Three of Cetera Financial Group’s independent broker-dealers allegedly failed to adequately supervise transactions at 32 hybrid RIAs over a period of more than five years

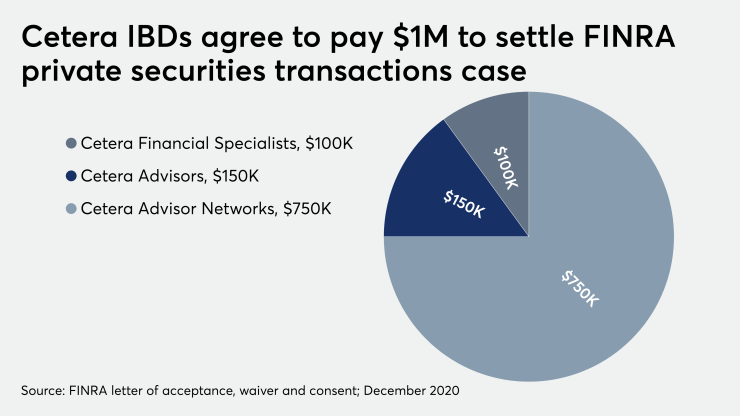

Cetera Advisor Networks, Cetera Advisors and Cetera Financial Specialists agreed to pay a fine of $1 million after failing to correct the deficiency cited three different times by SEC examiners between 2013 and 2017,

The investigation encompassed some 535 advisors who manage $80 billion in client assets.

The registered representatives service advisory clients through hybrid RIA entities rather than Cetera’s corporate RIAs. Despite rules requiring Cetera to supervise the hybrid RIA transactions and the fact that the advisors pay the firm fees for the supervision, Cetera Financial Group didn’t have enough data to conduct suitability reviews of the outside trades, according to FINRA.

“The Cetera firms were aware of the supervisory deficiencies — they were identified in SEC examinations in July 2013, August 2015 and September 2017— yet, despite several efforts to address such deficiencies, failed to implement systems and procedures to reasonably supervise the transactions,” the letter of acceptance, waiver and consent states.

Cetera Advisor Networks agreed to pay a fine of $750,000, while Cetera Advisors will pay $150,000 and Cetera Financial Specialists will pay $100,000. The settlement also obligates the three firms to achieve compliance with FINRA rules within 90 days.

“We are pleased to have settled this historical matter, having taken the corrective actions to resolve the matters identified by FINRA,” Cetera spokesman Sean Mogle said in an emailed statement. “Our clients’ fiduciary interests remain the top priority and we do everything we can to ensure our policies and procedures support those interests.”

Cetera Advisors had pledged in November 2013 to bulk up its oversight of its hybrid RIAs, but it didn’t start receiving the transactional data until June 2018, according to the investigation. Even after the data began to be collected by the firm, it didn’t contain enough customer-specific information for suitability reviews and other supervisory duties, FINRA says.

As of June 2018, Cetera’s second-largest IBD had 41 hybrid RIA advisors who managed about $1.2 billion in assets through 17 RIAs, according to the document. Cetera Advisor Networks, the firm’s largest IBD, had 487 advisors with $77.8 billion in AUM in 12 hybrid RIAs, the document states. FINRA alleges it didn’t receive automated data feeds from all custodians until June 2018.