Profits were up 8% for Bank of America's wealth management unit, as cost cutting efforts offset falling revenue growth.

The bank's Global Wealth & Investment Management unit – which includes Merrill Lynch – reported net income of $722 million, up from $669 million from the year ago period. However, GWIM's net income was down $2 million from the previous quarter.

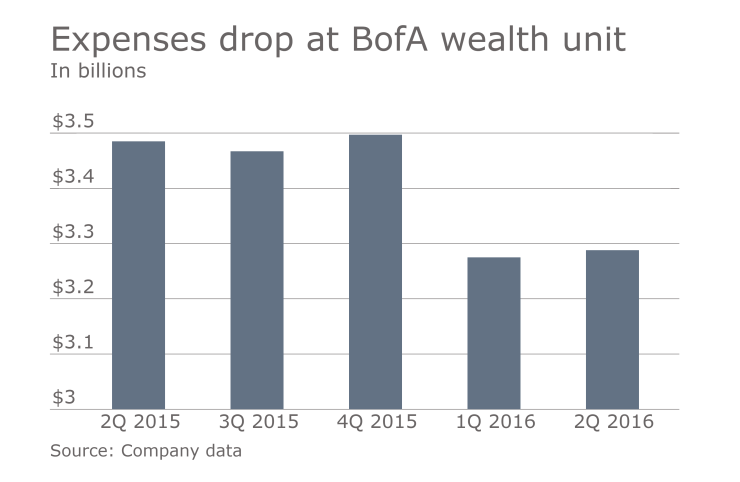

Revenues for the unit fell 2% year-over-year to $4.45 billion. Cost controls offset that decline, however, as non-interest expenses dropped 5.6% year-over-year.

Bank of America CFO Paul Donofrio told analysts during a conference call that market volatility had also dampened transactional revenue for BofA's wealth unit. However, interest revenue, which rose 6% to $1.4 billion for the quarter, filled in the gap. Interest revenue, which is derived from securities-based loans and other lending, continues to represent an ever larger share of the unit's total revenue.

The unit's pretax margin, at 26%, was up from 23% for the year-ago period.

THE THUNDERING HERD

Recent volatility has also taken its toll on Merrill Lynch's top line; revenue for the wirehouse dropped 4.3% year-over-year to $3.63 billion for the recent quarter. Client balances dipped 1.2% to $2.026 trillion.

Merrill Lynch's adviser force increased 1% to 14,416 advisers. Financial adviser productivity stood at $984,000 for the quarter, down from $1.05 million for the same period a year ago.

The firm's advisers continue to move towards a more fee-based business. A spokesman said that 61% of Merrill advisers have half or more of their client assets in a fee-based relationship. That figure was up from 55% for the previous quarter.

U.S. Trust, which is also part of BofA's wealth unit, reported that revenue rose about 1% to $769 million.

COST CUTTING

Companywide, Bank of America posted higher profit in each of its four main businesses as bond-trading revenue increased more than analysts estimated and expenses fell.

-

The number of financial advisers at the firm declines 1% to 15,042.

July 15

Net income fell 21% to $4.23 billion, as the company booked a roughly $1 billion accounting charge. Per-share earnings were 36 cents, compared with 43 cents a year earlier. The average estimate of analysts surveyed by Bloomberg was 33 cents.

CEO Brian Moynihan has focused on cutting expenses with the bank hamstrung by persistently low interest rates that crimp revenue and profit. The bank is targeting $53 billion in total annual expenses by 2018, Moynihan said on a conference call with analysts. Non-interest expenses totaled $57.2 billion last year.

“The expense-reduction story can be a catalyst for stock outperformance,” Goldman Sachs’ Richard Ramsden said in a note after results were released.

With additional reporting from Bloomberg News.