be no disruption to ongoing medical care. No time has to be spent calling doctors to confirm they accept new insurance, and no effort has to be expended looking for doctors on a new plan — because there is no new plan. In a similar vein, copayments, coinsurance and other plan features remain the same.

Although less important today, thanks to the Affordable Care Act COBRA continuation coverage also maintains an individual’s HIPAA eligibility. Under HIPAA, an employer could not exclude a new employee’s pre-existing condition from coverage for more than a year.

Those leaving the workforce before 65 need more cost-effective places to live.

And more importantly, especially for an early retiree, if an individual were HIPAA-eligible — that is, had continuous coverage for at least 18 months, with the most recent coverage via a group health plan — coverage provided by a new employer’s plan would begin immediately, and with no restrictions on pre-existing conditions.

Furthermore, such HIPAA eligibility would guarantee an individual the right, after exhausting COBRA continuation coverage, to purchase an individual health insurance plan directly without an employer — and at a time when such plans could otherwise deny such coverage — effectively making group health insurance portable to individual coverage, albeit only by first obtaining and exhausting COBRA coverage.

The Affordable Care Act, commonly known as ACA or Obamacare, no longer allows employers’ health insurance plans to deny coverage for any pre-existing conditions for any period of time. And as discussed in greater detail below, the same law made individual policies purchased via an exchange guaranteed issue, i.e., not requiring medical underwriting. The portability benefits of HIPAA are consequently no longer as meaningful.

The legislation, however, has been a source of intense political controversy, and there have been several attempts to repeal it in part, as well as in its entirety. In the event such repeals were effective, HIPAA credibility would likely become significantly more important. Thus, those concerned about the political risks surrounding ACA should consider this issue when evaluating health coverage options.

COST OF COBRA

Given its simplicity and other benefits, one might wonder, “Wouldn’t it almost always make sense to use COBRA continuation coverage when possible?” Indeed, while that might make sense for many individuals if they had an unlimited budget, the cost of maintaining COBRA continuation coverage is often the fly in the ointment.

As noted earlier, when an individual elects COBRA continuation coverage they become responsible for the full cost of the policy. And in most instances, employers are allowed to charge an additional 2% administration fee, bringing the total cost of the policy to 102% of the actual premium. However, this amount may be increased to 50%, making the total COBRA cost 150% of the policy premium, during the additional 11 months in which COBRA coverage is provided on account of a former worker’s disability.

It is important to note that the actual COBRA premium includes any amounts that were being paid by an employer prior to an employee’s separation of service. Given the average employer covers

Example No. 3: Jerry was recently let go from his employer. Prior to his termination, Jerry was paying $300 per month for his family health insurance, while his employer was picking up the remaining $1,700 balance of the $2,000 monthly premium.

If Jerry decides to continue his existing family coverage via COBRA, his monthly costs will increase from $300 per month to $2,040 = $2,000 x 102%, a nearly 600% increase.

Of course, in many cases purchasing health insurance on an exchange will result in a similarly substantial cost increase, as the primary driver is not that COBRA is more expensive but simply that it is provided without the common employer-provided premium subsidy. As a result, eligible retirees shouldn’t automatically reject COBRA coverage because of its relatively higher cost. Instead it’s necessary to compare the cost of COBRA to other available alternatives at the time of retirement.

UNDERSTANDING COBRA RULES

It is generally advisable to avoid any gaps in coverage. However, in limited circumstances, an individual can effectively guarantee coverage if health services are needed, while avoiding the need to pay for unnecessary coverage if such services are not required.

Recall that the COBRA rules require that an individual be given no less than 60 days to make their COBRA decision from the later of the date on which coverage is lost, or the date on which they receive their COBRA Election Notice. And once elected, the coverage is applicable retroactively back to the date the original coverage was terminated — i.e., at the end of employment.

Thus, if new coverage will be secured by the end of the 60-day COBRA election window — i.e. an individual becomes eligible for Medicare, coverage is available via a spouse’s employer, etc. — an individual who does not expect to need care before the new coverage is secured can forgo the COBRA election with the hope of avoiding a few months of health care premiums. If coverage becomes necessary within the window, it can be elected at that time.

