A financial advisor who built his father’s practice into an ensemble team and a major enterprise founder aiming to double his firm’s size are fueling record recruiting for Commonwealth Financial Network.

The No. 4

Scott Seymour’s Bethlehem, Pennsylvania-based Great Scott Financial Services

Seymour left a Cetera Advisor Network hybrid RIA, while Graybill ended a 27-year relationship with Securian Financial. Graybill's Legacy has added three more partners and 15 other advisors since he launched the firm 20 years ago, he says. The firm manages more than $1 billion in client assets across its four offices.

While he praises Securian as a great company and says he’ll continue to recommend its products, Graybill’s team selected Commonwealth for back-office services like technology that could enable Legacy to reach its growth goal of doubling during the next five years.

“What it takes to get to the next level is a whole new paradigm,” Graybill says. “To do that in the shortest period of time required a change in affiliation, a new partner.”

Representatives for Securian declined to comment on Legacy’s departure. Cetera Financial Group also declined to comment on Seymour’s change in affiliation.

Great Scott — which left Cetera hybrid RIA Vicus Capital for Commonwealth’s corporate RIA — has more than $190 million in client assets. Since Seymour’s father retired in 2010, the firm has hired two analysts, a paraplanner and a client service associate to its seven-member team.

The practice also doubled its asset base. The 21-year veteran advisor opted for Commonwealth because it’s privately owned by its partners rather than publicly traded, private equity-backed or insurer-owned — along with the fact that it has many advisors of his size and tenure.

“They are a key back office partner,” Seymour says. He notes he has many business-owner clients who “understand why it makes sense to outsource certain parts of your business. Commonwealth does a very good job of catering to the advisor and their own brand so that it takes a backseat to the brand the advisor's firm has built.”

In addition to Graybill, advisors Robert Wermuth, Matthew Kulp and Kevin Donohue lead Legacy. It has three main offices in West Chester, Plymouth Meeting and Allentown, with a team of 20 other employees including chiefs of operations, finance and new business processing.

About 70% of the firm’s assets are advisory AUM, but Legacy chose Commonwealth’s corporate RIA rather than launching its own. The four partners and one of its management executives own stakes in the enterprise, which Graybill says will also offer more shares in the future to its team.

Legacy’s client base spans employer retirement plans, family offices, executive compensation and union workers, in addition to traditional retail clients. The firm plans to build on those markets while growing both organically and inorganically with Commonwealth, Graybill says.

“At the end of the day, people want to know how to accomplish their goals, not how much money did they make,” he says. “My dream was always to deliver value around advice and therefore everybody in our company delivers their value by a process, not a product.”

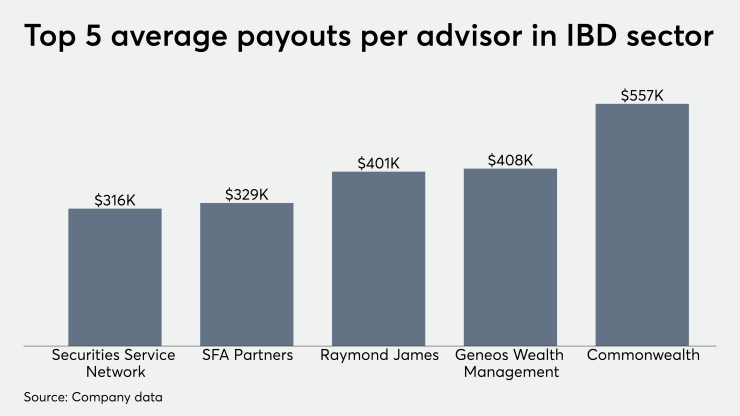

The advisors affiliating with Commonwealth this year are bringing an average annual production of more than $500,000, according to the firm. Commonwealth’s average payout as a firm of $557,000 is the