The race to zero has left fund managers behind.

Over five years, custodians have built out commission-free ETF platforms, expanding their fund lineups through distribution arrangements with third-party providers willing to pay for prime shelf space.

As of this month, these platforms suddenly no longer exist. Asset managers such as Aberdeen Standard Investments received no warning.

“That's basically years and years of relationships, of negotiations, that basically just went down the drain,” says Stan Kiang, director of strategic relationships at Aberdeen.

After Schwab on Oct. 1

“The OneSource team was unaware that this was taking place,” Dunn says. “They found out at the same time that we found out.”

Schwab spokeswoman Erin Montgomery wouldn’t comment on the notice OneSource representatives were given of the announcement, but stated the program “as it existed” was effectively discontinued on Oct. 7.

“We will no longer be marketing or promoting the program to our clients, and ETF sponsors will no longer compensate Schwab to participate in the commission-free ETF program,” she said in an email.

While the revenue Schwab received from ETF providers for its commission-free platform might pale in comparison to the $10 billion the company made in interest revenue in 2018, it’s hardly immaterial.

According to

Fidelity, TD Ameritrade and E-Trade have also eliminated commissions for U.S. stocks, ETFs and options.

Aberdeen had six ETFs on Schwab’s OneSource platform and four on each of TD Ameritrade and E-Trade’s platforms.

“I won't tell you exactly how much we pay, but those aren't cheap programs. … We're paying substantial amounts of money to participate in these things,” Dunn says.

Dunn and Kiang were likely not the only asset managers picking up the phone to call custodial partners in recent weeks.

BlackRock iShares, PIMCO, State Street, John Hancock Investments and J.P. Morgan Asset Management were all paying for this exclusive shelf space at the three brokerages.

Financial Planning reached out to 26 asset managers on these platforms for comment, some of which had ETFs across all three custodians. Seven declined to comment. Seventeen did not respond.

Commission-free platforms had offered attractive shelf space for which asset managers were willing to pay.

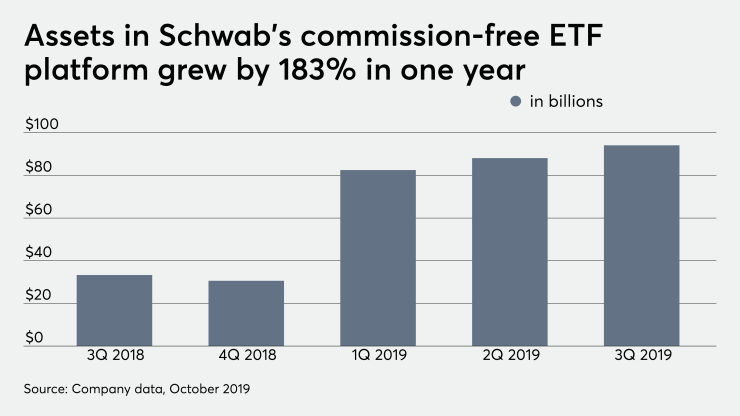

At Schwab, assets in its ETF OneSource platform grew by 183% — to $94.1 billion from $33.3 billion — in the year-over-year period ending Sept. 30, according to its

Assets in WisdomTree ETFs offered on commission-free platforms grew four times faster than those in commission-paying ETFs in the second quarter, according to a company earnings

These platforms were attractive to advisors with clients who didn’t want to pay commissions, according to Ryan Kirlin, head of capital markets at Alpha Architect, an asset manager that didn’t place its funds on any commission-free ETF platforms. Some advisors exclusively used these platforms to build out all their models, he says.

While TD Ameritrade and Fidelity don’t disclose specifics of their distribution relationships with asset managers, disclosures indicate they will lose revenue from commission-free ETF relationships.

Fidelity

While the fees weren’t the same, Aberdeen’s Dunn says platform costs were comparable at Schwab and TD Ameritrade. TD was more expensive on a per-ticker basis, he says.

What happens now? Schwab and TD Ameritrade say they are still sorting that out.