Example No. 4: Ron is planning to retire from his employer on December 31, 2019, at which point his employer-provided health coverage will terminate. Ron, however, will turn 65 on March 25, 2020, thus making him eligible for Medicare as of the first of that month.

Ron can “game” the COBRA rules to potentially avoid buying health insurance for January and February 2020. Given that Ron has no less than 60 days from the date he loses coverage to make a COBRA decision, if Ron has no immediate health care needs he can simply sit tight during the two months between his separation of service at the end of 2019 and when his Medicare coverage begins at the beginning of March 2020.

Medicare, longevity, medical expenses — these are some of the most pressing issues facing clients.

Suppose, however, that on February 15 Ron has shortness of breath and goes to the hospital for evaluation. At that time, he can contact his former employer to elect COBRA continuation coverage and minimize his out-of-pocket expenses for the hospital visit. It’s worth noting here that while the coverage itself would be retroactive to Ron’s termination, Ron would owe COBRA premiums for both January and February 2020 if he needed to make the COBRA election.

Also note that while COBRA rules only apply to employers with 20 or more persons,

GROUP TO INDIVIDUAL

An additional option for some retirees is to convert their group health insurance policy into their own individual health plan.

This option can be provided by a group plan, but it is not required. However, if such an option is available to a participant upon separation of service as an alternative to COBRA, the same option must also be made available at the endof the COBRA continuation-coverage window presuming COBRA was elected and maintained until that time.

Unlike COBRA continuation coverage though, the terms of a conversion policy do not have to be the same as the old policy. As such, premiums for such policies may be higher, and/or the policy may provide a lower level of coverage. Conversion options must consequently be evaluated on a case-by-case basis.

Finally, while COBRA maintains an individual’s HIPAA eligibility, conversion coverage is individual market coverage. Thus, it does not maintain the individual’s HIPAA eligibility. Although far less important in the post-ACA world, HIPAA eligibility continues to provide individuals purchasing individual coverage greater protection than is otherwise available via state law.

HEALTH CARE EXCHANGES

Retirees looking for coverage can also opt to purchase a health insurance policy

- Find that their COBRA continuation and/or conversion policy options are too expensive to maintain, or that they would prefer less robust but less expensive coverage;

- Have exhausted their COBRA continuation coverage window and are still not eligible to enroll in Medicare;

- Are moving to another state after retiring, and few or possibly even no doctors in the new location will accept the existing COBRA continuation coverage insurance; or

- Are eligible to receive premium assistance tax credit subsidies for their health insurance as a result of low income.

Public health insurance exchanges were created by ACA, and serve as a marketplace for persons seeking health insurance coverage. Each state has either its own exchange, uses the one created by the Federal government or uses a hybrid approach. Functionally though, the end result is the same: Individuals receive a range of health insurance options in their state but must purchase insurance from the state in which they maintain their permanent address. If

Of critical importance for many retirees is that since 2014, ACA has required that all major medical insurance policies be issued on a guaranteed basis. Thus, an individual can no longer be denied for a pre-existing condition, and to that end, the often-arduous medical underwriting process that applied in the pre-ACA era is also no longer applicable. In other words, an early retiree is assured, similar to COBRA coverage, of being able to transition from employer-provided health insurance to a private insurance plan via an insurance exchange, regardless of any health conditions.

But while a retiree can’t be denied coverage for a pre-existing medical condition, they cannot simply purchase coverage via an exchange whenever they want. Rather, coverage can only be purchased during an enrollment period. In general, retirees who lose employer-provided health coverage and wish to insure themselves via an exchange-purchased policy should secure coverage during their

If coverage is not purchased during this time, it is generally necessary to wait until the next

Example No. 5: Chris, 63, is an exceptionally healthy individual who retired on February 10, 2019. Given his health and the repeal of the individual mandate — made effective beginning in 2019 via the sweeping

Unfortunately, in August 2019 Chris begins to suffer from severe itching and unexplained weight loss. Eventually Chris goes to the doctor, who informs him he has Hodgkin’s lymphoma and must begin treatment immediately.

