How many Black financial planners are there?

It's a surprisingly difficult question to answer. Few firms or organizations, if any, disclose a tally, making it more difficult to track the industry's progress on increasing the representation of Black people and other minorities.

But, for the first time, the CFP Board provided Financial Planning with precise numbers for 2019. The figures showed some improvements in representation — and that the profession remains far behind in efforts to reflect the country's demographics.

The number of Black CFPs rose by 8% year-over-year, or 99 planners, to a total of 1,355 in 2019, part of a 12% surge to 3,259 Black or Latino CFPs that was the highest increase ever, according to D.A. Abrams, managing director of the CFP Board’s Center for Financial Planning. He notes that while the two groups represent about 30% of the U.S. population, they make up only 3.8% of CFPs.

The CFP Board didn’t break out the statistics it

He spoke after CFPs called

“We're going to continue to work to bridge the gap, not just for the benefit of the CFP Board, but, as we see it, for the benefit of the profession and for the benefit of the public overall,” Abrams said. “It shows the commitment across the entire organization to grow these numbers and these percentages.”

Abrams didn’t rule out eventually sharing the self-reported data for Asian American CFPs and other minority groups, though the center identified Black planners and Latino advisors as its “primary target focus audience,” he says. He didn’t directly answer when asked why the exact numbers don’t appear on the website, but he said there are no challenges with disclosing them.

The importance of tracking the number of Black CFPs looms large amid the civil unrest and the history of race relations in America. In addition, the CFP Board’s data enables the study of financial planners specifically. Other datasets — such as the 551,000 “personal financial advisors”

One reason the precise numbers can be hard to find in general is that “so many firms are embarrassed” by the stark figures, says Lazetta Braxton, chair of the board at the Association of African American Financial Advisors and a former member of the center's advisory council.

“While it may be alarming, at least we know where we're starting and the points to know where we're going,” says Braxton. “We know the numbers are low.”

Making the data completely available on the website could also draw attention from those who don’t keep it at the top of their minds, according to fellow CFP Anna N'Jie-Konte of Dare to Dream Financial Planning. She

At least nine CFPs with the mark on their profiles liked the tweet, and three other planners commented to say they agreed with N’Jie-Konte. It comes down to the board being accountable and expressing simply that “it's not OK to murder people in the street,” N’Jie-Konte says, noting that she’s been watching for reactions among her vendors and other professional contacts.

"We as an industry — the financial services industry — have a serious problem with diversity," she says. And while the CFP Board is "very vocal" about increasing diversity, the demonstrations also demand a response, N’Jie-Konte says.

"It's very clear there's a problem and it shouldn't be a political issue,” she adds. “At the end of the day, if you're going to say that you are for something ... then you have to follow through with that."

Two days after the tweet, officials released a

Abrams also notes that a whitepaper

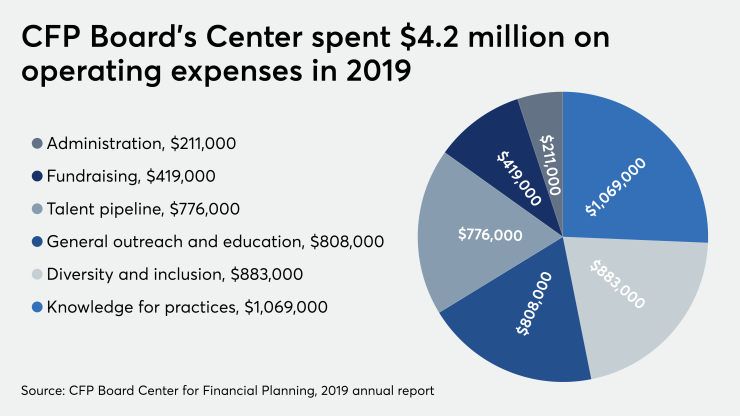

The center — where the former U.S. Tennis Association executive Abrams took over in November after the retirement of executive director Marilyn Mohrman-Gillis — issued its annual

In the past year, the center spent $4.2 million, including providing $250,000 in the form of 53 scholarships to students and other aspiring CFPs for training and educational requirements for certification. Many of the scholarships go to underrepresented populations.

“As we continue to navigate this trying and stressful time together, the Center team remains committed to attracting and retaining the next generation of financial planners, promoting greater diversity in our workforce, and supporting and sharing cutting-edge research that advances the knowledge of our professionals,” Abrams and CFP Board CEO Kevin Keller said in a message at the beginning of the report.

Since launching in 2015, the Center has received more than $13.2 million in donations from 4,500 corporate sponsors and individual contributors. The surge in Black and Latino CFPs in 2019 was three times as high as the overall rate of expansion in certificants, and the number of certificants who are women climbed above 20,000 for the first time.

“We're very proud of what we're doing in this area,” Abrams says. “We're not there yet, but we feel very good about the direction.”