“There are other attributes to the [OneSource program], such as data and reporting, that offer value to participating firms, and we are currently evaluating our overall ETF platform strategy with respect to those components,” Schwab’s Montgomery said in the statement.

“We can’t comment on the details of our asset manager relationships, but I will tell you those relationships are much broader than just our NTF programs,” TD Ameritrade spokesman Joe Giannone said in a statement. “We are continually reviewing our products and services to ensure they meet the needs of a competitive marketplace. With regard to ETF Market Center, no decisions have been made.”

Fidelity spokeswoman Nicole Abbott did not address the status of the company’s program, but provided the following statement in response to questions about the status of its relationships with asset managers, and BlackRock in particular:

“We continue to have a great relationship with BlackRock as well as the other ETF sponsors currently participating in our commission-free ETF platform. These firms are among the top ETF providers in the industry and we expect they will continue to attract customer assets due to the funds’ high quality, liquidity and diversification possibilities.”

At Aberdeen, billing has been put on hold momentarily at TD Ameritrade. “They are trying to find a way to make it work,” Dunn says.

There is certain information that could be valuable to fund providers, such as data on which advisors hold their ETFs, Kiang says. While asset managers of mutual funds readily have that information, ETFs are traded on a public exchange, and fund providers don’t have access to the end client.

Greg O’Gara, senior research analyst at Aite Group’s wealth management practice, says he anticipates a renegotiation between asset managers and custodians, and wouldn’t be surprised if custodians start to reveal the revenue-sharing agreements that currently take place largely behind the scenes.

“Where the dust settles, I’m sure all the custodians and distributor firms are working on this,” says O’Gara. He doubts that asset managers would stop paying custodians and brokerages altogether. “Having wide distribution in the market is still something that will drive assets in the future, so you can’t downplay the power of distribution,” he says.

In any case, not all distribution relationships have been affected. There are no signals that fees are declining for mutual fund trading, according to Jeff Ptak, head of global manager research for Morningstar.

“On the one hand you have [commissions] plunging toward zero, and then on the other hand, on the NTF [mutual fund] platforms, you would imagine nothing had changed in the world around us,” he says.

The cost is $49.99 per purchase for no-load mutual funds at

In the case of ETFs, zero commissions could benefit companies that had opted out of, or not been able to, participate in commission-free platforms, according to Kirlin.

“In Alpha Architects’ shoes, this was good for us versus our competitors because it levels the playing field,” he says.

Even asset management titans such as Vanguard, which never pays brokerages for distribution, will benefit. “We’re pleased that investors can now access Vanguard’s already low-cost ETFs on these platforms without paying commissions,” spokesman Freddy Martino said in a statement, declining to speculate on how this could impact asset adoption.

In general, ETF providers seem enthusiastic.

“The continued evolution of the marketplace will allow investors equal access to innovative products including alternative investment strategies that provide investors with unique hedging benefits,” Bill Carey, CEO of AGF Investments, an asset manager that had been on TD Ameritrade’s commission-free platform, said in a statement in response to questions.

“If you could see my face, I'm smiling at the opportunities,” BlackRock CEO Larry Fink said Oct. 16 on the company’s earnings call in response to an analyst’s question over what commission cuts mean for distribution and the competitive landscape.

Immediately after, BlackRock president Rob Kapito added, “The elimination of barriers to investing simply means that more and more investors are going to have the ability to use ETFs, and as the ETF market leader, this has got to be good for BlackRock.”

While prime shelf space had offered Aberdeen additional exposure, Kiang expects their ETFs to do well in a zero-commission landscape, now that product quality has become a more critical distinguisher. Since the announcement, the company has seen a boost in gross flows. “If two weeks are an indication, we've been doing OK,” he says.

Free trading is another way for ETF providers to stand out over other products in the marketplace. “Now we’ve got another advantage over our competitors — mutual funds,” Kirlin says.

What will it mean for the custodians who roiled the ETF distribution channel with the commission cuts?

“The custodial business — it's not an easy one,” Kiang says. “It's a low margin business and it's all about scale. When you lose such a large percent of your revenue ... there are very few ways to get that back to be totally honest with you.”