In this situation Chris would only be able to enroll in health insurance coverage during the next open Enrollment Period, which doesn’t open until November 1, and coverage wouldn’t begin until January 1, 2020. Chris would consequently be responsible for the full cost of his treatment from August until next January — which could easily bankrupt him, even if he had substantial savings.

EXCHANGE-BASED COSTS

Plan costs can vary dramatically on exchanges based on a number of factors, but somewhat ironically, an individual’s health is not one of them. Rather, under Federal law the only five factors that insurance companies can use — unless the state uses even fewer factors — when establishing premiums are: age; location; tobacco use; individual coverage vs. coverage for an individual and a spouse and/or dependents; and plan category, e.g., Catastrophic, Bronze, Silver, Gold and Platinum.

As noted earlier, the average cost of a Silver plan purchased via an exchange for a 64-year-old in 2019 is $1,123. But that’s just the average, and the actual price can vary substantially from location to location. For example, a Silver plan will cost a 64-year-old living in Lincoln, Nebraska, about

Guiding them through the fine print of narrow networks, deductibles and copays could become a key differentiator.

In a small number of states, health insurance for early retirees is dramatically cheaper than the national average, thanks to what are known as Community Ratings. Most states allow insurers to charge more to provide health insurance to an older person than to a younger person. But in a handful of states, insurers are required to use Community Rating, in which all persons in a geographic area are charged the same for the same insurance, regardless of age.

As one might imagine Community Rating systems result in younger individuals having health insurance costs that are higher compared to individuals of the same age in other, non-Community Ratings–based locales. But while it may come at the expense of younger persons’ finances, this is generally a boon for older individuals who need to purchase health insurance via an exchange.

In New York City, with one of the highest costs of living in the country, the average monthly premium paid by a 64-year-old individual purchasing a Silver plan in 2019 is just

UTILIZING TAX CREDITS

After separating from service, some retirees will experience a dramatic reduction in income. In such situations individuals may find themselves eligible to receive a

To qualify for a PATC, an individual must purchase health insurance via an exchange and generally meet the following requirements:

- Household income between 100% and 400% of the

Federal poverty level for the family size ($12,140 to $48,560 for a single individual in the continental U.S. during 2019, or $$16,460 to $65,840 for a married couple);

- Cannot be claimed as a dependent by someone else;

- Cannot be eligible for coverage through a government program (i.e., Medicare, Tricare, CHIP, Medicaid) or be able to purchase affordable coverage (less than 9.86% of household income for employee’s cost of employee’s coverage for 2019) via an employer-sponsored plan of minimum quality (actuarial equivalent of a Bronze plan, or higher);

- Cannot file married-separate; or

- Be a U.S. citizen or

lawful resident .

When eligible the PATC an individual receives is calculated using a complicated formula based on comparing the individual’s household income to the cost for the second-lowest-priced Silver plan available in the state. However, while the price of such a plan is the benchmark to determine the tax credit itself, a retiree can choose to purchase any plan they desire and use whatever credit is available toward the selected plan.

Purchasing a Bronze plan, for instance, might allow a low-income retiree to completely offset the cost of their health insurance with the premium they received. Meanwhile, if a retiree purchased a Platinum plan, they would almost certainly have to foot a substantial part of the bill via savings or some other means.

WHICH IS BEST?

In most cases, the best option for retirees is to hop onto Medicare. Absent that option, the question is generally, “Would I rather keep my current coverage via COBRA for as long as possible, or should I just get an individual coverage via an exchange?” A response must take into consideration a number of questions, not least of which being: Will key doctors take the new exchange-purchased insurance? How expensive is COBRA in comparison to the exchange-purchased policy? Would PATC be available for an exchange-purchased policy?

The onus falls squarely on the individual to sort out what makes the most sense for their situation. But with a little guidance from a trusted source, retirees can rest easier at night. And that alone carries its own, clear health benefits.