A doctor expected to work for two to three more years before moving closer to his kids and grandkids. A couple in their fifties and sixties looked forward to settling seaside in Costa Rica. A mortgage broker planned to retire later this year.

Instead, the coronavirus scrambled retirement plans for all three. It’s a story common right now for clients of many planning-centric RIAs.

“There’s a lot of retooling of financial plans,” says Dave Welling, CEO of Mercer Advisors, a Denver-based RIA with more than 14,000 clients. “Clients have gotten a good scare,” he adds, making it the right time to update their financial plans.

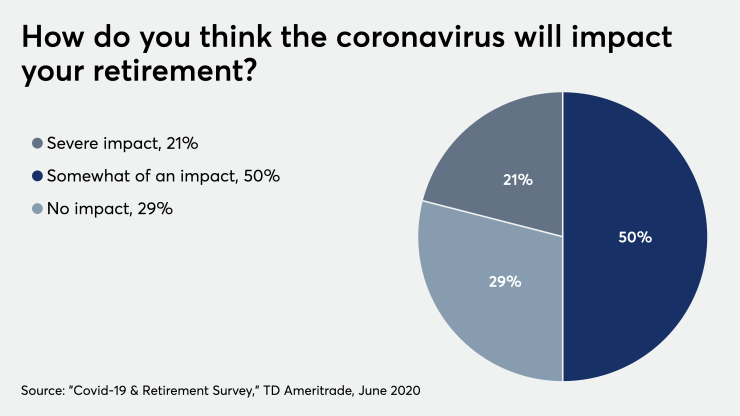

Certainly, the economic shock wrought by the coronavirus has given many Americans impetus to review those plans.

February’s 2.6% unemployment rate for Americans 55 years and older is a distant memory, having spiked to 9.6% in June, before backing down to 8.8% last month, according to data from the Bureau of Labor Statistics.

For that age group, labor force participation is now hovering at 39.2%. That's just a fifth of a percentage point higher than the prior month and down from 40.3% for February. (By comparison, the participation rate for all Americans 20 years and older was 63.4% for July.)

“Clearly, the country is dealing with a massive uptick in unemployment,” says investment banker David DeVoe, who advises RIAs on mergers and acquisitions.

Clients may be feeling the pinch. About 10% of plan sponsors have eliminated their matching contributions, according to a Secure Retirement Institute survey of 840 respondents with ten or more employees in May and June. Of those who still offer them, 7% have reduced the amount, and 19% say they may.

Before the pandemic, six in 10 Americans were regularly contributing to their retirement savings and on track with their retirement plans, according to a

The ongoing crisis has pushed two of Travis Maus’ clients into retirement almost overnight.

One was a postal worker and the other an essential worker in medicine. Maus, the managing partner of S.E.E.D. Planning Group in Binghamton, New York, was able to show each separately that, according to their plans, not only could they retire right away, but that, given their situations during a pandemic, both probably should.

“They were looking at the work environment and thinking, ‘I can’t handle this,’ “ Maus says. “We were like, ‘You can keep working and die of a heart attack, or retire early.”

Advisor Ahmie Baum, co-founder of Pittsburgh-based Interchange Capital Partners, a Dynasty Financial Partners practice, says two clients, a mortgage broker and his wife, were “very concerned” about their retirement plans at the onset of the coronavirus pandemic.

In his early sixties, the mortgage broker was dealing with health issues and worried about the economy.

“They called and said, ‘The markets are down. Can I still do this?’ “ Baum recalls. The client fretted, not only about his career, but about whether he would have to push his retirement off instead of retiring at the end of this year as planned. He and his wife proposed cutting back on their lifestyle and dreams.

“I said, ‘Let’s not go there first. Let’s work with the plan as if you don’t have to sacrifice,’” Baum says.

Running the numbers showed the couple that, even in a down market, they could retire on time. That gave them confidence, Baum says.

Half of what he does, Baum says, is just convince clients to look at their own plans, even when their circumstances have changed, seemingly for the worse.

“Clients have a tendency to dismiss their own strength,” says Baum.

For some clients the upheaval hasn’t been all bad.

Distancing necessitated by the pandemic forced a doctor to treat patients via telemedicine for the first time in his career. Surprised at how well he adjusted to virtual client care, he realized he would not have to start a new practice from scratch to be near his family, according to Kara Duckworth, his planner at Mercer.

After revisiting his financial plan, two weeks ago, the doctor moved to the smaller city where his two kids and two grandchildren live. He now thinks he may keep working part-time for another eight years, Duckworth says.

“That wasn’t on our radar screen at all. He’s feeling really good [about it],” she says.

And Duckworth’s fifty- and sixty-something couple who dreamed of Costa Rica?

An expat idyll lost its appeal amid a global health crisis. They worried what would happen if one of their mothers got COVID-19 and, due to global travel restrictions, they either couldn’t fly back to be with family or, worse still, couldn’t return for a funeral.

“We talked it all through. Sometimes it takes a discussion of all our human emotions,” Duckworth says.

Now the couple is looking for a seaside home, only somewhere in the U.S. Due to the higher cost of living here compared to Costa Rica, they intend to buy a smaller place, but are reconciled to the downgrade.

“Having a global crisis,” Duckworth says, “where you may be more isolated from people you care about really makes people think really hard about, “Is this what I want?’”